Question: please answer questions i got wrong with a red x thanks Self-Employed Social Security Taxes (LO. 2) Eric is a self-employed financial consultant. During 2020,

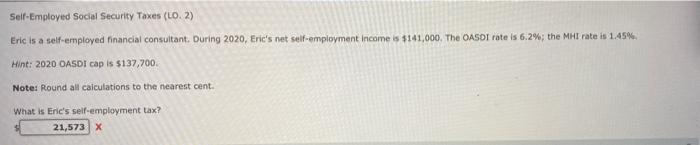

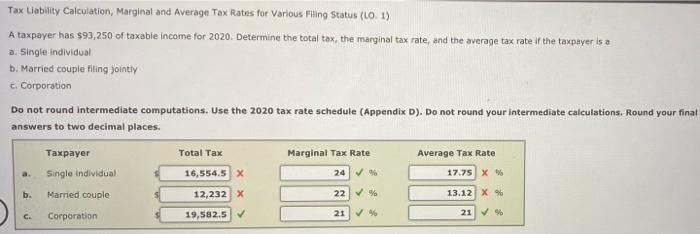

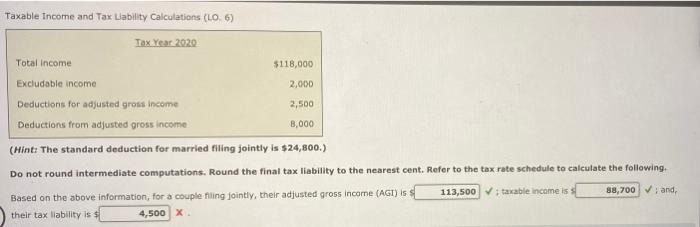

Self-Employed Social Security Taxes (LO. 2) Eric is a self-employed financial consultant. During 2020, Eric's net self-employment income is $141,000. The OASOT rate is 6.2%; the MHI rate is 1.45% Hint: 2020 OASDI cap is $137,700 Note: Round all calculations to the nearest cent. What is Eric's self-employment tax? 21,573 X Tax Lability Calculation, Marginal and Average Tax Rates for various Filing Status (LO. 1) A taxpayer has $93,250 of taxable income for 2020. Determine the total tax, the marginal tax rate, and the average tax rate if the taxpayer is a a. Single individual b. Married couple filing jointly c. Corporation Do not round Intermediate computations. Use the 2020 tax rate schedule (Appendix D). Do not round your intermediate calculations. Round your final answers to two decimal places. Taxpayer Total Tax Marginal Tax Rate Average Tax Rate a. Single individual 16,554.5 X 24% 17.75 X % b. Married couple 12,232 X 22 % 13.12 X % 21 G. Corporation 19,582.5 21 % Taxable income and Tax Liability calculations (L0.6) Tax Year 2020 Total income $118,000 Excludable income 2,000 Deductions for adjusted gross income 2,500 Deductions from adjusted gross income 8,000 (Hint: The standard deduction for married filing jointly is $24,800.) Do not round intermediate computations. Round the final tax liability to the nearest cent. Refer to the tax rate schedule to calculate the following: Based on the above information, for a couple ning jointly, their adjusted gross income (AGI) is 113,500 taxable income is s 88,700 ; and their tax liability is 4,500 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts