Question: Please answer Questions E & F using excel Please show formulas as well You are an analyst in charge of valuing common stocks. You have

Please answer Questions E & F using excel Please show formulas as well

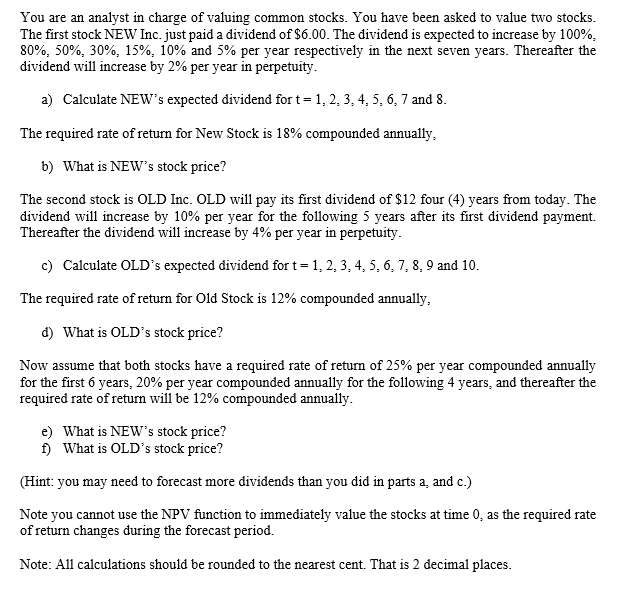

You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEW Inc. just paid a dividend of $6.00. The dividend is expected to increase by 100%, 80%,50%,30%,15%,10% and 5% per year respectively in the next seven years. Thereafter the dividend will increase by 2% per year in perpetuity. a) Calculate NEW's expected dividend for t=1,2,3,4,5,6,7 and 8 . The required rate of return for New Stock is 18% compounded annually, b) What is NEW's stock price? The second stock is OLD Inc. OLD will pay its first dividend of $12 four (4) years from today. The dividend will increase by 10% per year for the following 5 years after its first dividend payment. Thereafter the dividend will increase by 4% per year in perpetuity. c) Calculate OLD's expected dividend for t=1,2,3,4,5,6,7,8,9 and 10 . The required rate of return for Old Stock is 12% compounded annually, d) What is OLD's stock price? Now assume that both stocks have a required rate of return of 25% per year compounded annually for the first 6 years, 20% per year compounded annually for the following 4 years, and thereafter the required rate of return will be 12% compounded annually. e) What is NEW's stock price? f) What is OLD's stock price? (Hint: you may need to forecast more dividends than you did in parts a, and c.) Note you cannot use the NPV function to immediately value the stocks at time 0 , as the required rate of return changes during the forecast period. Note: All calculations should be rounded to the nearest cent. That is 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts