Question: PLEASE ANSWER QUESTION CORRECTLY AND SHOW WORK PLEASE!!! A local partnership was considering the possibility of liquidation. Capital account balances at that time were as

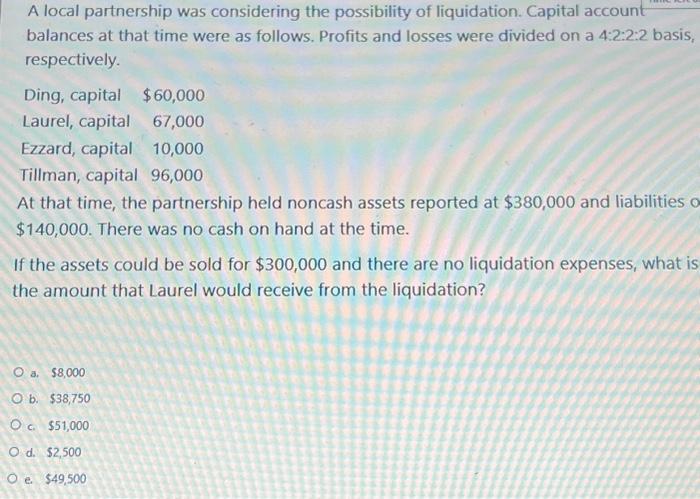

A local partnership was considering the possibility of liquidation. Capital account balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively. At that time, the partnership held noncash assets reported at $380,000 and liabilities $140,000. There was no cash on hand at the time. If the assets could be sold for $300,000 and there are no liquidation expenses, what is the amount that Laurel would receive from the liquidation? a. 58,000 b. $38,750 c. $51,000 d. $2,500 e. $49,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts