Question: Please answer questions D & E. With steps & work to get to answers, thank you. Here is questions A-C, might be helpful for answering

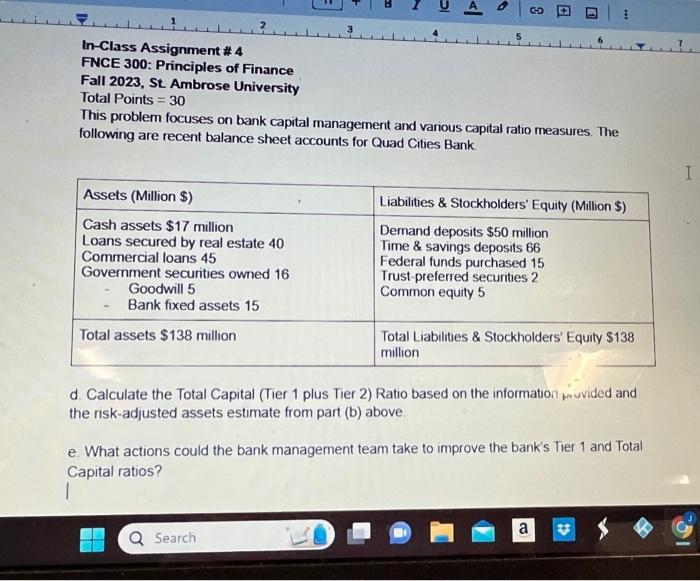

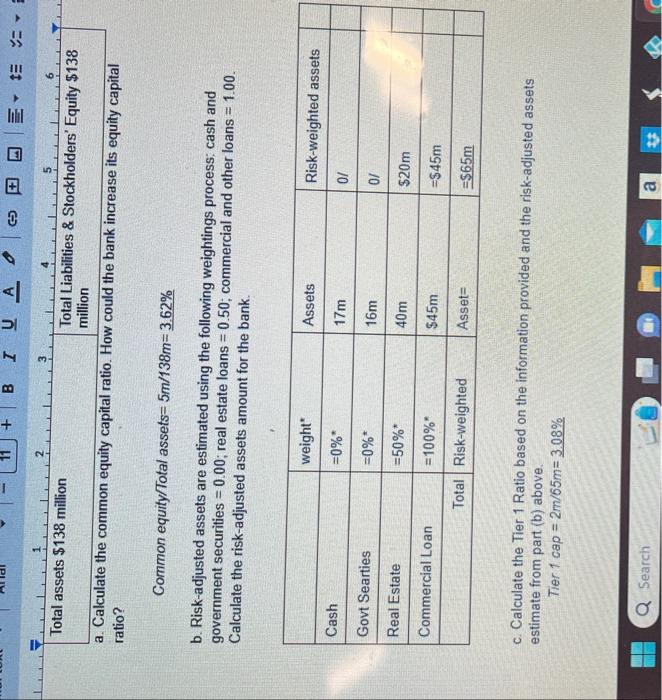

In-Class Assignment \# 4 FNCE 300: Principles of Finance Fall 2023, St. Ambrose University Total Points =30 This problem focuses on bank capital management and various capital ratio measures. The following are recent balance sheet accounts for Quad Cities Bank. d. Calculate the Total Capital (Tier 1 plus Tier 2) Ratio based on the information piuvided and the risk-adjusted assets estimate from part (b) above. e. What actions could the bank management team take to improve the bank's Tier 1 and Total Capital ratios? Common equity/Total assets =5m/138m=3.62% b. Risk-adjusted assets are estimated using the following weightings process; cash and government securities =0.00; real estate loans =0.50; commercial and other loans =1.00. Calculate the risk-adjusted assets amount for the bank. c. Calculate the Tier 1 Ratio based on the information provided and the risk-adjusted assets estimate from part (b) above. Tier 1cap=2m/65m=3.08% In-Class Assignment \# 4 FNCE 300: Principles of Finance Fall 2023, St. Ambrose University Total Points =30 This problem focuses on bank capital management and various capital ratio measures. The following are recent balance sheet accounts for Quad Cities Bank. d. Calculate the Total Capital (Tier 1 plus Tier 2) Ratio based on the information piuvided and the risk-adjusted assets estimate from part (b) above. e. What actions could the bank management team take to improve the bank's Tier 1 and Total Capital ratios? Common equity/Total assets =5m/138m=3.62% b. Risk-adjusted assets are estimated using the following weightings process; cash and government securities =0.00; real estate loans =0.50; commercial and other loans =1.00. Calculate the risk-adjusted assets amount for the bank. c. Calculate the Tier 1 Ratio based on the information provided and the risk-adjusted assets estimate from part (b) above. Tier 1cap=2m/65m=3.08%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts