Question: Please answer questions in the first picture. The article is in the following pictures. Read above article of a recent news event. a. Why does

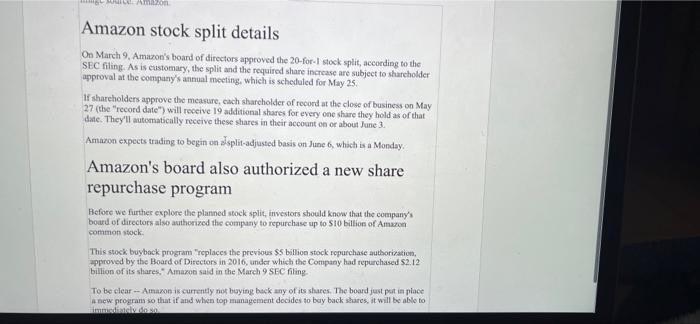

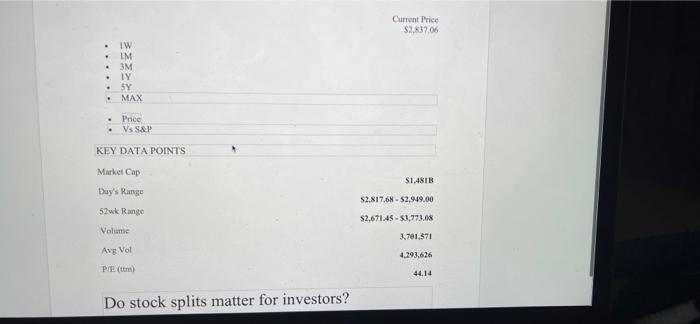

Read above article of a recent news event. a. Why does the board of directors usually authorize the company to repurchase common stock? b. What could be an advantage of a stock split for investors? c. What is the date of record for the split? d. look up what the price of the stock is on this day/today. Post e. When will Amazon start trading on a split-adjusted basis? a Market Cap $1,481B Today's Change (-2.52%) -573.43 Current Price $2,837.06 You're reading a free article with opinions that may differ from The Motley Fool's Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More Amazon stock surged 5.4% on Thursday following the e- commerce giant's 20-for-1 stock split announcement. Amazon (AMZN -2.52%) stock jumped 5,4% on Thursday following the commerce and tech giant's filing on the prior afternoon with the U.S. Securities and Exchange Commission (SEC) stating its intention to split its stock 20-for-I. For context, the market was down on Thursday, with the S&P 500 and Nasdaq Composite declining 0.4% and 1%, respectively. Here's what investors should know. Am Amazon stock split details On March 9, Amazon's board of directors approved the 20-for-stock split, according to the SEC filing. As is customary, the split and the required share increase are subject to shareholder approval at the company's annual meeting, which is scheduled for May 25 1 shareholders approve the measure, cach shareholder of record at the close of business on May 27 (the record date") will receive 19 additional shares for every one share they hold as of that date. They'll automatically receive these shares in their account on or about June 3 Amaron expects trading to begin on alsplit-adjusted basis on June 6, which is a Monday. Amazon's board also authorized a new share repurchase program Before we further explore the planned stock split, investors should know that the company's board of directors also authorized the company to repurchase up to 10 billion of Amazon common stock This stock buyback program "replaces the previous $5 billion stock ropurchase authorization, approved by the Board of Directors in 2016, under which the Company bad repurchased $2.12 billion of its shares.* Amazon said in the March 9 SEC filing To be clear -- Amazon is currently not buying back any of its shares. The board just put in place new program so that if and when top management decides to buy back shares, it will be able to maty do Page of 5 Amazon's board also authorized a new share repurchase program Before we further explore the planned stock split, investors should know that the company's board of directors also authorized the company to repurchase up to S10 billion of Amazon common stock. This stock buyback program "replaces the previous $5 billion stock repurchase authorization, approved by the Board of Directors in 2016, under which the Company had repurchased $2.12 billion of its shares," Amazon said in the March 9 SEC filing. To be clear -- Amazon is currently not buying back any of its shares. The board just put in place a new program so that if and when to management decides to buy back shares, it will be able to immediately do so In general, companies repurchase their shares when top management believes shares are undervalued relative to the company's long-term growth prospects. Collapse a Current Price $2.83706 . . IW IM 3M TY SY MAX - Price Vs S&P KEY DATA POINTS $1.4813 Market Cap uys Range 52wk Range 52.817,68 - $2.949.00 $2.671.45 - $1,773.08 Volume 3.701.971 Avg Vol 4.293.626 PE (tm) 44.14 Do stock splits matter for investors? Do stock splits matter for investors? Stock splits shouldn't matter too much to investors because they don't change the underlying value of a company or the investor's proportionate stake in the company. That said, there can be a couple of advantages to a stock split. The biggest one has to do with increasing liquidity and making a stock more accessible to individual investors, or everyday "retail investors." On Thursday, Amazon stock closed at $2,936.35 per share. No doubt, there are many investors who would like to own Amazon stock but either don't have nearly three grand to invest in it or don't want to invest that much money in just one company. Now, these investors could buy a fraction of one share, but they'd have lo use only certain online brokerages. Not all brokerages permit investors to buy or sell -- fractional shares. Moreover, some investors just don't like owning fractional shares Let's assume Amazon's stock split occurred at the market close on Thursday. In this case, the split-adjusted price per share would be one-twentieth of $2.936,35, or about $14682. That share price (which shouldn't be too far off the actual split-adjusted price, harring a huge surge or drop in the broader market over the next few months) is likely to increase the number of folks who buy the stock. Indeed, the market agrees, which is why Amazon stock got a bump on Thursday, Oftentimes a stock will give back these post-split announcement bumps, but I think there's a food case to be made that this one could be sustained. The 20-for-1 stock split could also give Amazon stock a better chance at being included on the Dow Jones Industrial Average, the granddaddy or U.S. stock indexes. This 30-large stock Index supposedly reflects the broad U.S. stock market and economy. But it's safe to say that's not been the case for some time because this index generally shuns very high-priced stocks (which have tended to be "big tech stocks") since it's a price-weighted index. In other words, a neatly $3.000 stock like Amazon would have an outside effect on the index Amazon's inclusion in the Dow would bring it to the attention of more individual investors Moreover, it would also mean that Dow index-based funds would have to buy shares of Amaron All other things being equal, higher demand for the stock should help increase its price Should you invest $1,000 in Amazon.com, Inc. right now? Before you consider Amazon.com, Inc., you'll want to hear this. Our award-winning analyst tum just revealed what they believe are the 10 best stocks for investors to buy night now and Amazon.com, Inc. wasn't one of them The online investing service they've run for nearly two decades, Morley Fool Stock Advisor, has beaten the stock market by over 4X. And right now, they think there are 10 sockstar - Page 4 of 5 ZOOM + Should you invest $1,000 in Amazon.com, Inc. right now? Before you consider Amazon.com, Inc., you'll want to hear this. Our award-winning analyst team just revealed what they believe are the 10 best stocks for investors to buy right now... and Amazon.com, Inc. wasn't one of them. The online investing service they've run for nearly two decades, Motley Fool Stock Advisor, has beaten the stock market by over 4X.* And right now, they think there are 10 stocks that are better buys. See the 10 stocks Shock Advisor rear of March 2012 This article represents the opinion of the writer, who may disagree with the official

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts