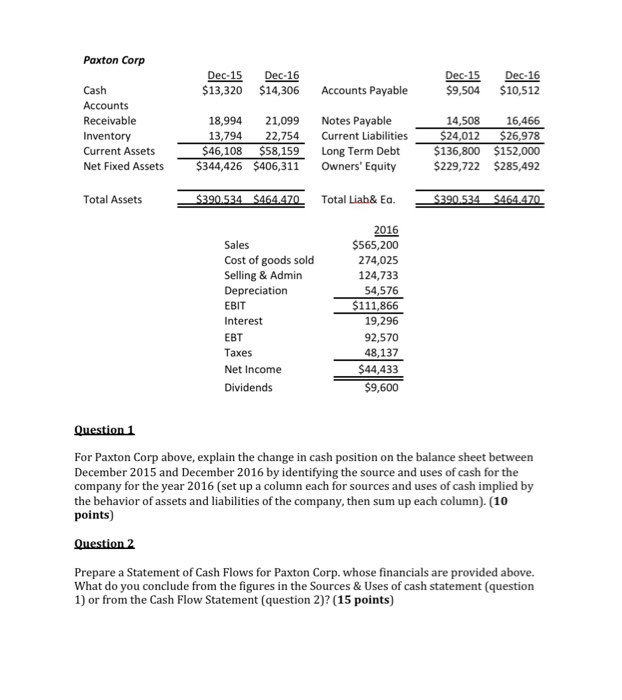

Question: Please answer Question one Paxton Corp Dec-15 Dec-16 S9,504 $10,512 Dec-15 Dec-16 Cash Accounts Receivable Inventory Current Assets Net Fixed Assets $13,320 $14,306 Accounts Payable

Paxton Corp Dec-15 Dec-16 S9,504 $10,512 Dec-15 Dec-16 Cash Accounts Receivable Inventory Current Assets Net Fixed Assets $13,320 $14,306 Accounts Payable 18,994 21,099 Notes Payable 13,794 22,754 Current Liabilities 46,108 $58,159 Long Term Debt 14,508 16,466 24,012 $26,978 136,800 $152,000 $229,722 $285,492 $344,426 $406,311 Owners' Equity Total Assets390.534 $46440 Total Liah& Ea. Sales Cost of goods sold Selling & Admin Depreciation EBIT Interest EBT Taxes Net Income Dividends 2016 $565,200 274,025 124,733 54,576 111,866 19,296 92,570 48,137 44,433 $9,600 Question 1 For Paxton Corp above, explain the change in cash position on the balance sheet between December 2015 and December 2016 by identifying the source and uses of cash for the company for the year 2016 (set up a column each for sources and uses of cash implied by the behavior of assets and liabilities of the company, then sum up each column). (10 points) Prepare a Statement of Cash Flows for Paxton Corp. whose financials are provided above. What do you conclude from the figures in the Sources & Uses of cash statement (question 1) or from the Cash Flow Statement (question 2)? (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts