Question: please answer questions 2,3,9, and 16 ABC please answer all questions 2. To pay the startup expenses on her business, Brenda has withdrawn $10,000 from

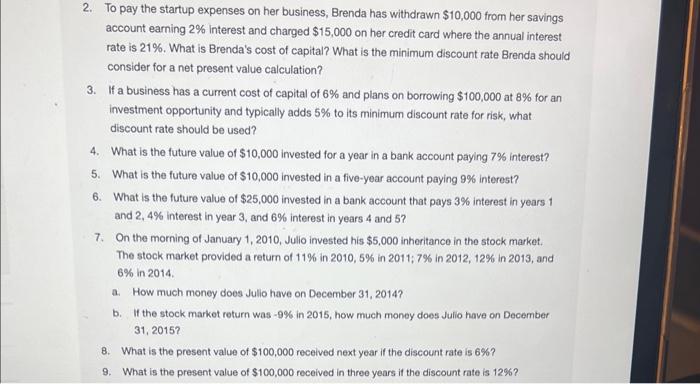

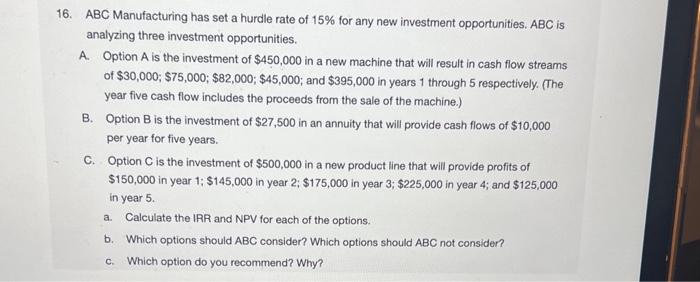

2. To pay the startup expenses on her business, Brenda has withdrawn $10,000 from her savings account earning 2% interest and charged $15,000 on her credit card where the annual interest rate is 21%. What is Brenda's cost of capital? What is the minimum discount rate Brenda should consider for a net present value calculation? 3. If a business has a current cost of capital of 6% and plans on borrowing $100,000 at 8% for an investment opportunity and typically adds 5% to its minimum discount rate for risk, what discount rate should be used? 4. What is the future value of $10,000 invested for a year in a bank account paying 7% interest? 5. What is the future value of $10,000 invested in a five-year account paying 9% interest? 6. What is the future value of $25,000 invested in a bank account that pays 3% interest in years 1 and 2,4% interest in year 3, and 6% interest in years 4 and 5 ? 7. On the morning of January 1,2010 , Julio invested his $5,000 inheritance in the stock market. The stock market provided a return of 11% in 2010, 5% in 2011;7% in 2012, 12\% in 2013, and 6% in 2014. a. How much money does Jullo have on December 31, 2014? b. If the stock market return was 9% in 2015 , how much money does Julio have on December 31, 2015? 8. What is the present value of $100,000 received next year if the discount rate is 6% ? 9. What is the present value of $100,000 received in three years if the discount rate is 12% ? 16. ABC Manufacturing has set a hurdle rate of 15% for any new investment opportunities. ABC is analyzing three investment opportunities. A. Option A is the investment of $450,000 in a new machine that will result in cash flow streams of $30,000;$75,000;$82,000;$45,000; and $395,000 in years 1 through 5 respectively. (The year five cash flow includes the proceeds from the sale of the machine.) B. Option B is the investment of $27,500 in an annuity that will provide cash flows of $10,000 per year for five years. C. Option C is the investment of $500,000 in a new product line that will provide profits of $150,000 in year 1; $145,000 in year 2;$175,000 in year 3;$225,000 in year 4; and $125,000 in year 5. a. Calculate the IRR and NPV for each of the options. b. Which options should ABC consider? Which options should ABC not consider? c. Which option do you recommend? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts