Question: Please answer question in the format pictured below. Data and information at the bottom. You gathered the following data from time cards and individual employee

Please answer question in the format pictured below. Data and information at the bottom.

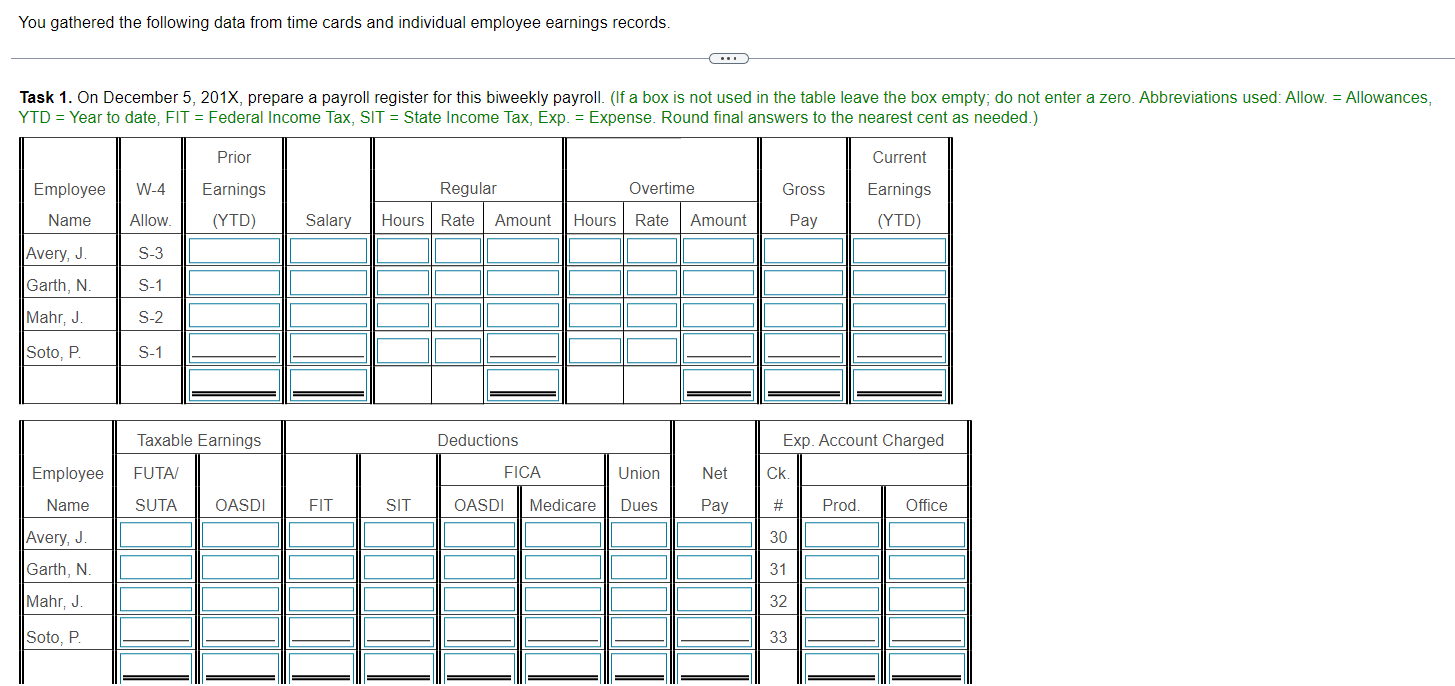

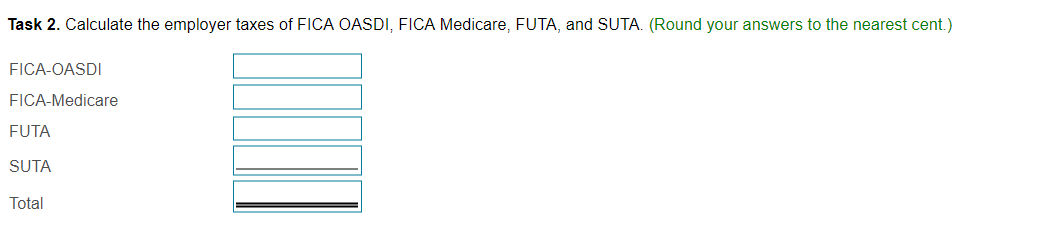

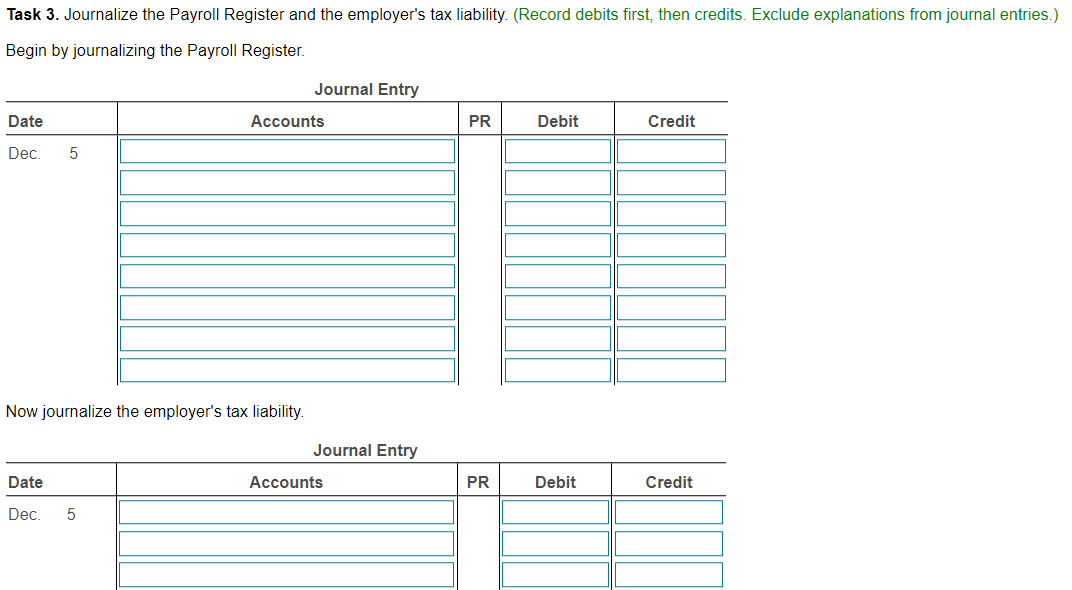

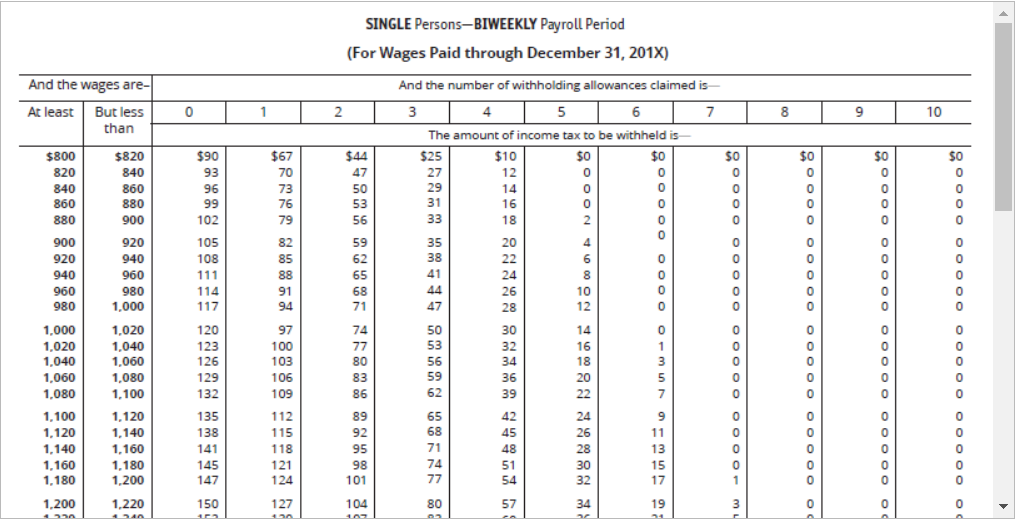

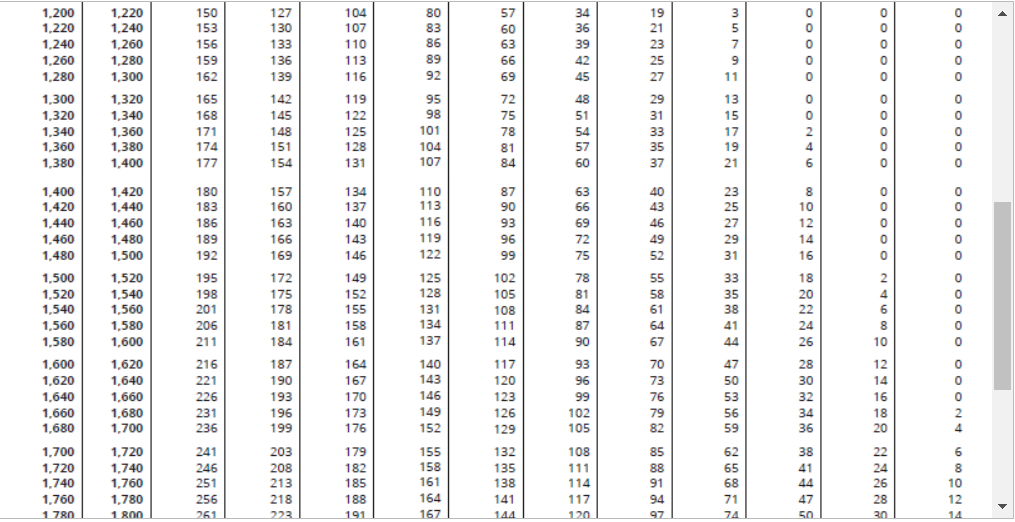

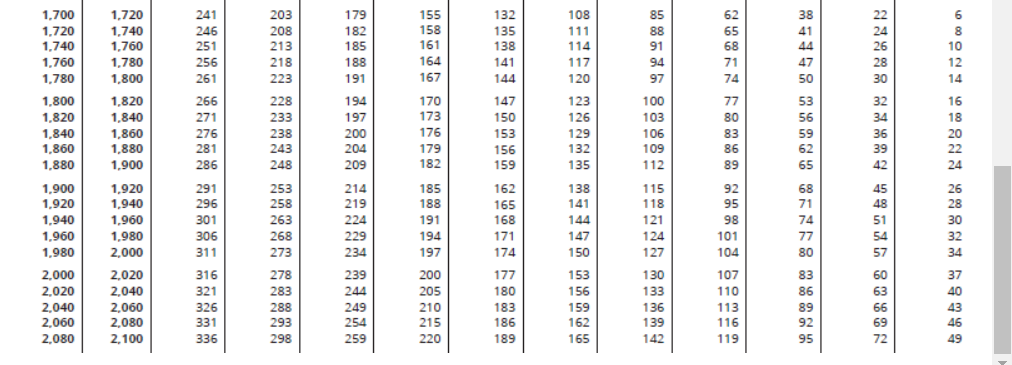

You gathered the following data from time cards and individual employee earnings records. Task 1. On December 5, 201X, prepare a payroll register for this biweekly payroll. (If a box is YTD = Year to date, FIT= Federal Income Tax, SIT= State Income Tax, Exp. = Expense. Rou Task 2. Calculate the employer taxes of FICA OASDI, FICA Medicare, FUTA, and SUTA. (Round your answers to the nearest cent.) FICA-OASDI FICA-Medicare FUTA SUTA Total Task 3. Journalize the Payroll Register and the employer's tax liability. (Record debits first, then credits. Exclude explanations from journal entries.) Begin by journalizing the Payroll Register. Now journalize the employer's tax liability. Data table More info Assume the following: 1. FICA OASDI: 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated using the federal income tax withholding table included. 3. State income tax is 5% of gross pay. 4. Union dues are $9 biweekly. 5. The SUTA rate is 5.4% and the FUTA rate is 0.6% on earnings up to $7,000. (Note that the $7,000 wage base applies to both SUTA and FUTA.) SINGLE Persons-BIWEEKLY Payroll Period (For Wages Paid through December 31, 201X) You gathered the following data from time cards and individual employee earnings records. Task 1. On December 5, 201X, prepare a payroll register for this biweekly payroll. (If a box is YTD = Year to date, FIT= Federal Income Tax, SIT= State Income Tax, Exp. = Expense. Rou Task 2. Calculate the employer taxes of FICA OASDI, FICA Medicare, FUTA, and SUTA. (Round your answers to the nearest cent.) FICA-OASDI FICA-Medicare FUTA SUTA Total Task 3. Journalize the Payroll Register and the employer's tax liability. (Record debits first, then credits. Exclude explanations from journal entries.) Begin by journalizing the Payroll Register. Now journalize the employer's tax liability. Data table More info Assume the following: 1. FICA OASDI: 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated using the federal income tax withholding table included. 3. State income tax is 5% of gross pay. 4. Union dues are $9 biweekly. 5. The SUTA rate is 5.4% and the FUTA rate is 0.6% on earnings up to $7,000. (Note that the $7,000 wage base applies to both SUTA and FUTA.) SINGLE Persons-BIWEEKLY Payroll Period (For Wages Paid through December 31, 201X)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts