Question: Please answer questions a, b, c, & d PART 1: BONDS You have gathered the folowing information regarding a corporate bond: Par value Coupon rate

Please answer questions a, b, c, & d

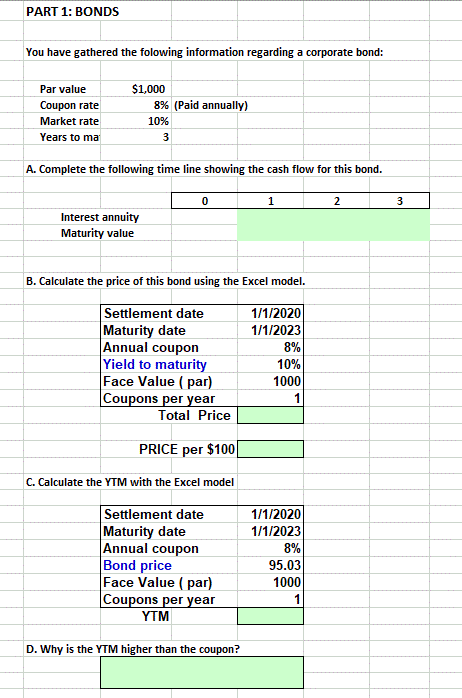

PART 1: BONDS You have gathered the folowing information regarding a corporate bond: Par value Coupon rate Market rate Years to ma $1,000 8% (Paid annually) 10% 3 A. Complete the following time line showing the cash flow for this bond. 0 2 3 Interest annuity Maturity value B. Calculate the price of this bond using the Excel model. Settlement date Maturity date Annual coupon Yield to maturity Face Value (par) Coupons per year Total Price 1/1/2020 1/1/2023 8% 10% 1000 1 PRICE per $100 C. Calculate the YTM with the Excel model Settlement date Maturity date Annual coupon Bond price Face Value (par) Coupons per year YTM 1/1/2020 1/1/2023 8% 95.03 1000 1 D. Why is the YTM higher than the coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts