Question: PLEASE ANSWER QUESTION SHOWING ALL WORK AND CORRECT ANSWER COMPLETELY!!! QUESTIONS 10-12!!! 9. Assume the initial value method is applied, compute Jasmine's Investment in Kayla

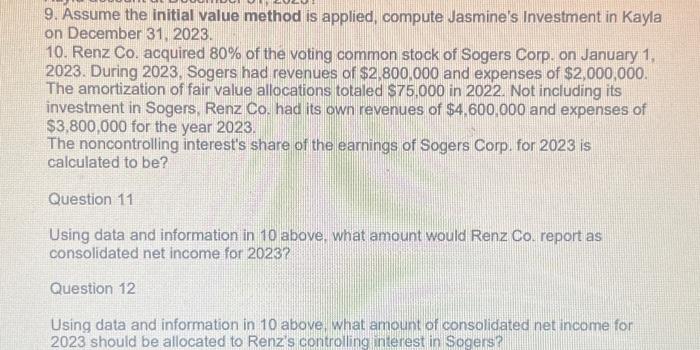

9. Assume the initial value method is applied, compute Jasmine's Investment in Kayla on December 31, 2023. 10. Renz Co. acquired 80% of the voting common stock of Sogers Corp. on January 1 , 2023. During 2023, Sogers had revenues of $2,800,000 and expenses of $2,000,000. The amortization of fair value allocations totaled $75,000 in 2022 . Not including its investment in Sogers, Renz Co. had its own revenues of $4,600,000 and expenses of $3,800,000 for the year 2023 . The noncontrolling interest's share of the earnings of Sogers Corp. for 2023 is calculated to be? Question 11 Using data and information in 10 above, what amount would Renz Co. report as consolidated net income for 2023 ? Question 12 Using data and information in 10 above, what amount of consolidated net income for 2023 should be allocated to Renz's controlling interest in Sogens

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts