Question: please answer question C for a good rating! a-b is correct. for c I input 20.39 and 20.40 and was wrong. Assumptions 1. The decision

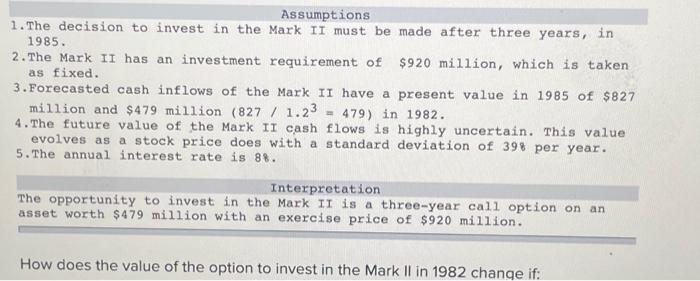

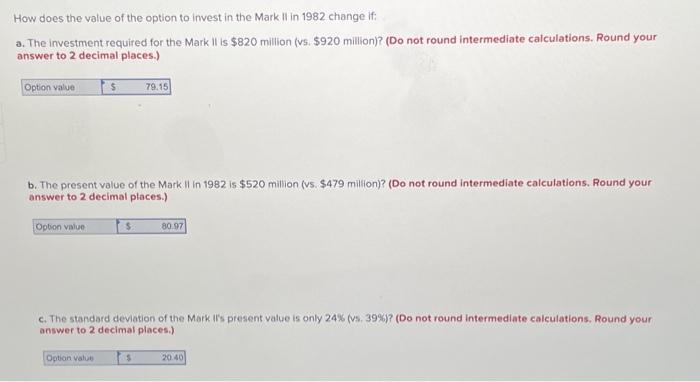

Assumptions 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $920 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $827 million and $479 million (827/1.23=479) in 1982 . 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 398 per year. 5. The annual interest rate is 88 . How does the value of the option to invest in the Mark II in 1982 change if: How does the value of the option to invest in the Mark II in 1982 change if: a. The investment required for the Marik is $820 million (vs. $920 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. The present value of the Mark 11 in 1982 is $520 million (vs. $479 milion)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. The standard deviation of the Mark ils present value is only 24% (vs, 39\%)? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts