Question: Please answer questions 5-10. The background information is below! Thank you! Thank you! What is the covariance between the stock fund and the bond fund?

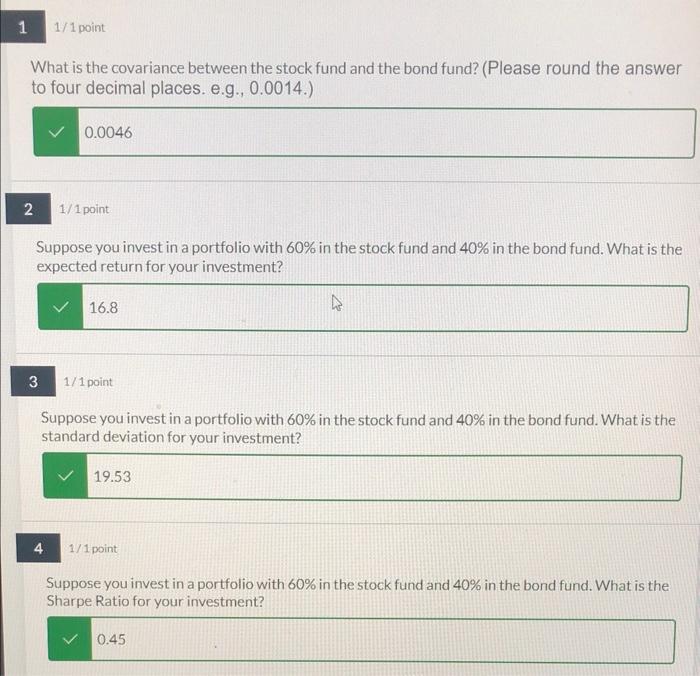

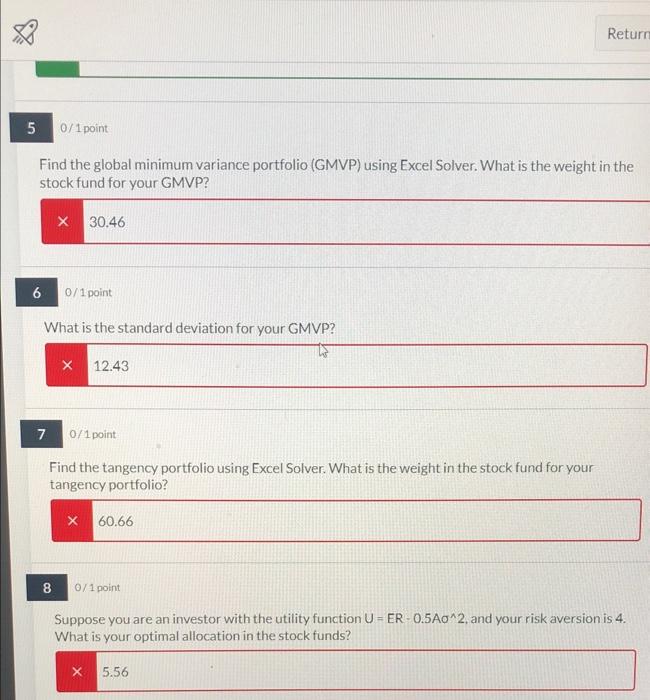

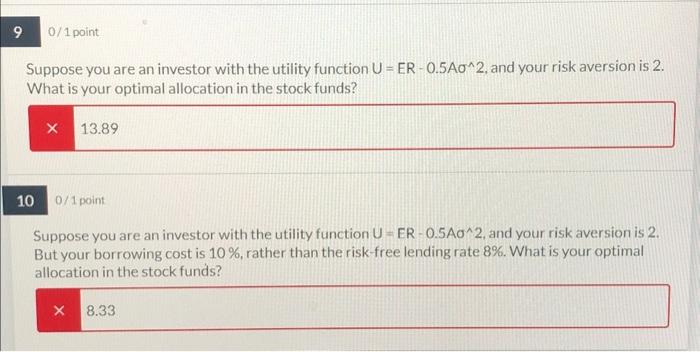

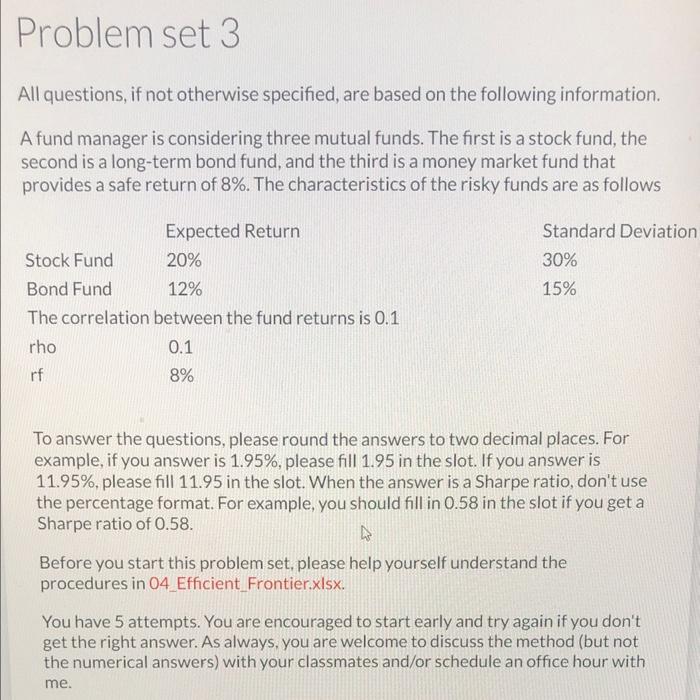

What is the covariance between the stock fund and the bond fund? (Please round the answer to four decimal places. e.g., 0.0014.) 2 1/1 point Suppose you invest in a portfolio with 60% in the stock fund and 40% in the bond fund. What is the expected return for your investment? 3 1/1 point Suppose you invest in a portfolio with 60% in the stock fund and 40% in the bond fund. What is the standard deviation for your investment? 4 Suppose you invest in a portfolio with 60% in the stock fund and 40% in the bond fund. What is the Sharpe Ratio for your investment? Find the global minimum variance portfolio (GMVP) using Excel Solver. What is the weight in the stock fund for your GMVP? 60/1 point What is the standard deviation for your GMVP? 7 0/1 point Find the tangency portfolio using Excel Solver. What is the weight in the stock fund for your tangency portfolio? 8 0/1point. Suppose you are an investor with the utility function U=ER0.5A2, and your risk aversion is 4. What is your optimal allocation in the stock funds? Suppose you are an investor with the utility function U=ER0.5A2, and your risk aversion is 2. What is your optimal allocation in the stock funds? 0/1 point Suppose you are an investor with the utility function U=ER0.5A2, and your risk aversion is 2. But your borrowing cost is 10%, rather than the risk-free lending rate 8%. What is your optimal allocation in the stock funds? All questions, if not otherwise specified, are based on the following information. A fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows The correlation between the fund returns is 0.1 To answer the questions, please round the answers to two decimal places. For example, if you answer is 1.95%, please fill 1.95 in the slot. If you answer is 11.95%, please fill 11.95 in the slot. When the answer is a Sharpe ratio, don't use the percentage format. For example, you should fill in 0.58 in the slot if you get a Sharpe ratio of 0.58 . Before you start this problem set, please help yourself understand the proceduresin 04_Efficient_Frontier.xlsx. You have 5 attempts. You are encouraged to start early and try again if you don't get the right answer. As always, you are welcome to discuss the method (but not the numerical answers) with your classmates and/or schedule an office hour with me

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts