Question: Please answer quick as possible no explanation is required! Entry Rules: Round your answer to the nearest whole number. Examples: If your answer is $24,500.47,

Please answer quick as possible no explanation is required!

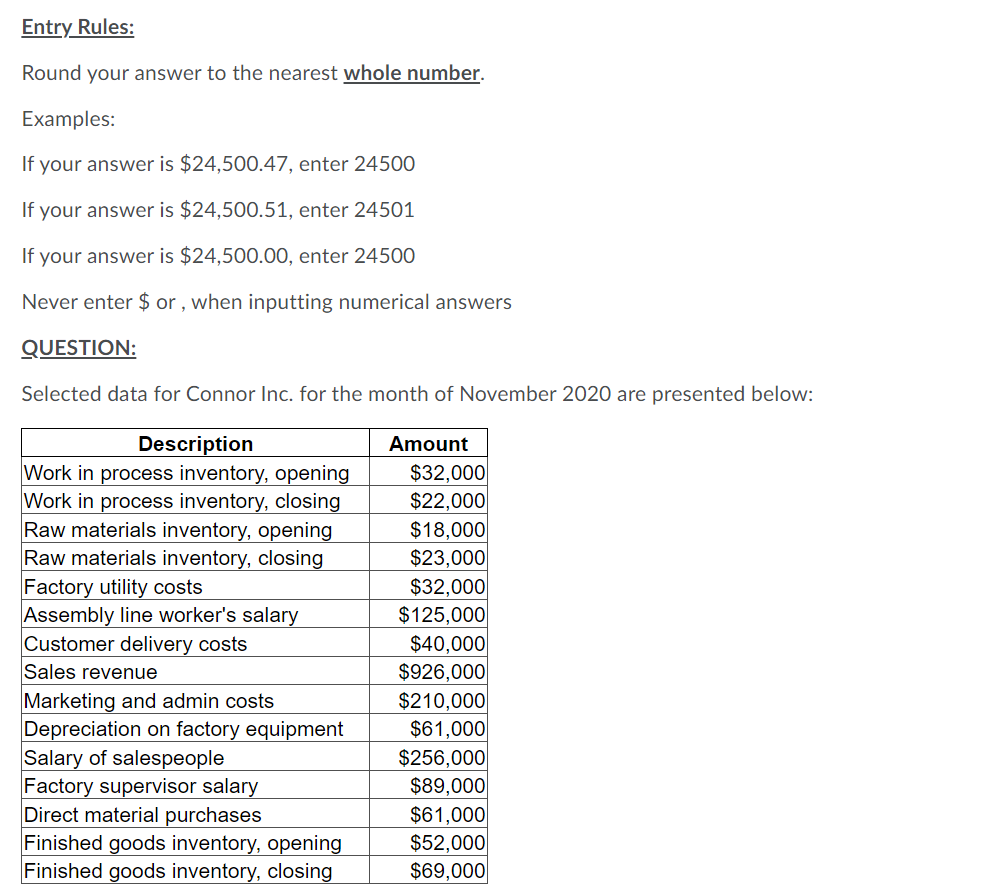

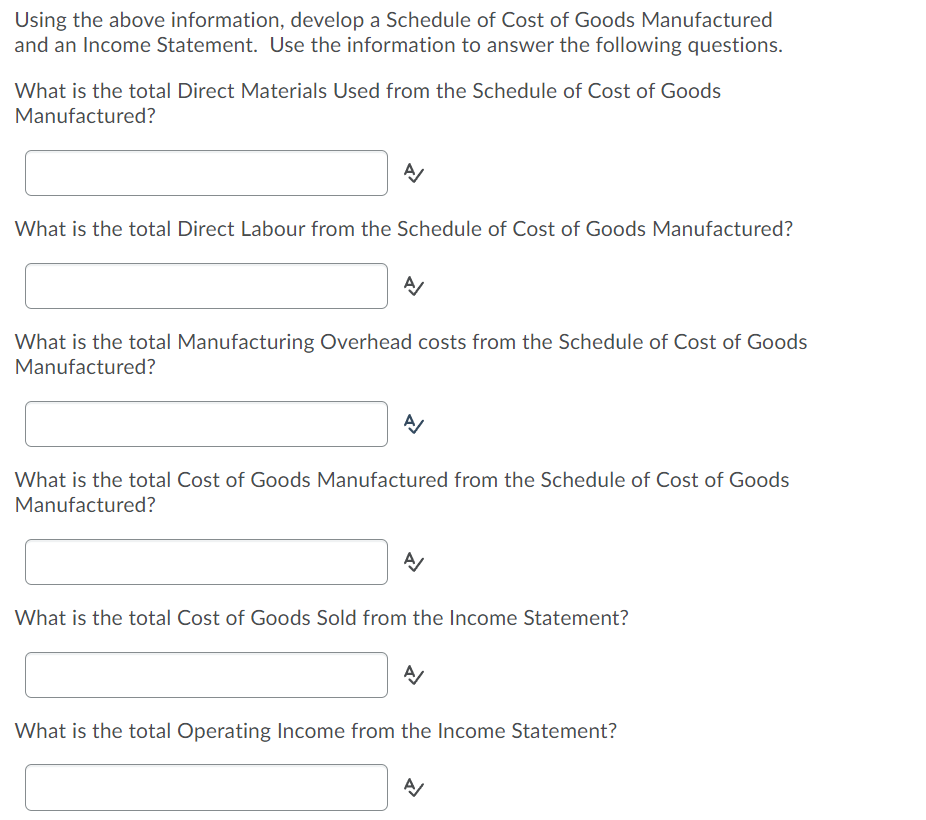

Entry Rules: Round your answer to the nearest whole number. Examples: If your answer is $24,500.47, enter 24500 If your answer is $24,500.51, enter 24501 If your answer is $24,500.00, enter 24500 Never enter $ or, when inputting numerical answers QUESTION: Selected data for Connor Inc. for the month of November 2020 are presented below: Description Work in process inventory, opening Work in process inventory, closing Raw materials inventory, opening Raw materials inventory, closing Factory utility costs Assembly line worker's salary Customer delivery costs Sales revenue Marketing and admin costs Depreciation on factory equipment Salary of salespeople Factory supervisor salary Direct material purchases Finished goods inventory, opening Finished goods inventory, closing Amount $32,000 $22,000 $18,000 $23,000 $32,000 $125,000 $40,000 $926,000 $210,000 $61,000 $256,000 $89,000 $61,000 $52,000 $69,000 Using the above information, develop a Schedule of Cost of Goods Manufactured and an Income Statement. Use the information to answer the following questions. What is the total Direct Materials Used from the Schedule of Cost of Goods Manufactured? ? A/ What is the total Direct Labour from the Schedule of Cost of Goods Manufactured? A/ What is the total Manufacturing Overhead costs from the Schedule of Cost of Goods Manufactured? A What is the total cost of Goods Manufactured from the Schedule of Cost of Goods Manufactured? A What is the total cost of Goods Sold from the Income Statement? A What is the total Operating Income from the Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts