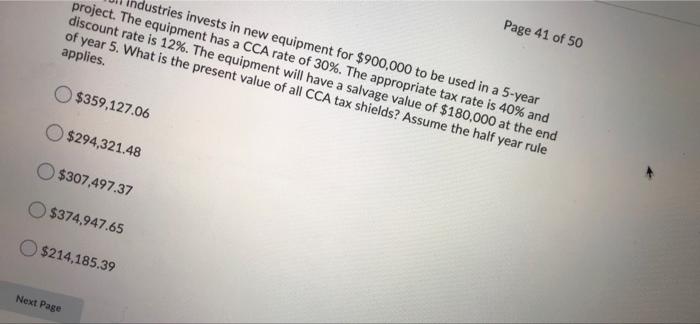

Question: Please answer quick, will give a like. lustries invests in new equipment for $900,000 to be used in a 5-year project. The equipment has a

lustries invests in new equipment for $900,000 to be used in a 5-year project. The equipment has a CCA rate of 30%. The appropriate tax rate is 40% and discount rate is 12%. The equipment will have a salvage value of $180,000 at the end of year 5. What is the present value of all CCA tax shields? Assume the half year rule applies. Page 41 of 50 $359,127.06 $294,321.48 $307,497.37 $374,947.65 $214,185.39 Next Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts