Question: please answer questions 1 and 2 completely Scenario 1 On December 1, the balance of supplies totals $400. On December 15, the company purchases an

please answer questions 1 and 2 completely

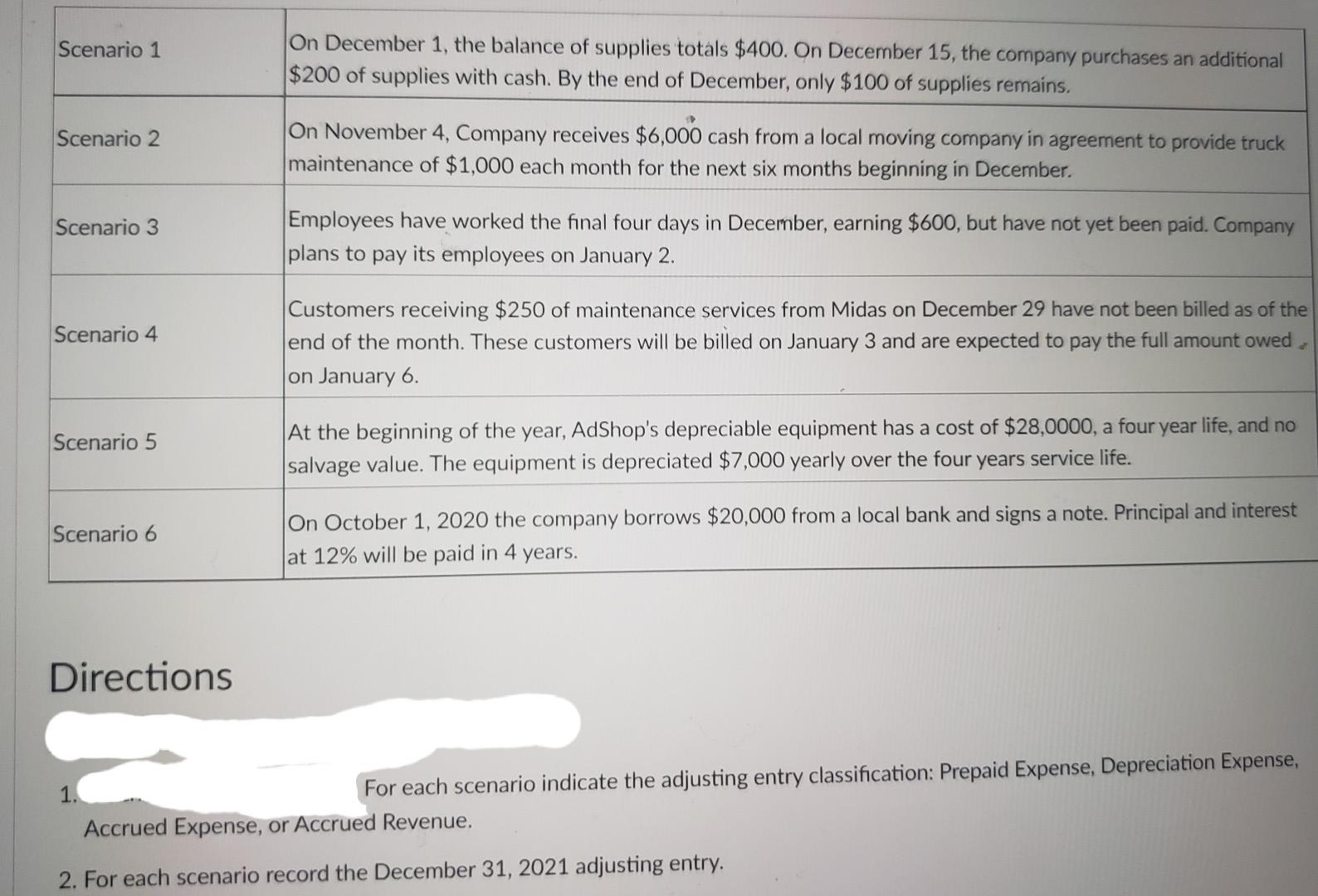

Scenario 1 On December 1, the balance of supplies totals $400. On December 15, the company purchases an additional $200 of supplies with cash. By the end of December, only $100 of supplies remains. Scenario 2 On November 4, Company receives $6,000 cash from a local moving company in agreement to provide truck maintenance of $1,000 each month for the next six months beginning in December. Scenario 3 Employees have worked the final four days in December, earning $600, but have not yet been paid. Company plans to pay its employees on January 2. Scenario 4 Customers receiving $250 of maintenance services from Midas on December 29 have not been billed as of the end of the month. These customers will be billed on January 3 and are expected to pay the full amount owed on January 6. Scenario 5 At the beginning of the year, AdShop's depreciable equipment has a cost of $28,0000, a four year life, and no salvage value. The equipment is depreciated $7,000 yearly over the four years service life. Scenario 6 On October 1, 2020 the company borrows $20,000 from a local bank and signs a note. Principal and interest at 12% will be paid in 4 years. Directions 1. For each scenario indicate the adjusting entry classification: Prepaid Expense, Depreciation Expense, Accrued Expense, or Accrued Revenue. 2. For each scenario record the December 31, 2021 adjusting entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts