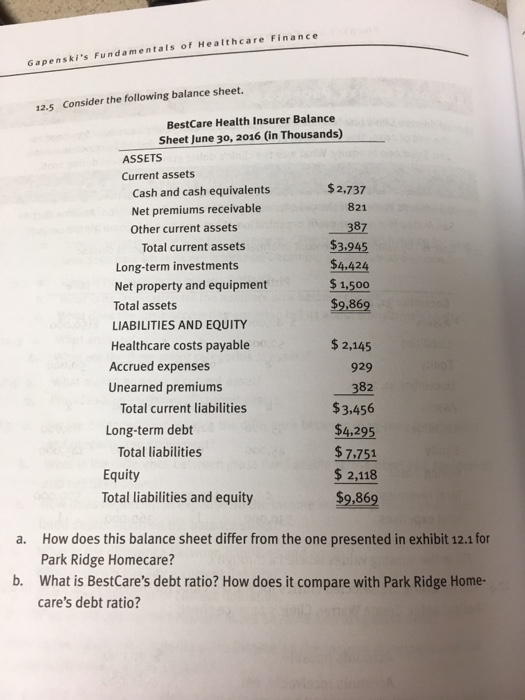

Question: Please answer questions a and b. Exhibit 12.1 Gapenski 's Fundamentals of Healthcare Finance Consider the following balance sheet. 12.5 BestCare Health Insurer Balance Sheet

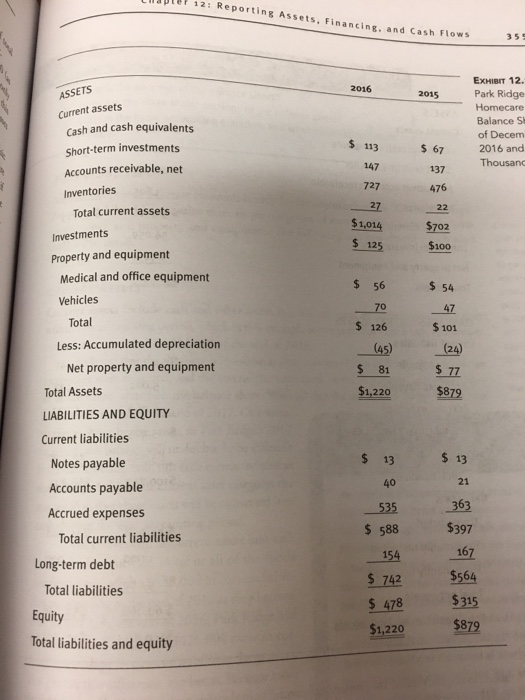

Gapenski 's Fundamentals of Healthcare Finance Consider the following balance sheet. 12.5 BestCare Health Insurer Balance Sheet June 30o, 2016 (in Thousands) ASSETS Current assets $2,737 Cash and cash equivalents Net premiums receivable 821 387 Other current assets $3.945 $4.424 $ 1,500 Total current assets Long-term investments Net property and equipment $9,869 Total assets LIABILITIES AND EQUITY $2,145 Healthcare costs payable Accrued expenses 929 Unearned premiums 382 Total current liabilities $3.456 $4.295 $7.751 Long-term debt Total liabilities $ 2,118 Equity Total liabilities and equity $9.869 How does this balance sheet differ from the one presented in exhibit 12.1 for a. Park Ridge Homecare? What is BestCare's debt ratio? How does it compare with Park Ridge Home- b. care's debt ratio? 12: Reporting Assets, Financing, and Cash Flow 355 EXHIBIT 12. Park Ridge 2016 2015 ASSETS Homecare Current assets Balance Sh Cash and cash equivalents of Decem $ 113 Short-term investments 67 2016 and Thousano 147 Accounts receivable, net 137 727 476 Inventories 27 22 Total current assets $1,014 $702 Investments $ 125 $100 Property and equipment Medical and office equipment $ 56 $54 Vehicles 70 47 Total $ 126 $ 101 Less: Accumulated depreciation (45) (24) Net property and equipment S $ 77 81 $879 $1,220 Total Assets LIABILITIES AND EQUITY Current liabilities $ 13 13 Notes payable 21 40 Accounts payable 363 535 Accrued expenses $397 $ 588 Total current liabilities 167 154 Long-term debt $564 $ 742 Total liabilities $315 $ 478 Equity $879 $1,220 Total liabilities and equity d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts