Question: Please answer questions E9-18A, E9-19A, and E9-20A E9-18A. (Learning Objective 1: Account for payroll expense and liabilities) Southwest Talent Search has an annual payroll of

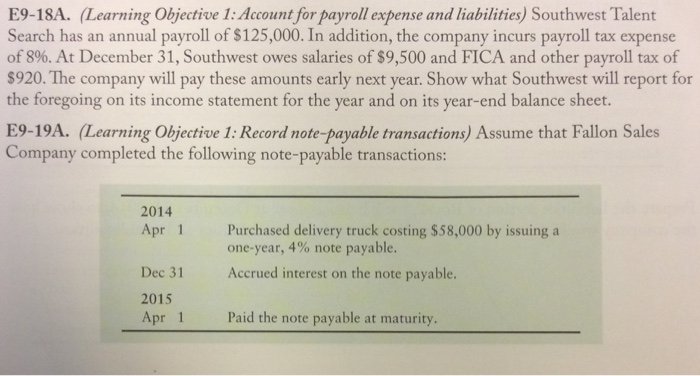

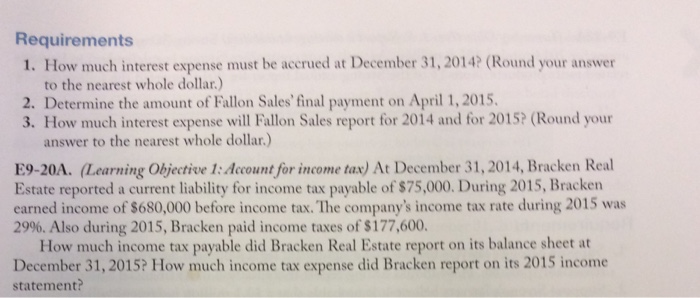

E9-18A. (Learning Objective 1: Account for payroll expense and liabilities) Southwest Talent Search has an annual payroll of $125,000. In addition, the company incurs payroll tax expense of 8%. At December 31, Southwest owes salaries of $9,500 and FICA and other payroll tax of $920. The company will pay these amounts early next year. Show what Southwest will report for the foregoing on its income statement for the year and on its year-end balance sheet. E9-19A. (Learning Objective 1: Record note-payable transactions) Assume that Fallon Sales Company completed the following note-payable transactions: 2014 Apr 1 Purchased delivery truck costing $58,000 by issuing a one-year, 4% note payable. Accrued interest on the note Dec 31 Accred interest on theote payable Dec 31 2015 Apr 1 Paid the note payable at maturity Apr 1 Paid the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts