Question: Please answer questions with the work shown, or explanation not just the correct answer, thank you. 1. What is the goal of financial management for

Please answer questions with the work shown, or explanation not just the correct answer, thank you.

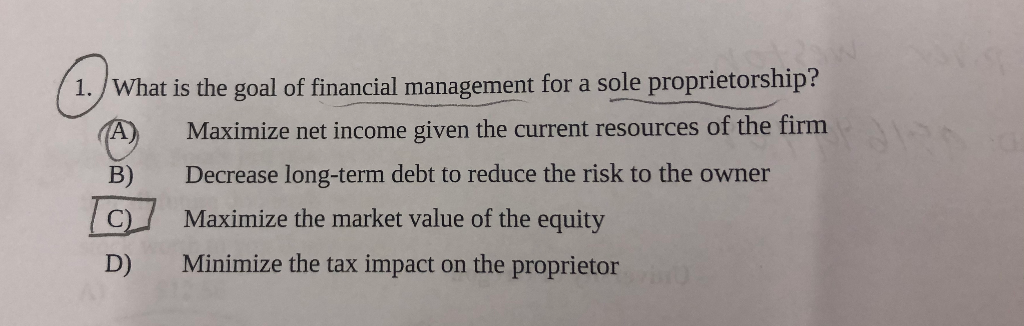

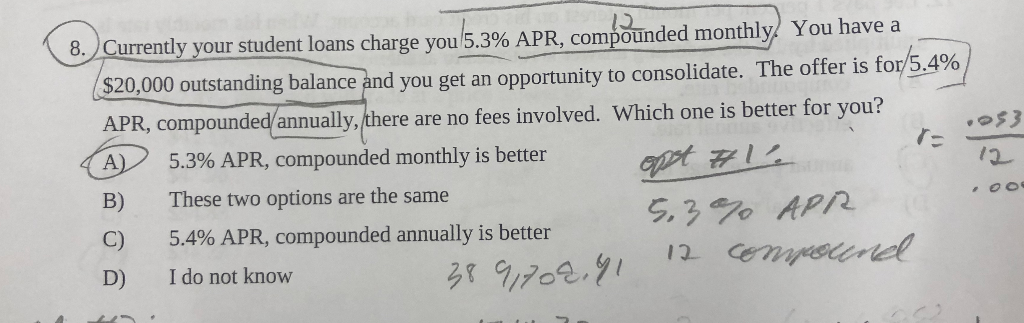

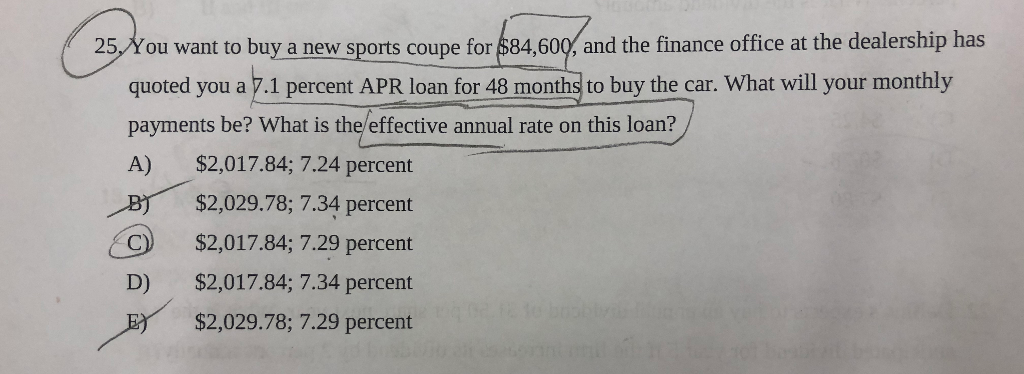

1. What is the goal of financial management for a sole proprietorship? (A) Maximize net income given the current resources of the firm B) Decrease long-term debt to reduce the risk to the owner C Maximize the market value of the equity D) Minimize the tax impact on the proprietor W 053 8. Currently your student loans charge you 5.3% APR, compounded monthly. You have a $20,000 outstanding balance and you get an opportunity to consolidate. The offer is for/5.4% APR, compounded annually, there are no fees involved. Which one is better for you? A) 5.3% APR, compounded monthly is better opst 71. These two options are the same 5.4% APR, compounded annually is better D) I do not know 389,708.41 12 compound 12 5,3% APR 25. You want to buy a new sports coupe for $84,609, and the finance office at the dealership has quoted you a 7.1 percent APR loan for 48 months to buy the car. What will your monthly payments be? What is the effective annual rate on this loan? A) $2,017.84; 7.24 percent B) $2,029.78; 7.34 percent o $2,017.84; 7.29 percent $2,017.84; 7.34 percent $2,029.78; 7.29 percent D)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts