Question: Please answer quick!!! Next question A firm has to make a capacity expansion decision this year. There are two possible options: option A or option

Please answer quick!!!

Please answer quick!!!

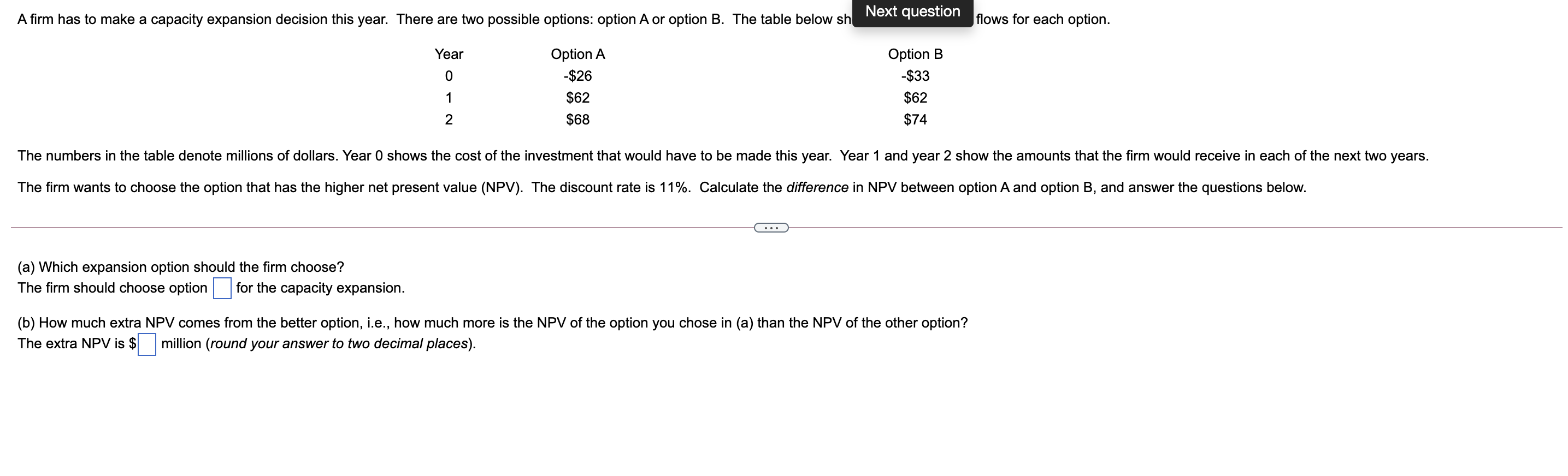

Next question A firm has to make a capacity expansion decision this year. There are two possible options: option A or option B. The table below sh flows for each option. Year 0 Option A -$26 $62 $68 Option B -$33 $62 $74 1 2 The numbers in the table denote millions of dollars. Year 0 shows the cost of the investment that would have to be made this year. Year 1 and year 2 show the amounts that the firm would receive in each of the next two years. The firm wants to choose the option that has the higher net present value (NPV). The discount rate is 11%. Calculate the difference in NPV between option A and option B, and answer the questions below. (a) Which expansion option should the firm choose? The firm should choose option for the capacity expansion. (b) How much extra NPV comes from the better option, i.e., how much more is the NPV of the option you chose in (a) than the NPV of the other option? The extra NPV is $ million (round your answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts