Question: please answer questions one and two and show all work and steps steps will be discounted significantly. Good luck! Q1 (10 points) Suppose a share

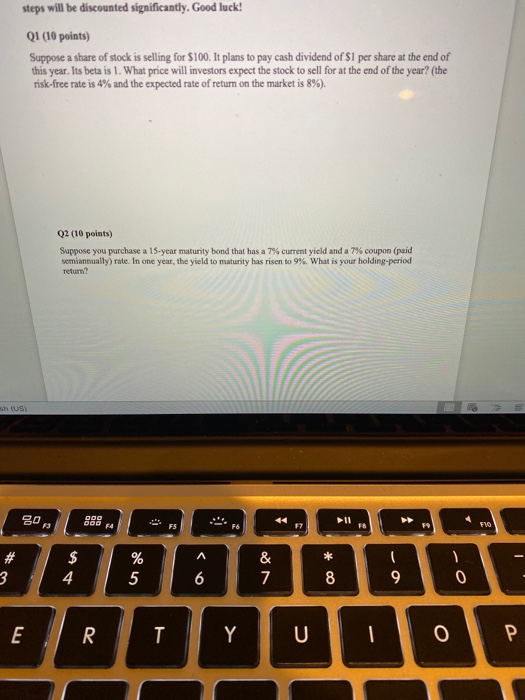

steps will be discounted significantly. Good luck! Q1 (10 points) Suppose a share of stock is selling for $100. It plans to pay cash dividend of S1 per share at the end of this year. Its beta is 1. What price will investors expect the stock to sell for at the end of the year? (the risk-free rate is 4% and the expected rate of return on the market is 8%). Q2 (10 points) Suppose you purchase a 15-year maturity bond that has a 7% current yield and a 7% coupon (paid semiannually) rate. In one year, the yield to maturity has risen to 9%. What is your holding-period return? sh (US) * At on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts