Question: Please answer questions A, B, C, D and E. If you can explain them it would be highly appreciated. 5-10 The risk-free rate of re

Please answer questions A, B, C, D and E. If you can explain them it would be highly appreciated.

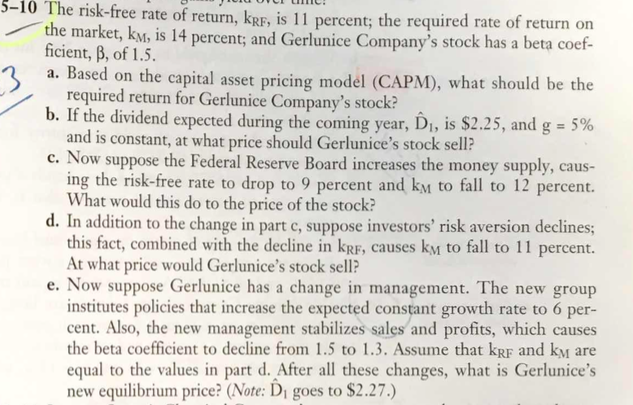

5-10 The risk-free rate of re turn, kRE, is 11 percent; the required rate of return on the market, kt, is 14 percent; and Gerlunice Company's stock has a beta coef- ficient, , of 1.5 a. Based on the capital asset pricing model (CAPM), what should be the required return for Gerlunice Company's stock? and is constant, at what price should Gerlunice's stock sell? What would this do to the price of the stock? At what price would Gerlunice's stock sell? e dividend expected during the coming year, D1, is $2.25, and g = 5% c. Now suppose the Federal Reserve Board increases the money supply, caus- ing the risk-free rate to drop to 9 percent and kM to fall to 12 percent. d. In addition to the change in part c, suppose investors' risk aversion declines this fact, combined with the decline in kRF, causes kw to fall to 11 percent. e. Now suppose Gerlunice has a change in management. The new group institutes policies that increase the expected constant growth rate to 6 per- cent. Also, the new management stabilizes sales and profits, which causes the beta coefficient to decline from 1.5 to 1.3. Assume that kRE and ky are equal to the values in part d. After all these changes, what is Gerlunice's new equilibrium price? (Note: Di goes to $2.27.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts