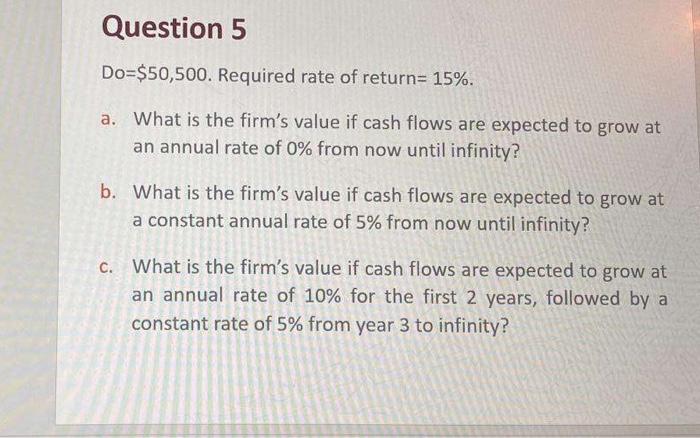

Question: Please answer question C Please answer question C Please answer question C Do =$50,500. Required rate of return =15%. a. What is the firm's value

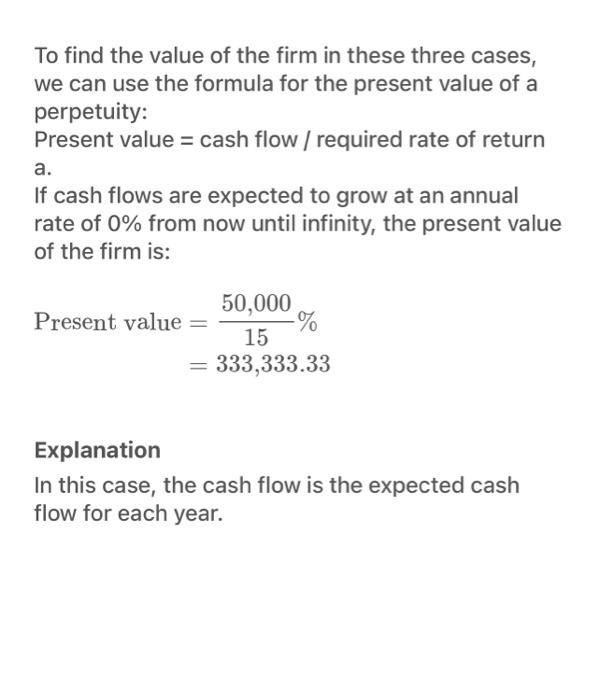

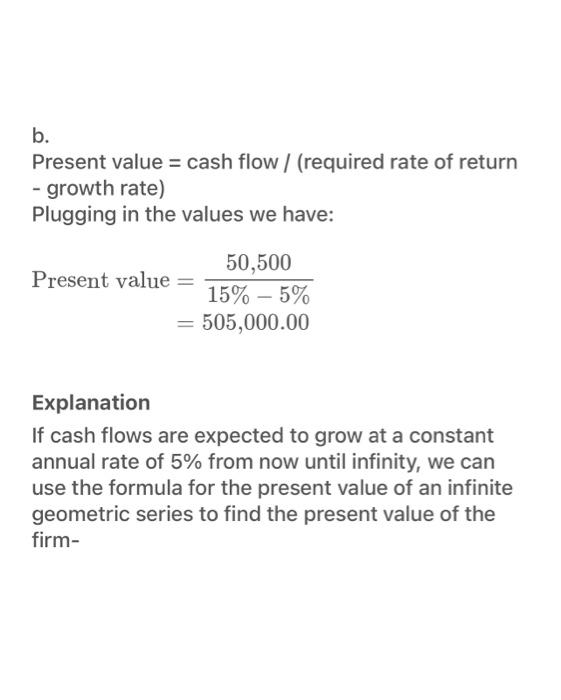

Do =$50,500. Required rate of return =15%. a. What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now until infinity? b. What is the firm's value if cash flows are expected to grow at a constant annual rate of 5% from now until infinity? c. What is the firm's value if cash flows are expected to grow at an annual rate of 10% for the first 2 years, followed by a constant rate of 5% from year 3 to infinity? To find the value of the firm in these three cases, we can use the formula for the present value of a perpetuity: Present value = cash flow / required rate of return a. If cash flows are expected to grow at an annual rate of 0% from now until infinity, the present value of the firm is: Presentvalue=1550,000%=333,333.33 Explanation In this case, the cash flow is the expected cash flow for each year. b. Present value = cash flow / (required rate of return - growth rate) Plugging in the values we have: Presentvalue=15%5%50,500=505,000.00 Explanation If cash flows are expected to grow at a constant annual rate of 5% from now until infinity, we can use the formula for the present value of an infinite geometric series to find the present value of the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts