Question: please answer questions #1-2 and show all work and explain answers You are planning to purchase a house in Houston upon graduation in exactly 3

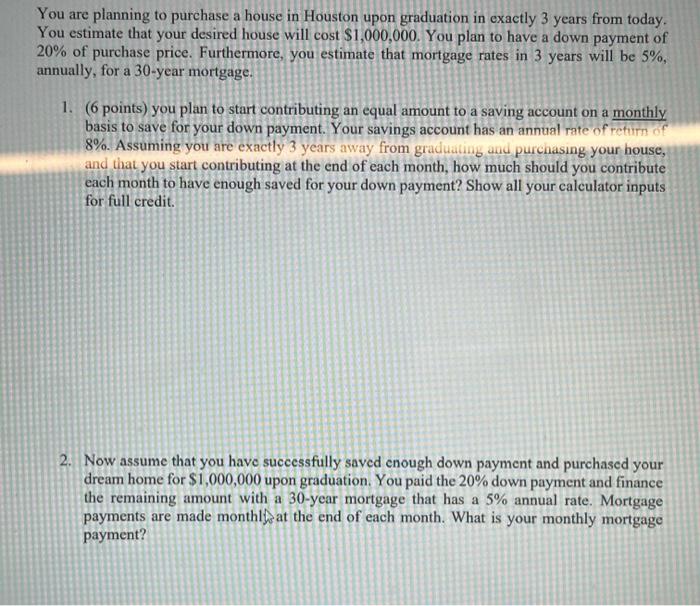

You are planning to purchase a house in Houston upon graduation in exactly 3 years from today. You estimate that your desired house will cost $1,000,000. You plan to have a down payment of 20% of purchase price. Furthermore, you estimate that mortgage rates in 3 years will be 5%, annually, for a 30-year mortgage. 1. (6 points) you plan to start contributing an equal amount to a saving account on a monthly basis to save for your down payment. Your savings account has an annual rate of return chf 8%. Assuming you are exactly 3 years away from graduating and purchasing your house, and that you start contributing at the end of each month, how much should you contribute each month to have enough saved for your down payment? Show all your calculator inputs for full credit. 2. Now assume that you have successfully saved enough down payment and purchased your dream home for $1,000,000 upon graduation. You paid the 20% down payment and finance the remaining amount with a 30 -year mortgage that has a 5% annual rate. Mortgage payments are made monthly at the end of each month. What is your monthly mortgage payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts