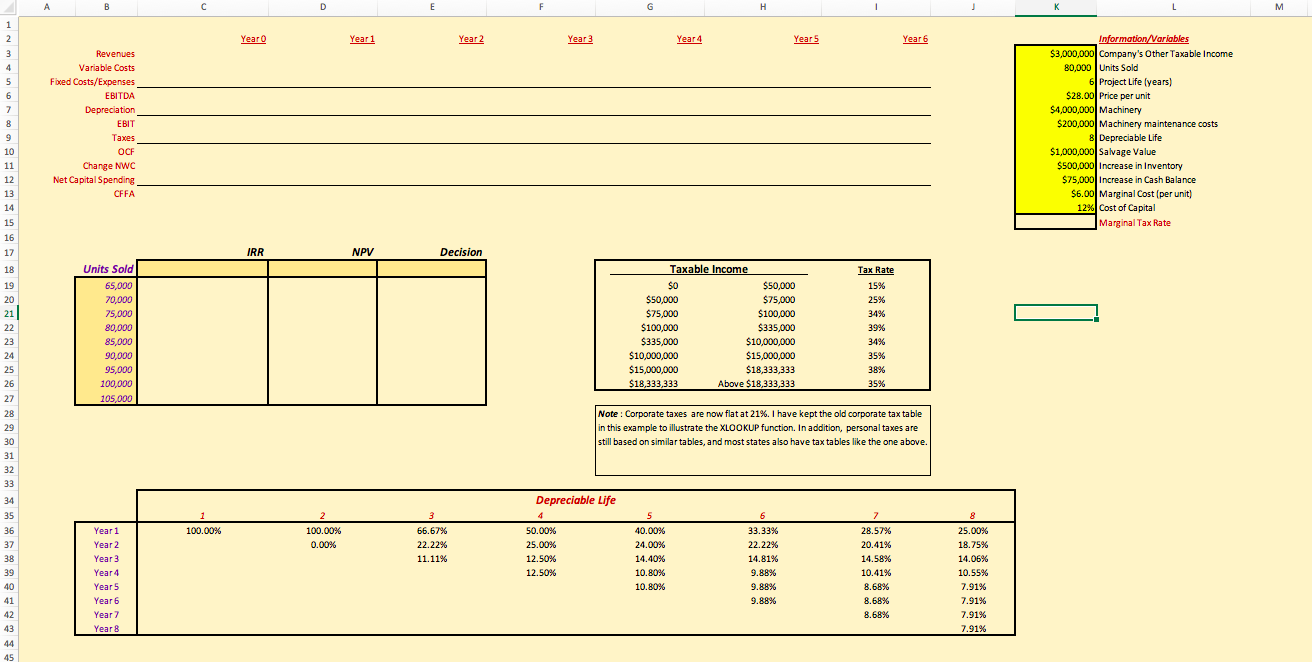

Question: Please answer questions 1-5 Information given in first paragraph has been imputed into column k please refer to first paragraph and excel sheet (column k)

Please answer questions 1-5

Information given in first paragraph has been imputed into column k

please refer to first paragraph and excel sheet (column k) for referenced values

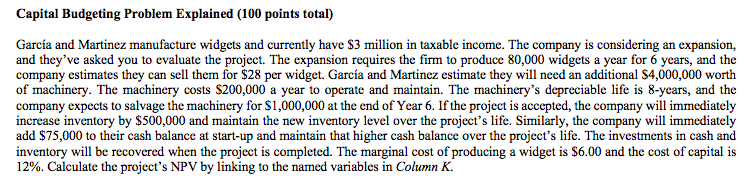

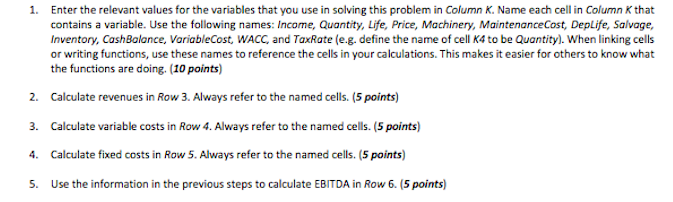

Note : Corporate taxes are now flat at 21%. have kept the old corporate tax table in this example to illustrate the XLOOKUP function. In addition, personal taxes are still based on similar tables, and most states also have tax tables like the one above. Capital Budgeting Problem Explained (100 points total) Garca and Martinez manufacture widgets and currently have $3 million in taxable income. The company is considering an expansion, and they've asked you to evaluate the project. The expansion requires the firm to produce 80,000 widgets a year for 6 years, and the company estimates they can sell them for $28 per widget. Garca and Martinez estimate they will need an additional $4,000,000 worth of machinery. The machinery costs $200,000 a year to operate and maintain. The machinery's depreciable life is 8-years, and the company expects to salvage the machinery for $1,000,000 at the end of Year 6 . If the project is accepted, the company will immediately increase inventory by $500,000 and maintain the new inventory level over the project's life. Similarly, the company will immediately add $75,000 to their cash balance at start-up and maintain that higher cash balance over the project's life. The investments in cash and inventory will be recovered when the project is completed. The marginal cost of producing a widget is $6.00 and the cost of capital is 12%. Calculate the project's NPV by linking to the named variables in Column K. 1. Enter the relevant values for the variables that you use in solving this problem in Column K. Name each cell in Column K that contains a variable. Use the following names: Income, Quantity, Life, Price, Machinery, MaintenanceCost, DepLife, Salvage, Inventory, CashBalance, VariableCost, WACC, and TaxRate (e.g. define the name of cell K4 to be Quantity). When linking cells or writing functions, use these names to reference the cells in your calculations. This makes it easier for others to know what the functions are doing. ( 10 points) 2. Calculate revenues in Row 3. Always refer to the named cells. (5 points) 3. Calculate variable costs in Row 4 . Always refer to the named cells. ( 5 points) 4. Calculate fixed costs in Row 5. Always refer to the named cells. (5 points) 5. Use the information in the previous steps to calculate EBITDA in Row 6 . ( 5 points) Note : Corporate taxes are now flat at 21%. have kept the old corporate tax table in this example to illustrate the XLOOKUP function. In addition, personal taxes are still based on similar tables, and most states also have tax tables like the one above. Capital Budgeting Problem Explained (100 points total) Garca and Martinez manufacture widgets and currently have $3 million in taxable income. The company is considering an expansion, and they've asked you to evaluate the project. The expansion requires the firm to produce 80,000 widgets a year for 6 years, and the company estimates they can sell them for $28 per widget. Garca and Martinez estimate they will need an additional $4,000,000 worth of machinery. The machinery costs $200,000 a year to operate and maintain. The machinery's depreciable life is 8-years, and the company expects to salvage the machinery for $1,000,000 at the end of Year 6 . If the project is accepted, the company will immediately increase inventory by $500,000 and maintain the new inventory level over the project's life. Similarly, the company will immediately add $75,000 to their cash balance at start-up and maintain that higher cash balance over the project's life. The investments in cash and inventory will be recovered when the project is completed. The marginal cost of producing a widget is $6.00 and the cost of capital is 12%. Calculate the project's NPV by linking to the named variables in Column K. 1. Enter the relevant values for the variables that you use in solving this problem in Column K. Name each cell in Column K that contains a variable. Use the following names: Income, Quantity, Life, Price, Machinery, MaintenanceCost, DepLife, Salvage, Inventory, CashBalance, VariableCost, WACC, and TaxRate (e.g. define the name of cell K4 to be Quantity). When linking cells or writing functions, use these names to reference the cells in your calculations. This makes it easier for others to know what the functions are doing. ( 10 points) 2. Calculate revenues in Row 3. Always refer to the named cells. (5 points) 3. Calculate variable costs in Row 4 . Always refer to the named cells. ( 5 points) 4. Calculate fixed costs in Row 5. Always refer to the named cells. (5 points) 5. Use the information in the previous steps to calculate EBITDA in Row 6 . ( 5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts