Question: Please answer question E3. indicate how many call(put) options you will need to short or long at what strike price in order to secure the

Please answer question E3. indicate how many call(put) options you will need to short or long at what strike price in order to secure the payoff at each stock price level as shown above.

Please answer question E3. indicate how many call(put) options you will need to short or long at what strike price in order to secure the payoff at each stock price level as shown above.

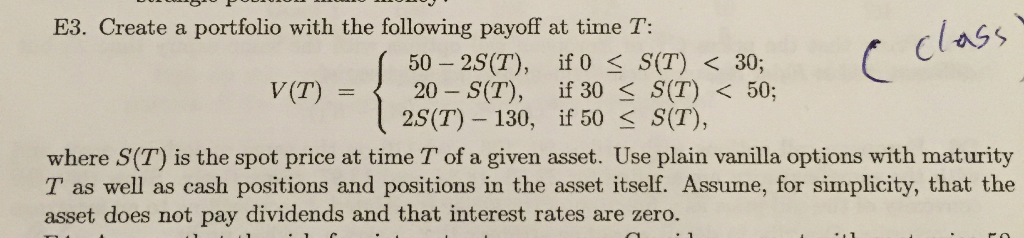

E3. Create a portfolio with the following payoff at time T: Class 50 2 S(T), if 0 S S(T) 30; 20 S(T), if 30 S S(T) 500 V(T) 2S(T) 130, if 50 S S(T), where S(T) is the spot price at time T of a given asset. Use plain vanilla options with maturity T as well as cash positions and positions in the asset itself. Assume, for simplicity, that the asset does not pay dividends and that interest rates are zero. E3. Create a portfolio with the following payoff at time T: Class 50 2 S(T), if 0 S S(T) 30; 20 S(T), if 30 S S(T) 500 V(T) 2S(T) 130, if 50 S S(T), where S(T) is the spot price at time T of a given asset. Use plain vanilla options with maturity T as well as cash positions and positions in the asset itself. Assume, for simplicity, that the asset does not pay dividends and that interest rates are zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts