Question: Please answer questions with full working out and explanations based on microeconomic auctions and bidding ASAP, I am quite stuck. (a) A single object is

Please answer questions with full working out and explanations based on microeconomic auctions and bidding ASAP, I am quite stuck.

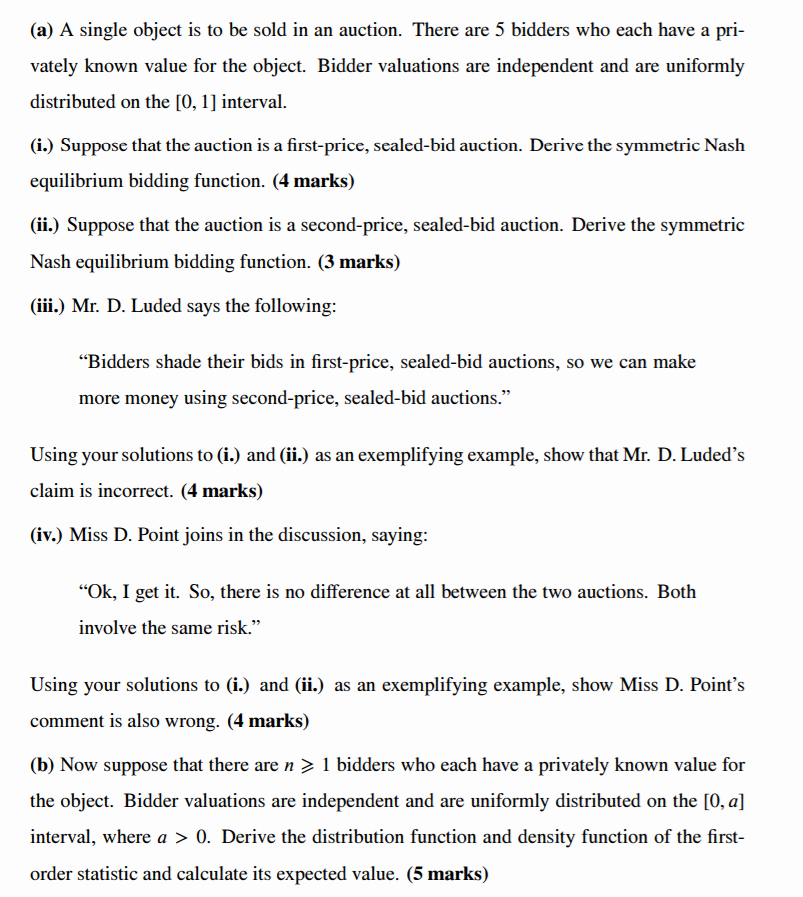

(a) A single object is to be sold in an auction. There are 5 bidders who each have a pri- vately known value for the object. Bidder valuations are independent and are uniformly distributed on the [0, 1] interval. (L) Suppose that the auction is a rst-price, sealed-bid auction. Derive the syrrunetric Nash equilibrium bidding function. (4 marks) (ii) Suppose that the auction is a second-price, sealed-bid auction. Derive the symmetric Nash equilibrium bidding function. (3 marks) (iii.) Mr. D. Luded says the following: \"Bidders shade their bids in rst-price, sealed-bid auctions, so we can make more money using second-price, sealed-bid auctions." Using your solutions to (L) and (ii.) as an exemplifying example, show that N11". D. Luded's claim is incorrect. (4 marks) (iv.) Miss D. Point joins in the discussion, saying: \"01:, I get it. So, there is no difference at all between the two auctions. Both involve the same risk." Using your solutions to (L) and (ii) as an exemplifying example, show Miss D. Point's comment is also wrong. (4 marks) 0)) Now suppose that there are n 2. 1 bidders who each have a privately known value for the object. Bidder valuations are independent and are uniformly distributed on the [0, a] interval, where a > 0. Derive the distribution function and density function of the rst- order statistic and calculate its expected value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts