Question: Please answer questions 8, 9 and 10 by using the information given below: If it's possible please answer question 7 as well, thanks. 7. Melbourne

Please answer questions 8, 9 and 10 by using the information given below:

If it's possible please answer question 7 as well, thanks.

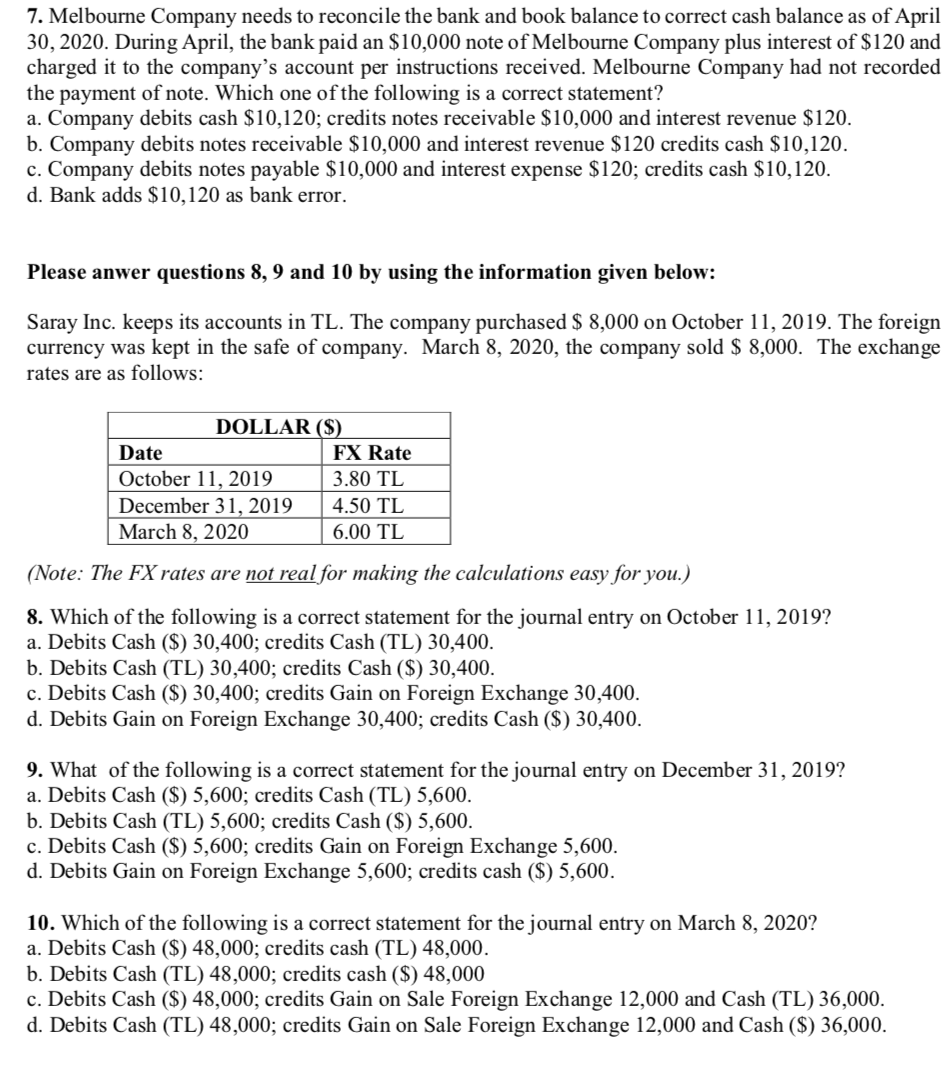

7. Melbourne Company needs to reconcile the bank and book balance to correct cash balance as of April 30, 2020. During April, the bank paid an $10,000 note of Melbourne Company plus interest of $120 and charged it to the company's account per instructions received. Melbourne Company had not recorded the payment of note. Which one of the following is a correct statement? a. Company debits cash $10,120; credits notes receivable $10,000 and interest revenue $120. b. Company debits notes receivable $10,000 and interest revenue $120 credits cash $10,120. c. Company debits notes payable $10,000 and interest expense $120; credits cash $10,120. d. Bank adds $10,120 as bank error. Please anwer questions 8, 9 and 10 by using the information given below: Saray Inc. keeps its accounts in TL. The company purchased $ 8,000 on October 11, 2019. The foreign currency was kept in the safe of company. March 8, 2020, the company sold $ 8,000. The exchange rates are as follows: DOLLAR ($) Date FX Rate October 11, 2019 3.80 TL December 31, 2019 4.50 TL March 8, 2020 6.00 TL (Note: The FX rates are not real for making the calculations easy for you.) 8. Which of the following is a correct statement for the journal entry on October 11, 2019? a. Debits Cash ($) 30,400; credits Cash (TL) 30,400. b. Debits Cash (TL) 30,400; credits Cash ($) 30,400. c. Debits Cash ($) 30,400; credits Gain on Foreign Exchange 30,400. d. Debits Gain on Foreign Exchange 30,400; credits Cash ($) 30,400. 9. What of the following is a correct statement for the journal entry on December 31, 2019? a. Debits Cash ($) 5,600; credits Cash (TL) 5,600. b. Debits Cash (TL) 5,600; credits Cash ($) 5,600. c. Debits Cash ($) 5,600; credits Gain on Foreign Exchange 5,600. d. Debits Gain on Foreign Exchange 5,600; credits cash ($) 5,600. 10. Which of the following is a correct statement for the journal entry on March 8, 2020? a. Debits Cash ($) 48,000; credits cash (TL) 48,000. b. Debits Cash (TL) 48,000; credits cash ($) 48,000 c. Debits Cash ($) 48,000; credits Gain on Sale Foreign Exchange 12,000 and Cash (TL) 36,000. d. Debits Cash (TL) 48,000; credits Gain on Sale Foreign Exchange 12,000 and Cash ($) 36,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts