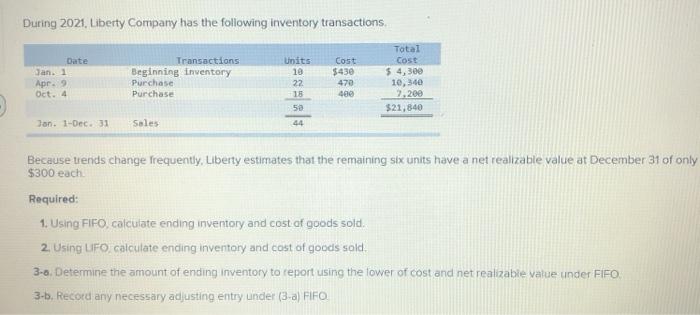

Question: Please answer questions 3-A and 3-B for positive feedback, thanks! :) During 2021, Liberty Company has the following inventory transactions Cost Date Jan. 1 Apr.

During 2021, Liberty Company has the following inventory transactions Cost Date Jan. 1 Apr. 9 Oct. 4 Transactions Beginning inventory Purchase Purchase Units 10 22 18 50 44 470 400 Total Cost $ 4,300 10,340 2. 200 $21,840 Jan. 1-Dec. 31 Sales Because trends change frequently, Liberty estimates that the remaining six units have a net realizable value at December 31 of only $300 each Required: 1. Using FIFO, calculate ending inventory and cost of goods sold. 2. Using Ufo calculate ending inventory and cost of goods sold 3-3. Determine the amount of ending inventory to report using the lower of cost and net realizable value under FIFO 3-b. Record any necessary adjusting entry under (3-a FIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts