Question: Please answer questions 13-21 18. Should they accept this order? Yes or no and by how much? Accept Reject Amount of benefit 19. Now assume

Please answer questions 13-21

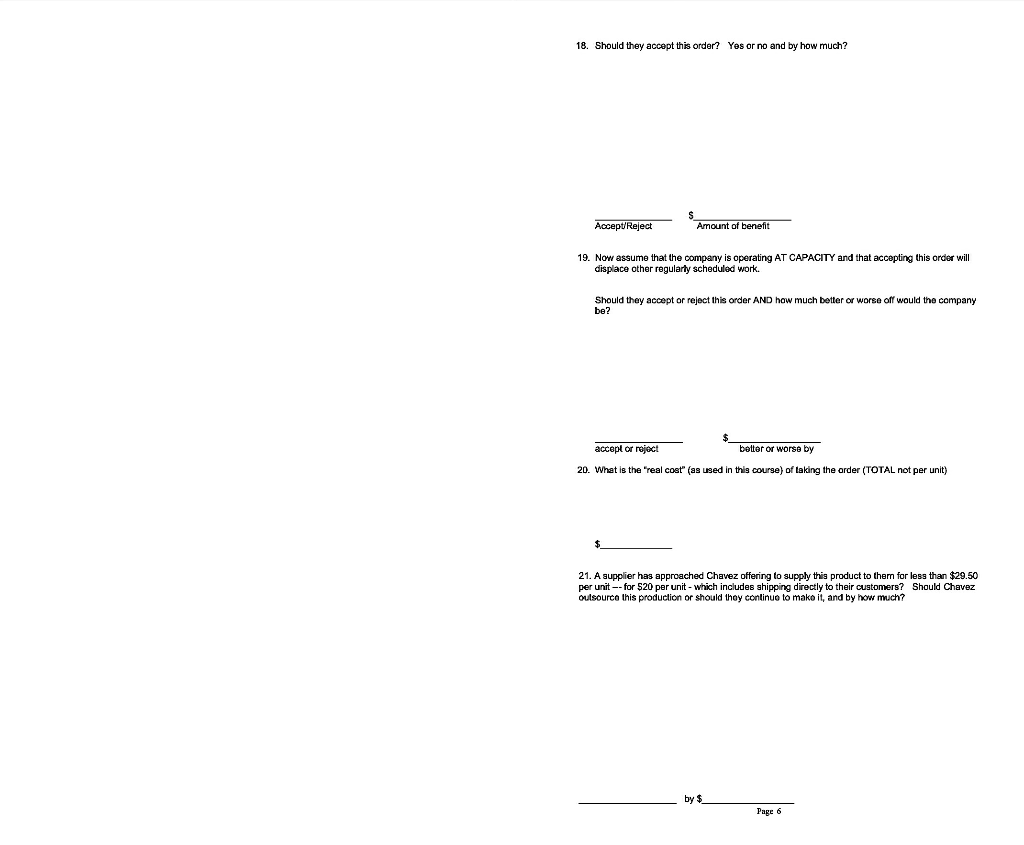

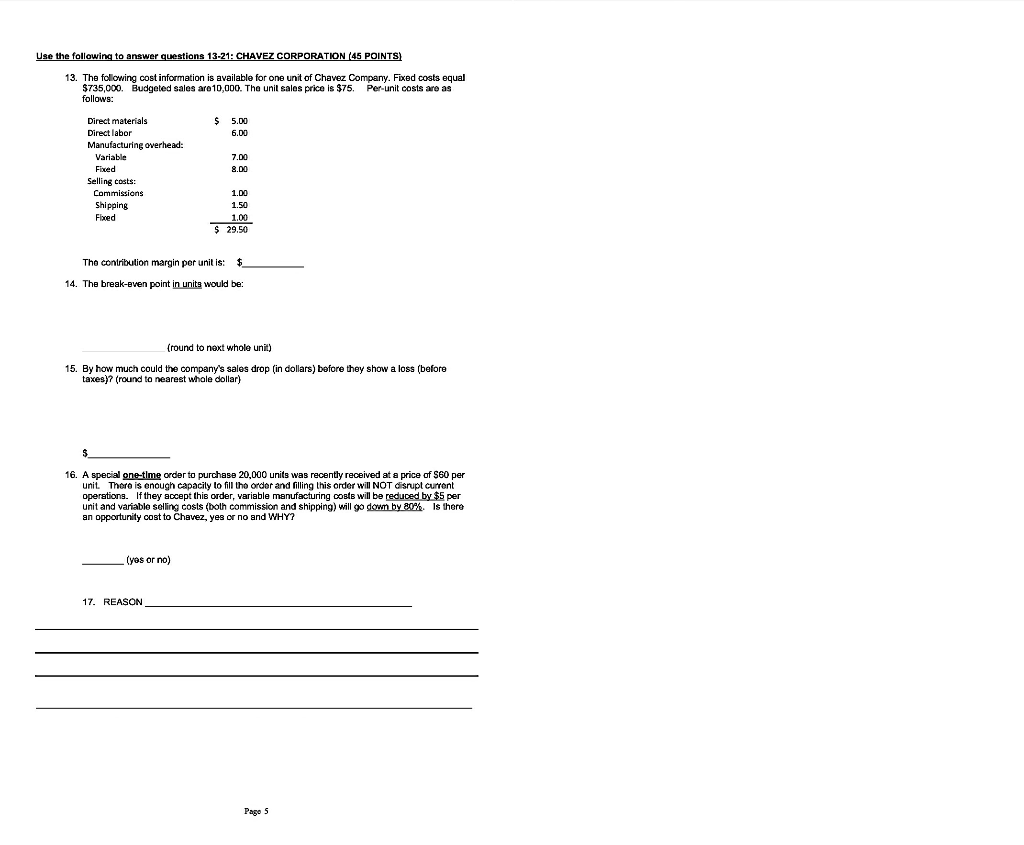

18. Should they accept this order? Yes or no and by how much? Accept Reject Amount of benefit 19. Now assume that the company is operating AT CAPACITY and that accepting this order will displace other regularly scheduled work. Should they accept or reject this order AND how much better or worse off would the company be? accepl or reject better or worse by 20. What is the "real cost" (as used in this course) of taking the order (TOTAL not per unit) 21. A supplier has approached Chavez offering to supply this product to them for less than $29.50 per unit--for $20 per unit - which includes shipping directly to their customers? Should Chavez Outsourco this production or should they continue to make it, and by how much? by $2 Page 6 Use the following to answer questions 13-21: CHAVEZ CORPORATION (45 POINTS) 13. The following cost information is available for one unit of Chavez Company. Fixed costs equal $735,000. Budgeted sales are 10,000. The unit sales price is $75. Per-unit costs are as follows: 5.00 6.00 Direct materials Direct labor Manufacturing overhead: Variable Fixed Selling costs: Commissions Shipping Fixed 7.00 8.00 1.00 1.50 1.00 $ 29.50 The contribution margin per unit is: $ 14. The break-even point in units would be: (round to next whole unit) 15. By how much could the company's sales drop (in dollars) before they show a loss (before taxes}? (round to nearest whole dollar) $ 16. A special one-time order to purchase 20,000 units was recently received at a price of S60 per unit. There is enough capacity to fill the order and filling this order will NOT disrupt current operations. If they accept this order, variable manufacturing costs will be reduced by $5 per unit and variable selling costs (both commission and shipping) will go down by 20%. Is there an opportunity cost to Chavez, yes or no and WHY? (yes or no) 17. REASON Page 5 18. Should they accept this order? Yes or no and by how much? Accept Reject Amount of benefit 19. Now assume that the company is operating AT CAPACITY and that accepting this order will displace other regularly scheduled work. Should they accept or reject this order AND how much better or worse off would the company be? accepl or reject better or worse by 20. What is the "real cost" (as used in this course) of taking the order (TOTAL not per unit) 21. A supplier has approached Chavez offering to supply this product to them for less than $29.50 per unit--for $20 per unit - which includes shipping directly to their customers? Should Chavez Outsourco this production or should they continue to make it, and by how much? by $2 Page 6 Use the following to answer questions 13-21: CHAVEZ CORPORATION (45 POINTS) 13. The following cost information is available for one unit of Chavez Company. Fixed costs equal $735,000. Budgeted sales are 10,000. The unit sales price is $75. Per-unit costs are as follows: 5.00 6.00 Direct materials Direct labor Manufacturing overhead: Variable Fixed Selling costs: Commissions Shipping Fixed 7.00 8.00 1.00 1.50 1.00 $ 29.50 The contribution margin per unit is: $ 14. The break-even point in units would be: (round to next whole unit) 15. By how much could the company's sales drop (in dollars) before they show a loss (before taxes}? (round to nearest whole dollar) $ 16. A special one-time order to purchase 20,000 units was recently received at a price of S60 per unit. There is enough capacity to fill the order and filling this order will NOT disrupt current operations. If they accept this order, variable manufacturing costs will be reduced by $5 per unit and variable selling costs (both commission and shipping) will go down by 20%. Is there an opportunity cost to Chavez, yes or no and WHY? (yes or no) 17. REASON Page 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts