Question: please answer questions A-D ! Uning the daba in the folowing table, consider a pertfolo that maintains a 55% weight on slock A and a

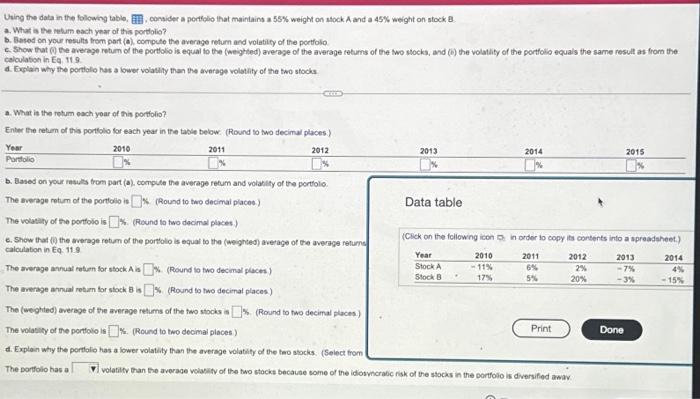

Uning the daba in the folowing table, consider a pertfolo that maintains a 55% weight on slock A and a 45% weight on stock B. a. What is the wum each year of this portfolio? b. Based on your results from part (a), ecmpute the average retum and volatily of the portfolio. c. Show that (a the average retum of the portolis is equal to the (weighted) average of the average returns of the Iwo stocks, and (i) the volatily of the portfolio equals the sarne result as from the calculation in Eq,119. d. Explain why the portiolo has a lower volatity than the average volotily of the two stocks. a. What is the retum each yoar of this portfolio? Enler the retum of this portolio for each year in the table below: (Round to two decimul places) b. Based on your matis from part (a), compute the average retum and volabity of the portolo. The everaje retum of the portolio is is. (Round to two decimai places.) Data table The volatily of the pontolio is K. (Round to two decimal places) e. Show that 6 , the average retion of the portolio is equal to the (weighted) average of the average retume calculation in Eq. 11.9 The average annual retuen for stock A is 6 (Round to tho decimal placest) The everase arnual rotam for slock B is 1. (Round to two decimal places) The (weighted) average of the average retums of the two stocks is \$. (Round to two decimal places) The volasicy of the portfolo is K. (Round to two decimal places) d. Explain why the portalio has a lower volatily than the average volatily of the tho sbocks, (Select from (Click on the following icon p in order to copy ts contents into a spreadsheet) The portfolo has a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts