Question: Please answer questions 1-6. Below are options multiple choice answers for problems 1-6. 200 THOUSAND 0 100 THOUSAND Iestion 4 0 587,150 You have a

Please answer questions 1-6. Below are options multiple choice answers for problems 1-6.

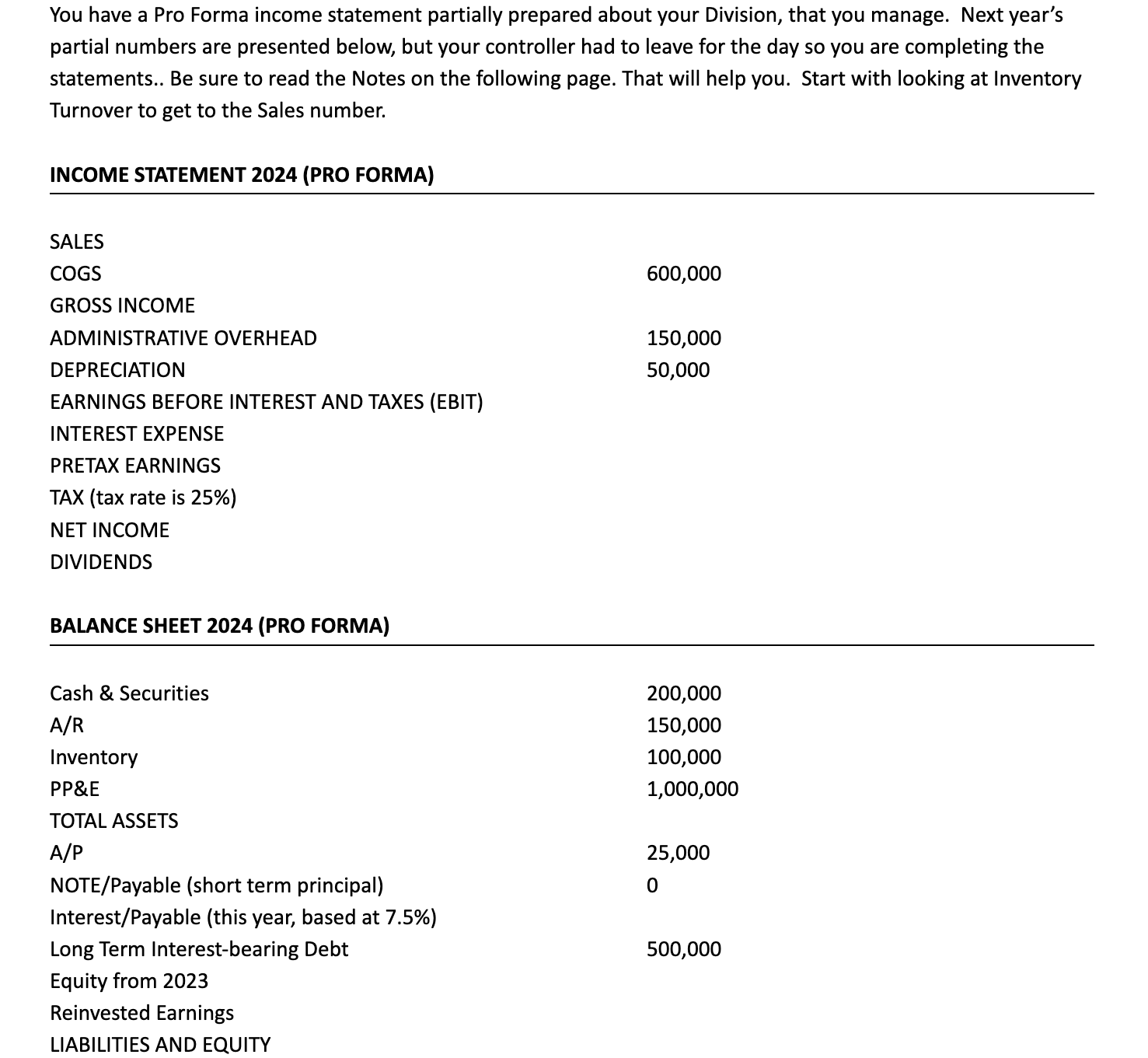

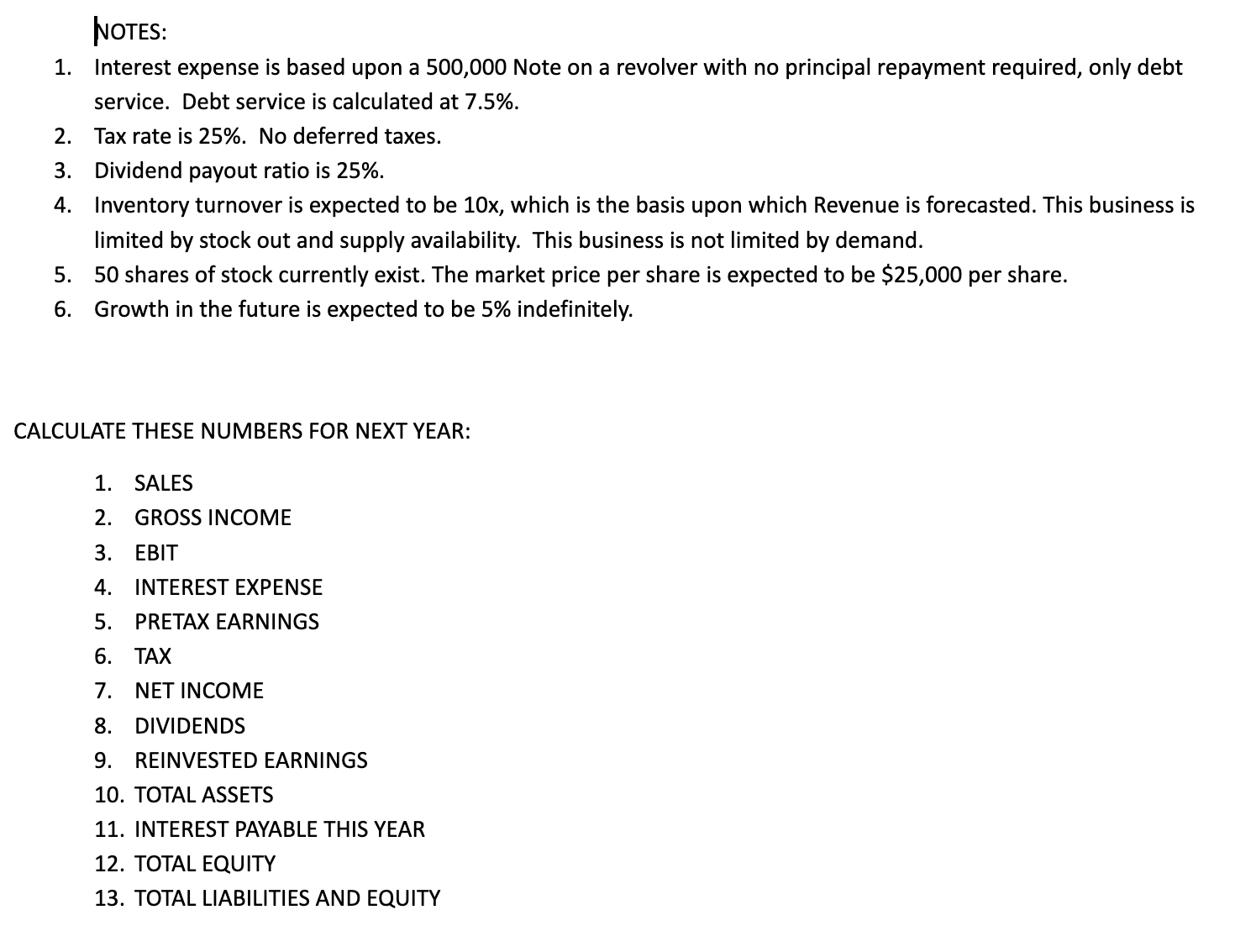

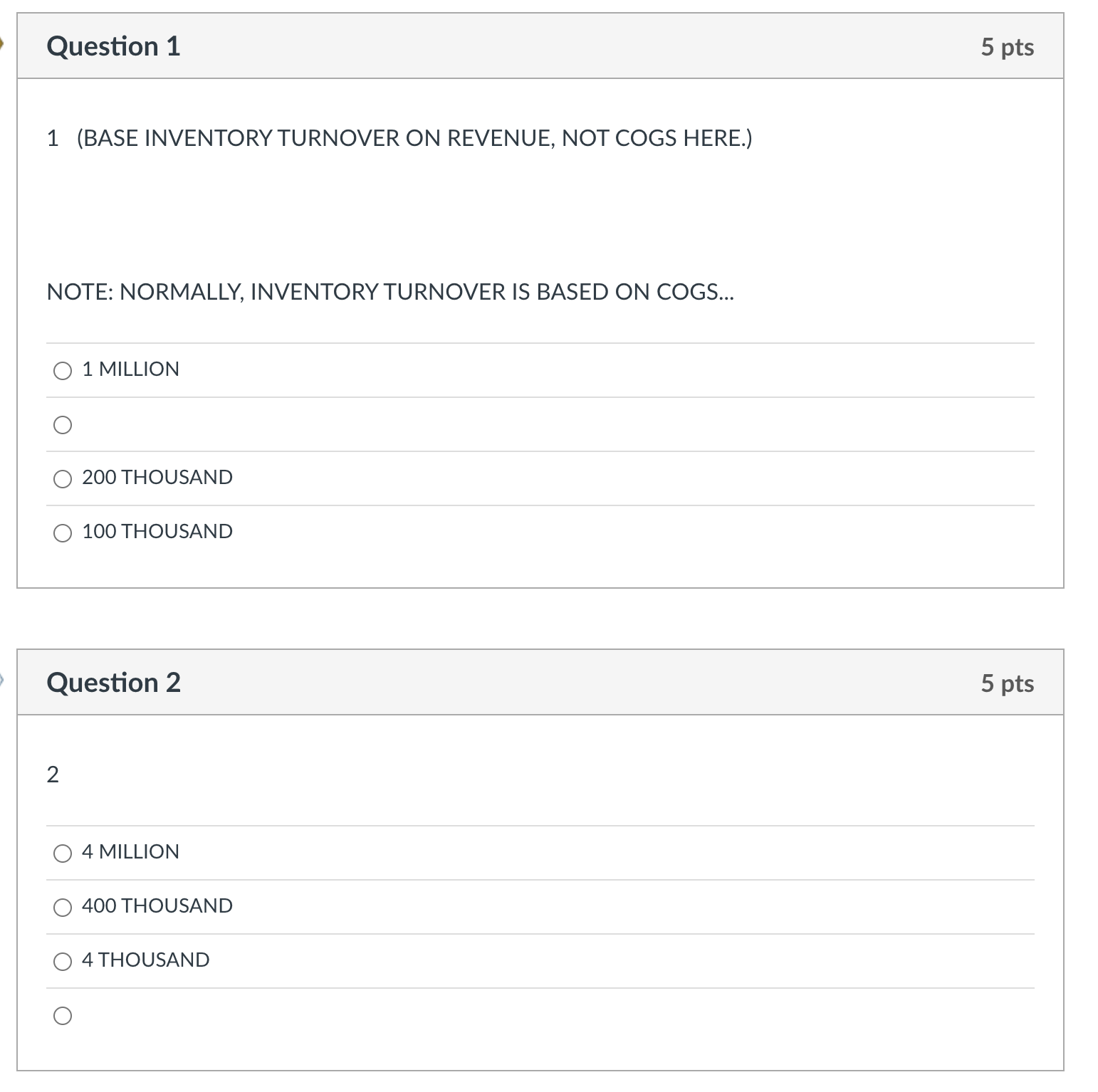

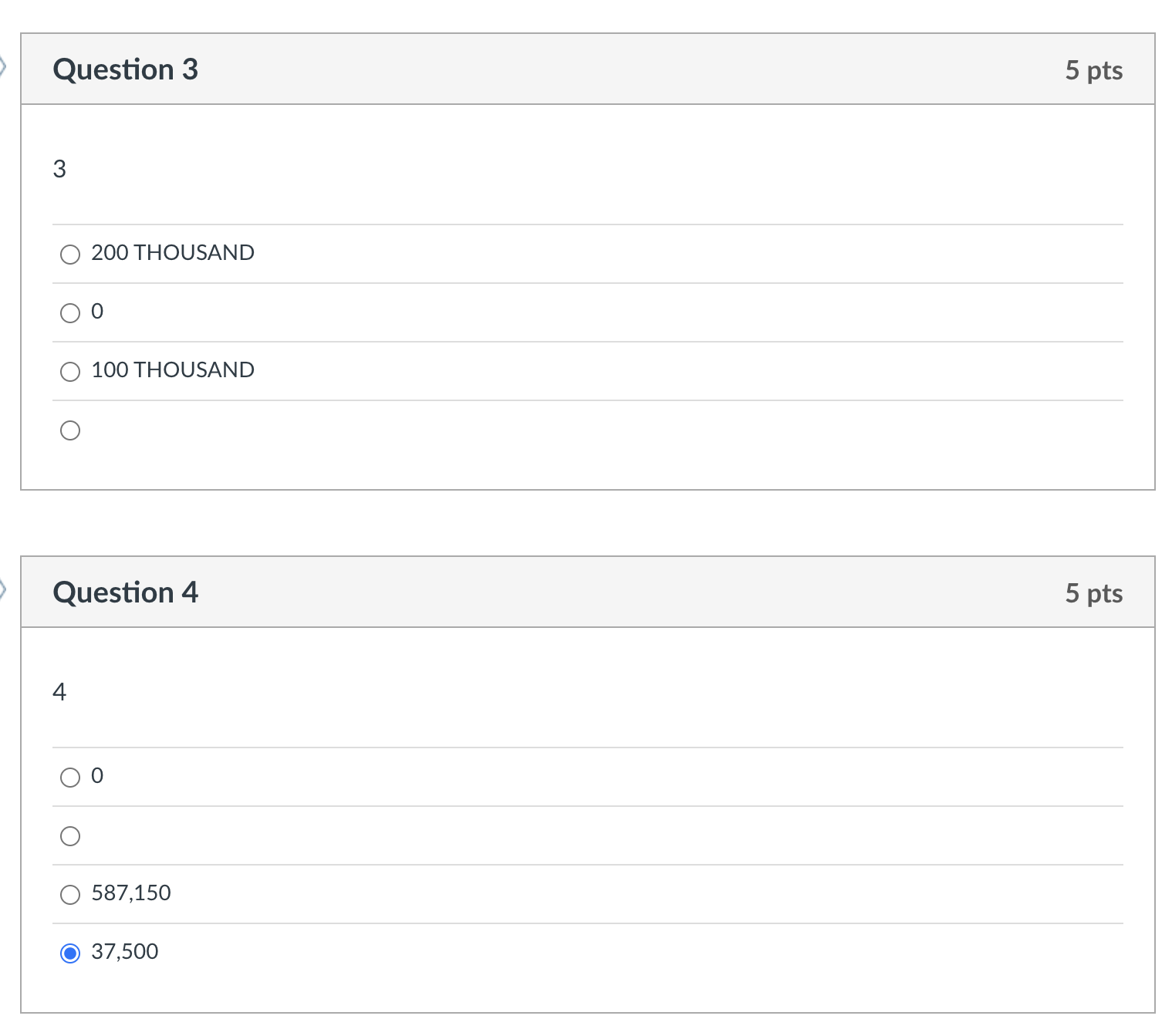

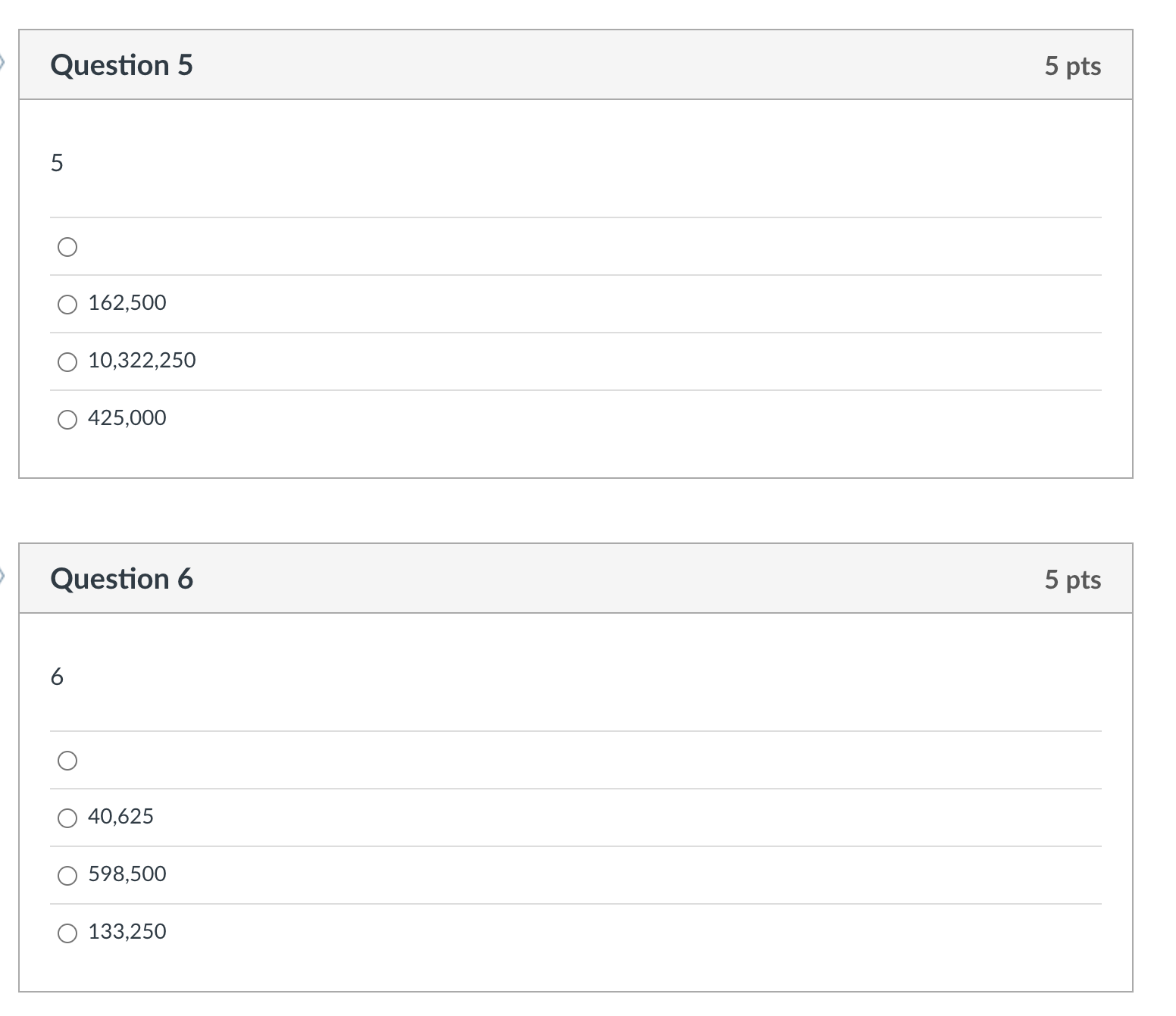

200 THOUSAND 0 100 THOUSAND Iestion 4 0 587,150 You have a Pro Forma income statement partially prepared about your Division, that you manage. Next year's partial numbers are presented below, but your controller had to leave for the day so you are completing the statements.. Be sure to read the Notes on the following page. That will help you. Start with looking at Inventory Turnover to get to the Sales number. INCOME STATEMENT 2024 (PRO FORMA) SALES COGS 600,000 GROSS INCOME ADMINISTRATIVE OVERHEAD DEPRECIATION 150,000 EARNINGS BEFORE INTEREST AND TAXES (EBIT) 50,000 INTEREST EXPENSE PRETAX EARNINGS TAX (tax rate is 25\%) NET INCOME DIVIDENDS BALANCE SHEET 2024 (PRO FORMA) Cash \& Securities A/R Inventory PP\&E TOTAL ASSETS A/P NOTE/Payable (short term principal) Interest/Payable (this year, based at 7.5% ) Long Term Interest-bearing Debt Equity from 2023 Reinvested Earnings LIABILITIES AND EQUITY 200,000 150,000 100,000 1,000,000 25,000 0 500,000 500,000 5 162,500 10,322,250 425,000 Question 6 5 pts 6 40,625 598,500 133,250 1. Interest expense is based upon a 500,000 Note on a revolver with no principal repayment required, only debt service. Debt service is calculated at 7.5%. 2. Tax rate is 25%. No deferred taxes. 3. Dividend payout ratio is 25%. 4. Inventory turnover is expected to be 10x, which is the basis upon which Revenue is forecasted. This business is limited by stock out and supply availability. This business is not limited by demand. 5. 50 shares of stock currently exist. The market price per share is expected to be $25,000 per share. 6. Growth in the future is expected to be 5% indefinitely. CALCULATE THESE NUMBERS FOR NEXT YEAR: 1. SALES 2. GROSS INCOME 3. EBIT 4. INTEREST EXPENSE 5. PRETAX EARNINGS 6. TAX 7. NET INCOME 8. DIVIDENDS 9. REINVESTED EARNINGS 10. TOTAL ASSETS 11. INTEREST PAYABLE THIS YEAR 12. TOTAL EQUITY 13. TOTAL LIABILITIES AND EQUITY 1 (BASE INVENTORY TURNOVER ON REVENUE, NOT COGS HERE.) NOTE: NORMALLY, INVENTORY TURNOVER IS BASED ON COGS... 1 MILLION 200 THOUSAND 100 THOUSAND Question 2 5 pts 5 4 MILLION 400 THOUSAND 4 THOUSAND

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts