Question: - please answer questions - Suppose a stock had an initial price of $35.71 per share, paid a dividend of $2.01 per share during the

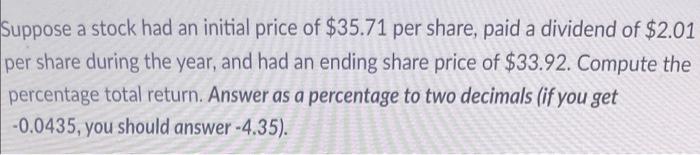

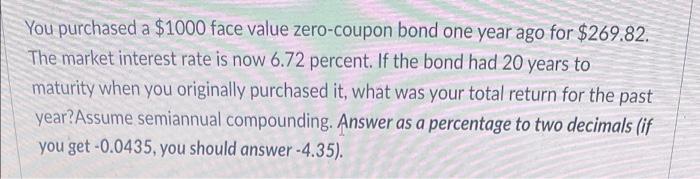

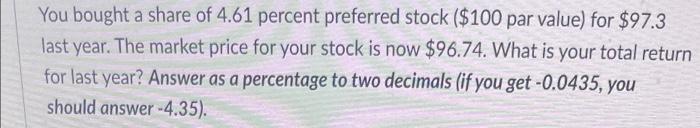

Suppose a stock had an initial price of $35.71 per share, paid a dividend of $2.01 per share during the year, and had an ending share price of $33.92. Compute the percentage total return. Answer as a percentage to two decimals (if you get -0.0435, you should answer -4.35). You purchased a $1000 face value zero-coupon bond one year ago for $269.82. The market interest rate is now 6.72 percent. If the bond had 20 years to maturity when you originally purchased it, what was your total return for the past year?Assume semiannual compounding. Answer as a percentage to two decimals (if you get -0.0435, you should answer -4.35). You bought a share of 4.61 percent preferred stock ($100 par value) for $97.3 last year. The market price for your stock is now $96.74. What is your total return for last year? Answer as a percentage to two decimals (if you get -0.0435, you should answer - 4.35)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts