Question: Please answer questions E through I. Part l Evaluation of Projects under Conditions of Unchanging Risk Two of the most widely used methods of evaluating

Please answer questions E through I.

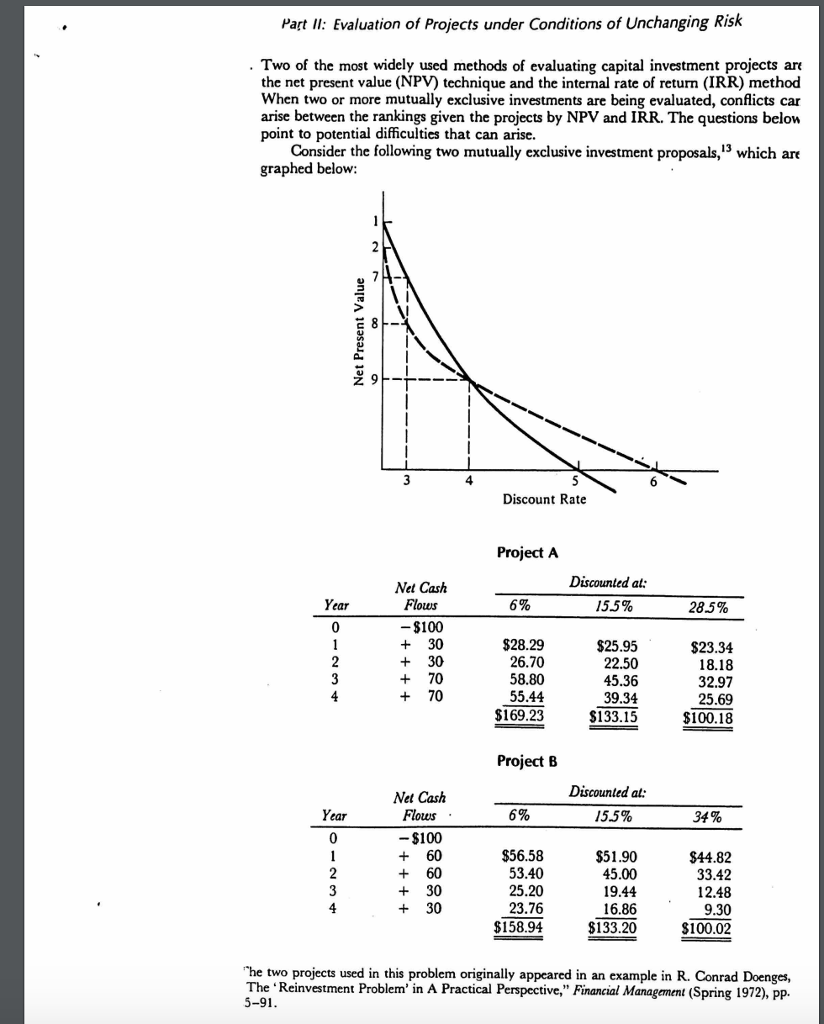

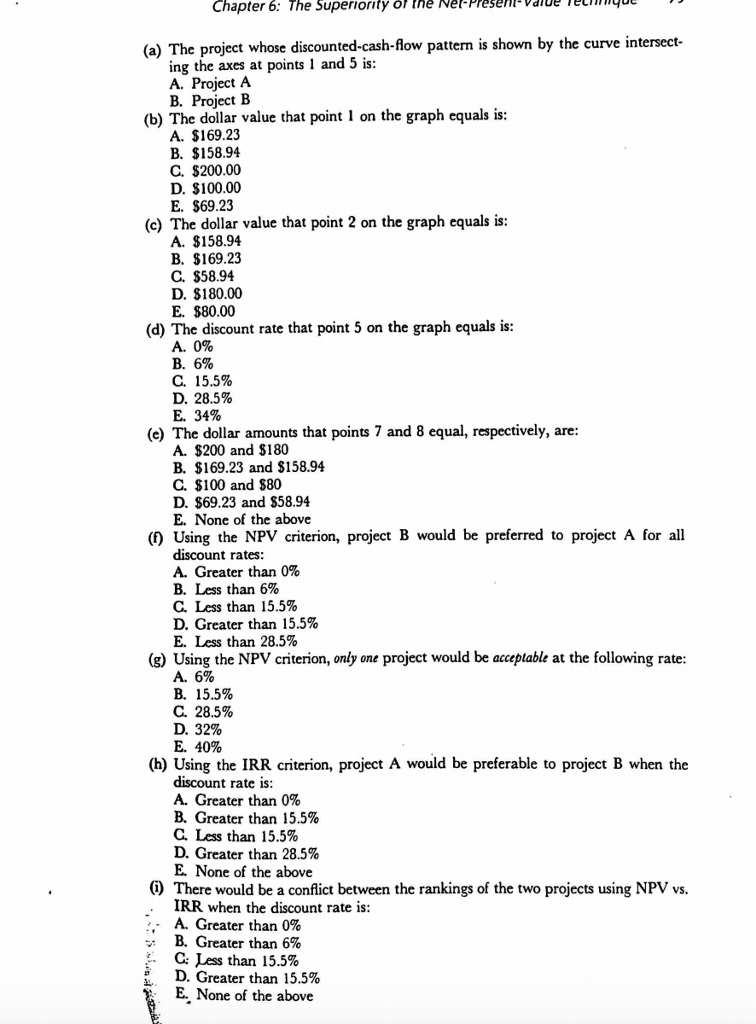

Part l Evaluation of Projects under Conditions of Unchanging Risk Two of the most widely used methods of evaluating capital investment projects are the net present value (NPV) technique and the internal rate of return (IRR) method When two or more mutually exclusive investments are being evaluated, conflicts car arise between the rankings given the projects by NPV and IRR. The questions below point to potential difficulties that can arise. Consider the following two mutually exclusive investment proposals,13 which are graphed below 4 Discount Rate Project A Discounted at Net Cash -$100 + 30 6% 155% 28.5% 0 S28.29 26.70 58.80 55.44 $25.95 22.50 45.36 39.34 S133.15 $23.34 18.18 32.97 25.69 $100.18 + 70 $169.23 Project B Discounted at: 15.5% Net Cash 34% -$100 + 60 + 60 + 30 + 30 $56.58 53.40 25.20 23.76 $158.94 S4482 33.42 12.48 $51.90 45.00 1944 9.30 16.86 4 $133.20 100.02 he two projects used in this problem originally appeared in an example in R. Conrad Doenges, The 'Reinvestment Problem' in A Practical Perspective," Financial Management (Spring 1972), pp. 5-91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts