Question: Please answer questions A thru E. Thanks! P5-38. Analysis and Interpretation of Return on Investment for Competitors Balance sheets and income statements for The Home

Please answer questions A thru E. Thanks!

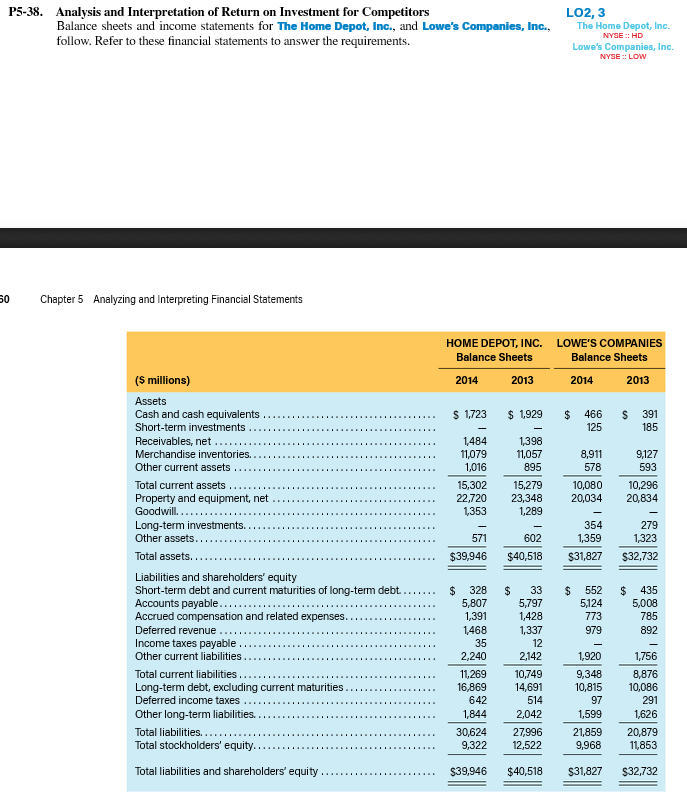

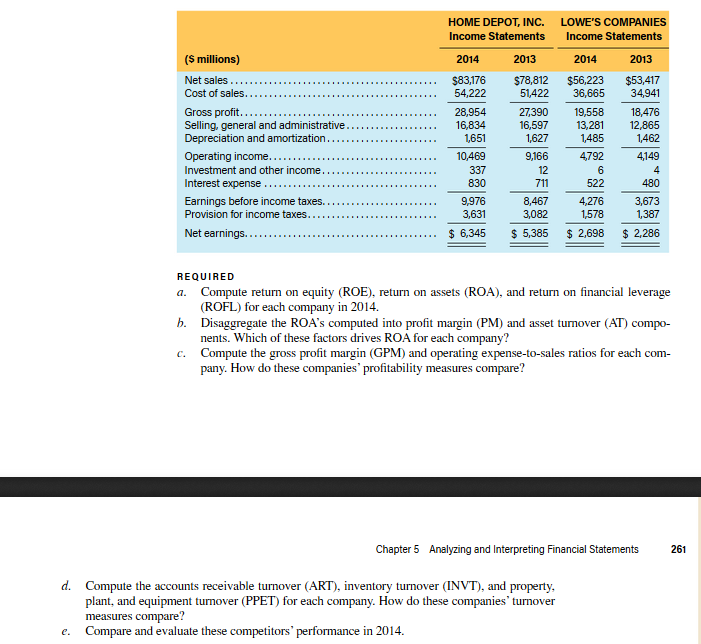

P5-38. Analysis and Interpretation of Return on Investment for Competitors Balance sheets and income statements for The Home Depot, Inc., and Lowe's Companies, Inc he Home Depot, Inc. follow. Refer to these financial statements to answer the requirements. LO2, 3 Lowe's Companies, Inc. 0 Chapter 5 Analyzing and Interpreting Financial Statements HOME DEPOT, INC. Balance Sheets LOWE'S COMPANIES Balance Sheets (S millions) 2013 2014 2013 Assets Cash and cash equivalents Short-term investments. Receivables, net . 125 185 11079 1,016 1,398 11,057 895 8,911 578 9,127 593 ...15,302 Total current assets Property and equipment, net Goodwill... 15,279 10,080 10,296 22,720 23,348 20,034 20,83 354 1,359 279 Other assets 571 602 . $39,946 $40,518 31,827 $32,732 Liabilities and shareholders' equity Short-term debt and current maturities of long-term debt Accounts payable.. . . Accrued compensation and related expenses....... Deferred revenue 328 33 $ 552 435 5124 5,008 5,807 1,391 5,797 1,428 892 35 2,240 1,920 9,348 10,815 97 1,599 Other current liabilities... 1,756 8,876 10,086 2,142 Total current liabilities 16,869 14,691 514 1,8442,042 30,624 27996 .9,322 12,522 642 Deferred income taxes.. Other long-term liabilities. Total liabilities... 1,626 21,859 20,879 11,853 9,968 Total liabilities and shareholders' equity $39,946 $40,518 $31,827 $32,732

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts