Question: PLEASE ANSWER QUESTIONS THAT ARE IN RED ONLY, HAVING A DIFFICULT TIME. THANK YOU! Exercise 20-7 Riggs Company purchases sails and produces sailboats. It currently

PLEASE ANSWER QUESTIONS THAT ARE IN RED ONLY, HAVING A DIFFICULT TIME. THANK YOU!

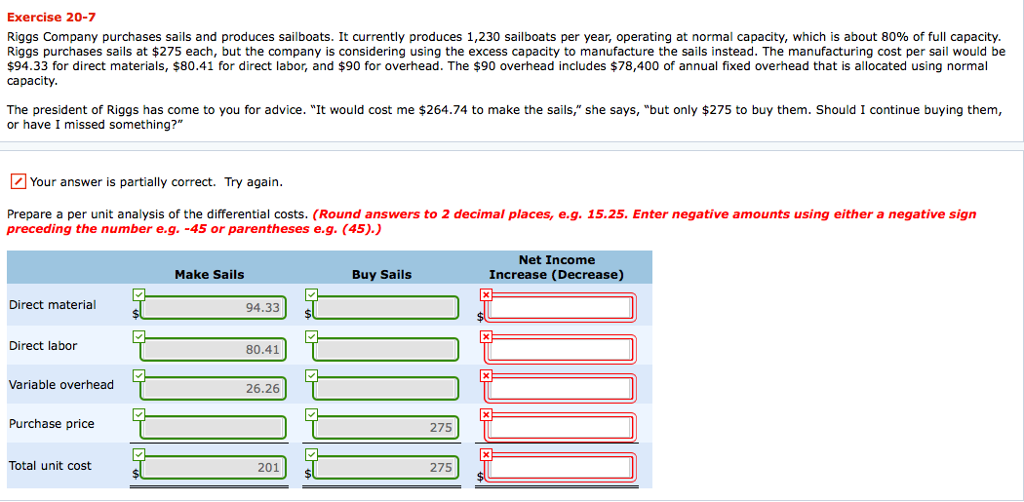

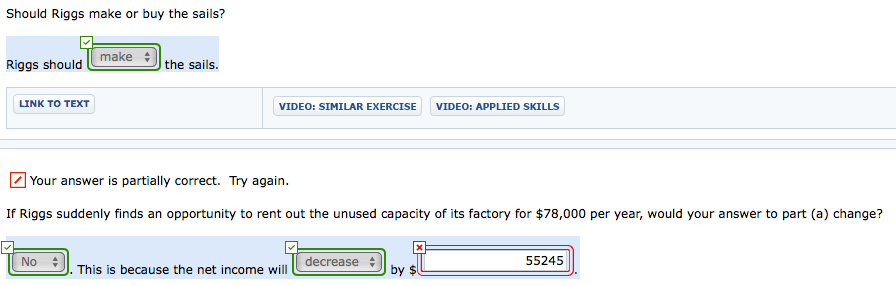

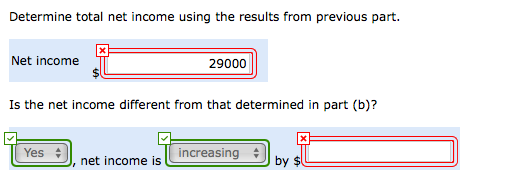

Exercise 20-7 Riggs Company purchases sails and produces sailboats. It currently produces 1,230 sailboats per year, operating at normal capacity, which is about 80% of full capacity. Riggs purchases sails at $275 each, but the company is considering using the excess capacity to manufacture the sails instead. The manufacturing cost per sail would be $94.33 for direct materials, $80.41 for direct labor, and $90 for overhead. The $90 overhead includes $78,400 of annual fixed overhead that is allocated using normal capacity The president of Riggs has come to you for advice. "It would cost me $264.74 to make the sails," she says, "but only $275 to buy them. Should I continue buying them, or have I missed something?" Z Your answer is partially correct. Try again. Prepare a per unit analysis of the differential costs. (Round answers to 2 decimal places, e.g. 15.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e g. (45).) Net Income Make Sails Increase (Decrease) Buy Sails s 94,330 Direct material Direct labor 80.41 T Variable overhead 26.26 2750 Purchase price 2010 27s Total unit cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts