Question: Please answer questions 6-9. 6 Should Exxon Mobil use the same WACC for all divisions (offshore exploration, gas stations)? What about Kelloggs (cereal and cookies).

Please answer questions 6-9.

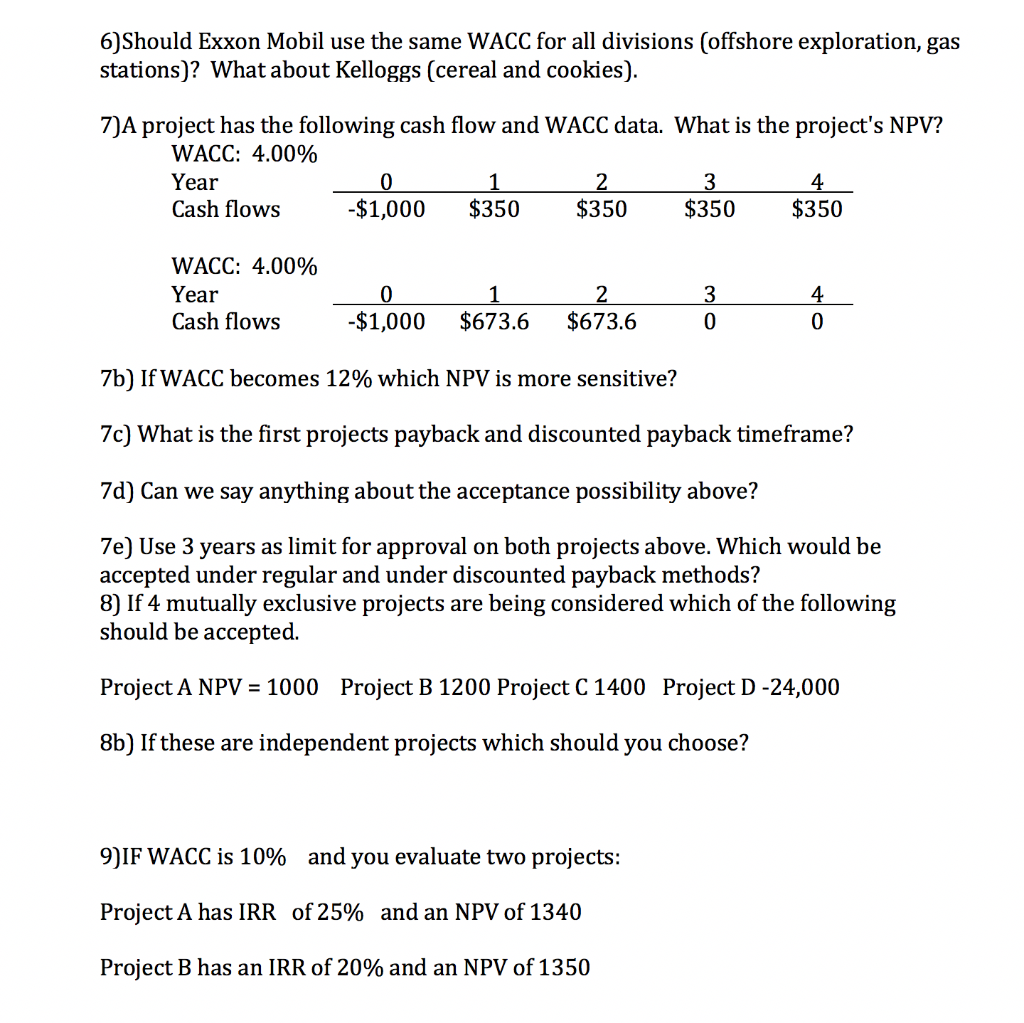

6 Should Exxon Mobil use the same WACC for all divisions (offshore exploration, gas stations)? What about Kelloggs (cereal and cookies). 7)A project has the following cash flow and WACC data. What is the project's NPV? WACC: 4.00% Year Cash flows -$1,000 $350 $350 $350 $350 Cash flows -$1,000 $350 $350 $350 $350 WACC: 4.00% Year Cash flows 3 4 _ 0 -$1,000 1 $673.6 2 $673.6 7b) If WACC becomes 12% which NPV is more sensitive? 7c) What is the first projects payback and discounted payback timeframe? 7d) Can we say anything about the acceptance possibility above? 7e) Use 3 years as limit for approval on both projects above. Which would be accepted under regular and under discounted payback methods? 8) If 4 mutually exclusive projects are being considered which of the following should be accepted. Project A NPV = 1000 Project B 1200 Project C 1400 Project D-24,000 8b) If these are independent projects which should you choose? 9IF WACC is 10% and you evaluate two projects: Project A has IRR of 25% and an NPV of 1340 Project B has an IRR of 20% and an NPV of 1350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts