Question: please answer question number (2) 1) Netphone Inc expects the following: UCFBT-$ 1million in perpetuity from the beginning of year 3 There is no income

please answer question number "(2)"

please answer question number "(2)"

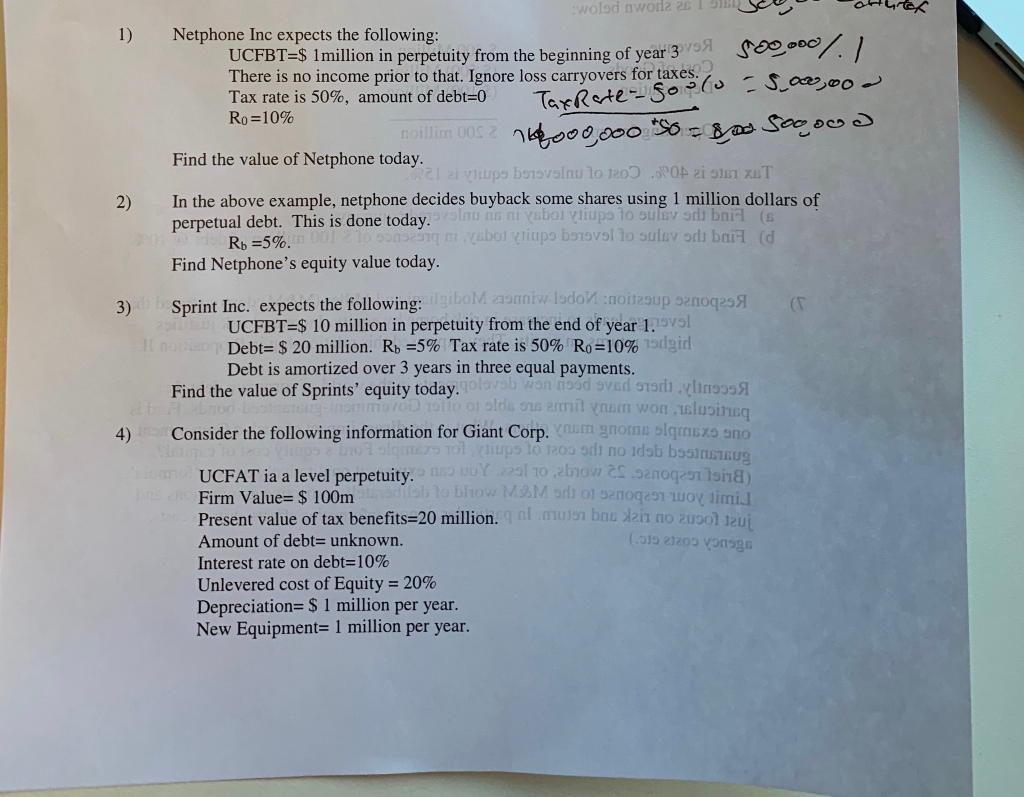

1) Netphone Inc expects the following: UCFBT-$ 1million in perpetuity from the beginning of year 3 There is no income prior to that. Ignore loss carryovers for taxes.s Tax rate is 50%, amount of debt=0 Ta Rete-50-( Ro =10% ow eo 0_ - Find the value of Netphone today. In the above example, netphone decides buyback some shares using 1 million dollars of perpetual debt. This is done today. 2) Rs 5%. Find Netphone's equity value today. 3) Sprint Inc. expects the following: UCFBT=$ 10 million in perpetuity from the end of year 1. Debt-$ 20 million. Rb-5% Tax rate is 50% Ro-10% Debt is amortized over 3 years in three equal payments. odgird Find the value of Sprints' equity today 4) Consider the following information for Giant Corp. UCFAT ia a level perpetuity Firm Value $ 100m Present value of tax benefits 20 million. Amount of debt- unknown Interest rate on debt=10% Unlevered cost of Equity-20% Depreciation S 1 million per year. New Equipment- 1 million per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts