Question: please answer questions #10-12 thanks Question 10 (1 point) You are considering purchasing an office building in Boston for a pension fund. You plan to

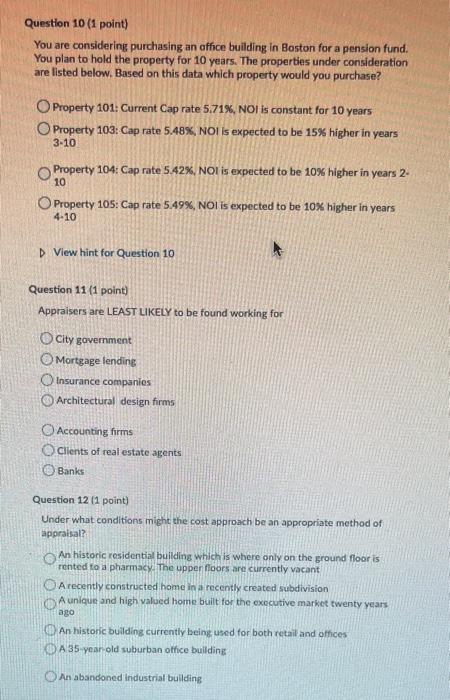

Question 10 (1 point) You are considering purchasing an office building in Boston for a pension fund. You plan to hold the property for 10 years. The properties under consideration are listed below. Based on this data which property would you purchase? Property 101: Current Cap rate 5.71%, NOI is constant for 10 years Property 103: Cap rate 5.48%, NOI is expected to be 15% higher in years 3-10 Property 104: Cap rate 5.42%, NOI is expected to be 10% higher in years 2- 10 O Property 105: Cap rate 5.49%, NOI is expected to be 10% higher in years 4-10 View hint for Question 10 Question 11 (1 point) Appraisers are LEAST LIKELY to be found working for City government Mortgage lending Insurance companies Architectural design firms Accounting firms Clients of real estate agents Banks Question 12 (1 point) Under what conditions might the cost approach be an appropriate method of appraisal? An historic residential building which is where only on the ground floor is rented to a pharmacy. The upper floors are currently vacant A recently constructed home in a recently created subdivision A unique and high valued home built for the executive market twenty years ago An historic building currently being used for both retail and offices A 35 year old suburban office building An abandoned industrial building

Step by Step Solution

There are 3 Steps involved in it

Here are the answers to Questions 1012 based on the information provided Question 10 Property Selection We are evaluating which property to purchase b... View full answer

Get step-by-step solutions from verified subject matter experts