Question: *** PLEASE ANSWER QUESTIONS 1, 2, & 3 *** Deli Meat Slicers, Car Door Handles, and Six-Pack Carriers? ITW Illinois Tool Works was founded in

*** PLEASE ANSWER QUESTIONS 1, 2, & 3 ***

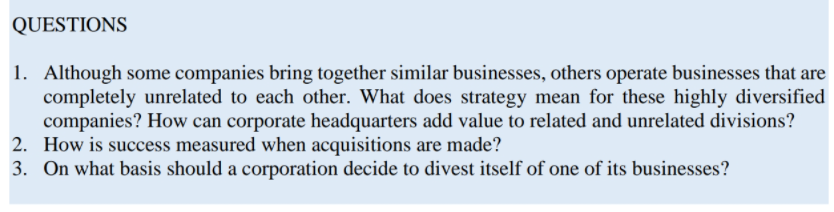

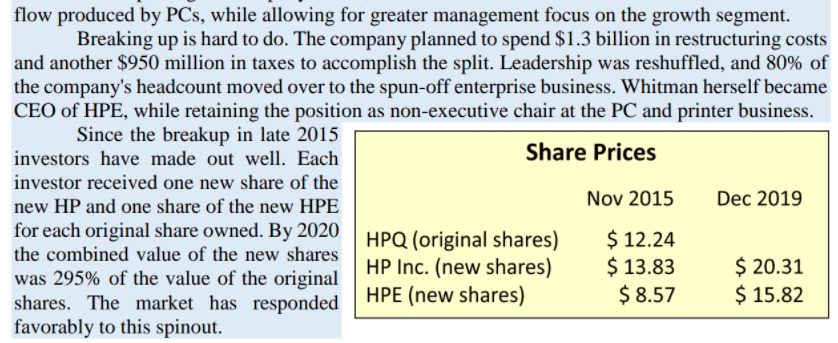

Deli Meat Slicers, Car Door Handles, and Six-Pack Carriers? ITW Illinois Tool Works was founded in 1912 in Chicago as a manufacturer of metal cutting tools. Over the years it branched out into completely unrelated enterprises such as electric switches, screws, fasteners, transmissions, and plastics. The company created and patented the plastic 6-pack can holder, among many other inventions. By the early 1980s the company had forty separate business units, each operating a different type of business in a variety of industries. After several of its business units came under competitive pressure from Japanese manufacturers and a troubled domestic auto industry, the company accelerated acquisitions. The blistering pace of acquisitions over the last 35 years has resulted in a company that operates 800 separate businesses worldwide in 87 divisions. Since 2013 it has divested 30 businesses. In 2020 its divisions are further organized into seven SBUs (strategic business units). The ITW headquarter office extols its "portfolio management" capabilities for handling this kind of business diversity. Cousins: Mickey Mouse, Princess Leia, and Iron Man? Walt Disney acquired Marvel Studios in 2009, giving it access to a trove of iconic characters like Iron Man and The Avengers. Then it acquired Lucasfilm Ltd. in 2012 for $4.1 billion, with its Star Wars franchise. It paid half this acquisition price in cash, and half with Disney shares. Disney CEO Robert Iger had a clear vision that that Disney's future rested on enduring characters. Building on its previous acquisition of Pixar Animation, the Marvel and Star Wars portfolios gave Disney more material to appeal to a broader range of children and families, especially teenage boys. George Lucas, who produced Star Wars, had initially been worried about giving up control and oversight of the Star Wars franchise and details to another company. However, Disney and Lucasfilm had already collaborated on a Star Wars ride at Disney World, and this had given each company to a chance learn about how the other worked. Lucas commented on the sale of his company: "Disney's reach and experience give Lucasfilm the opportunity to blaze new trails in film, televisions, interactive media, theme parks, live entertainment and consumer products." By 2012 the seven Star Wars movies to date had generated $4.5 billion in worldwide theater revenues over a 30-year period. Iger defended its acquisition price: "We are confident we can earn a return on invested capital well in excess of our cost of capital." In 2015 Disney released its first Lucasfilm collaboration, Star Wars Episode VII: The Force Awakens. The film achieved the highest domestic box office of all films ever, and 3rd highest worldwide box office ever. In 2017 Disney followed with Star Wars Episode VIII: The Last Jedi, which outsold all movies domestically that year and is ranked 13th on the best-selling films worldwide. In 2019 after only 11 days in theaters Star Wars IX: The Rise of Skywalker was already 10th in U.S. box office revenues for the entire year. Under the Marvel Studios name, Disney released Black Panther in 2018 and Avengers Endgame in 2019. Endgame ranks 1st among all films ever released. Breaking Up is Hard to Do Three years after she took over as CEO of Hewlett-Packard, Meg Whitman announced that the iconic company would rend itself into two separate entities - one selling PCs and printers (HP), and one selling enterprise hardware and systems (HPE). The dynamic of the two businesses were very different in 2014. PCs and printers were a mature industry, where large scale and thin profit margins prevailed amidst ever-increasing global competition. Enterprise hardware and systems (massive servers and cloud computing technology) were fast growth industry segments that required speed and agility. Although operating them as completely separate divisions was possible, markets tended to push down HP's stock and overall growth assessment because of the old, staid PC business. Splitting the company in two, HP's investors would continue to benefit from the cash flow produced by PCs, while allowing for greater management focus on the growth segment. flow produced by PCs, while allowing for greater management focus on the growth segment. Breaking up is hard to do. The company planned to spend $1.3 billion in restructuring costs and another $950 million in taxes to accomplish the split. Leadership was reshuffled, and 80% of the company's headcount moved over to the spun-off enterprise business. Whitman herself became CEO of HPE, while retaining the position as non-executive chair at the PC and printer business. Since the breakup in late 2015 investors have made out well. Each Share Prices investor received one new share of the new HP and one share of the new HPE Nov 2015 Dec 2019 for each original share owned. By 2020 HPQ (original shares) $ 12.24 the combined value of the new shares HP Inc. (new shares) $ 13.83 $ 20.31 was 295% of the value of the original shares. The market has responded HPE (new shares) $8.57 $15.82 favorably to this spinout. QUESTIONS 1. Although some companies bring together similar businesses, others operate businesses that are completely unrelated to each other. What does strategy mean for these highly diversified companies? How can corporate headquarters add value to related and unrelated divisions? 2. How is success measured when acquisitions are made? 3. On what basis should a corporation decide to divest itself of one of its businesses