Question: Please Answer questions 1, 2, and 3. Question 3 is at the bottom of the image. Thank you! Question 3.1 - Inventory: Below is the

Please Answer questions 1, 2, and 3. Question 3 is at the bottom of the image. Thank you!

Please Answer questions 1, 2, and 3. Question 3 is at the bottom of the image. Thank you!

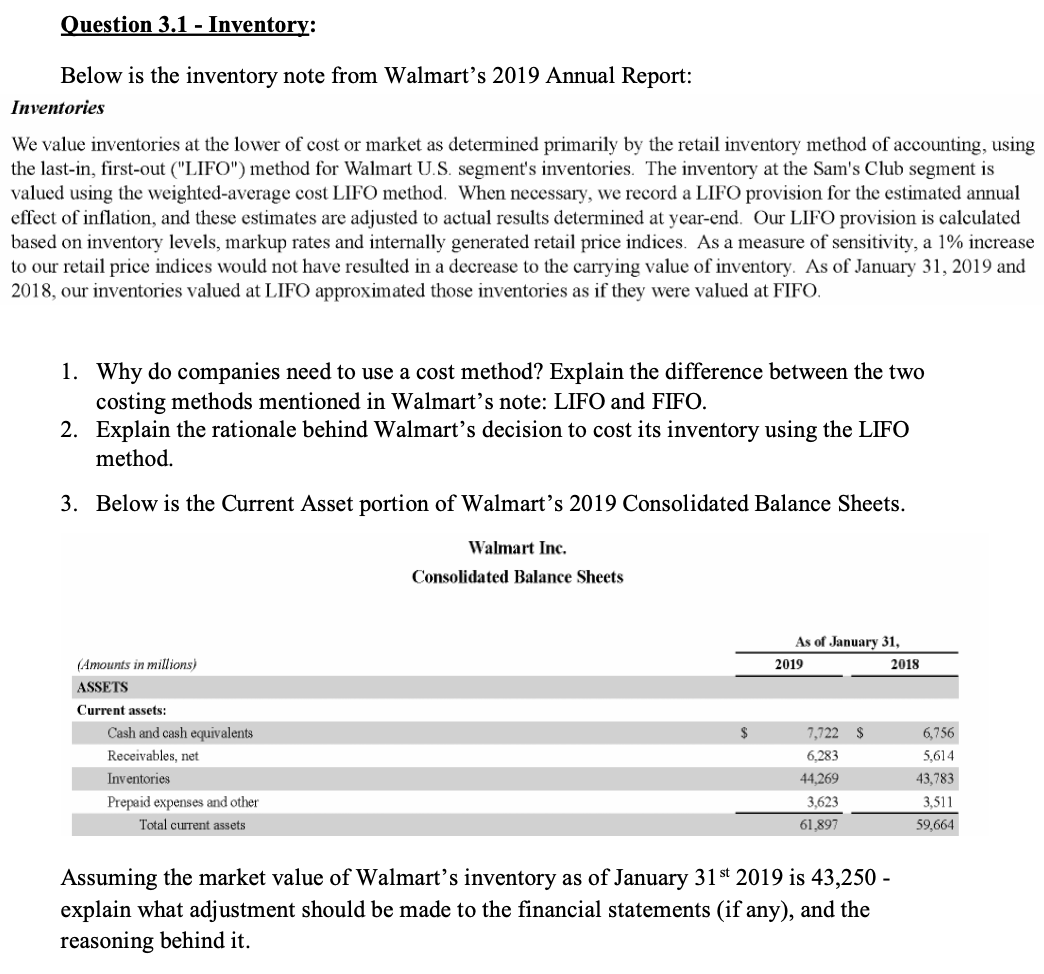

Question 3.1 - Inventory: Below is the inventory note from Walmart's 2019 Annual Report: Inventories We value inventories at the lower of cost or market as determined primarily by the retail inventory method of accounting, using the last-in, first-out ("LIFO") method for Walmart U.S. segment's inventories. The inventory at the Sam's Club segment is valued using the weighted-average cost LIFO method. When necessary, we record a LIFO provision for the estimated annual effect of inflation, and these estimates are adjusted to actual results determined at year-end. Our LIFO provision is calculated based on inventory levels, markup rates and internally generated retail price indices. As a measure of sensitivity, a 1% increase to our retail price indices would not have resulted in a decrease to the carrying value of inventory. As of January 31, 2019 and 2018, our inventories valued at LIFO approximated those inventories as if they were valued at FIFO. 1. Why do companies need to use a cost method? Explain the difference between the two costing methods mentioned in Walmart's note: LIFO and FIFO. 2. Explain the rationale behind Walmart's decision to cost its inventory using the LIFO method. 3. Below is the Current Asset portion of Walmart's 2019 Consolidated Balance Sheets. Assuming the market value of Walmart's inventory as of January 31st2019 is 43,250 explain what adjustment should be made to the financial statements (if any), and the reasoning behind it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts