Question: PLease answer question C only Case Study 5(i) - ABC Beauty Products Corporation ABC Beauty Products Corporation is considering the production of a new conditioning

PLease answer question C only

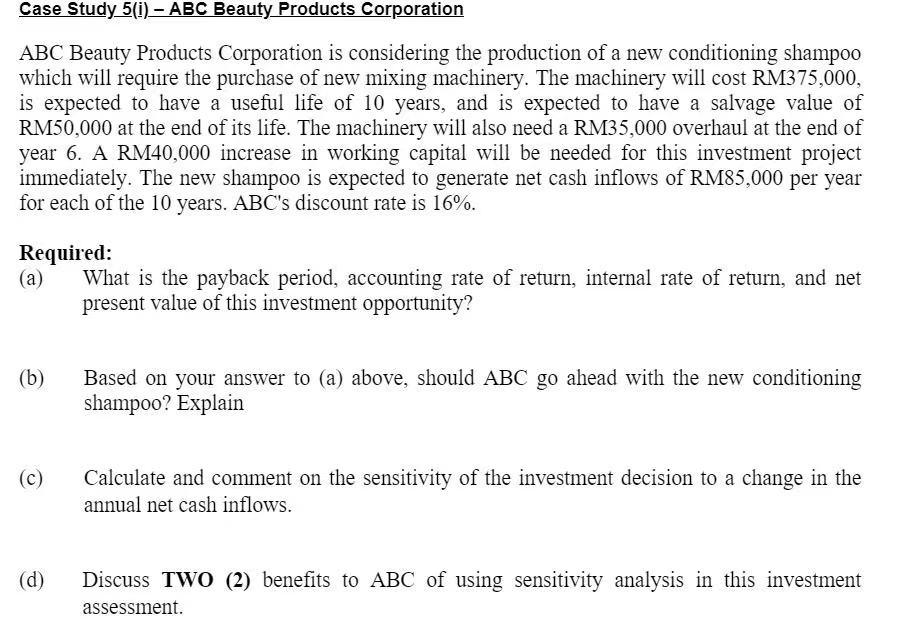

Case Study 5(i) - ABC Beauty Products Corporation ABC Beauty Products Corporation is considering the production of a new conditioning shampoo which will require the purchase of new mixing machinery. The machinery will cost RM375,000, is expected to have a useful life of 10 years, and is expected to have a salvage value of RM50,000 at the end of its life. The machinery will also need a RM35,000 overhaul at the end of year 6. A RM40,000 increase in working capital will be needed for this investment project immediately. The new shampoo is expected to generate net cash inflows of RM85,000 per year for each of the 10 years. ABC's discount rate is 16%. Required: What is the payback period, accounting rate of return, internal rate of return, and net present value of this investment opportunity? (a) (b) ( Based on your answer to (a) above, should ABC go ahead with the new conditioning shampoo? Explain (C) Calculate and comment on the sensitivity of the investment decision to a change in the annual net cash inflows. (d) Discuss TWO (2) benefits to ABC of using sensitivity analysis in this investment assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts