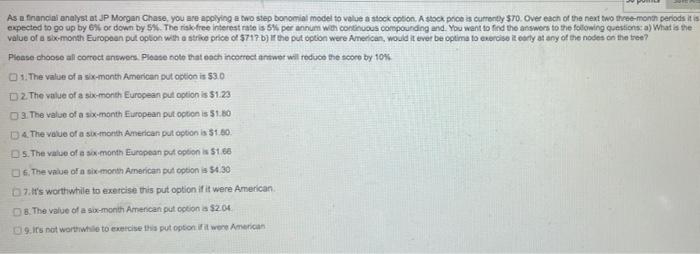

Question: please answer quickly and accuratly for a thumbs up!!! As a financial analyst at JP Morgan Chase, you are applying a two step onomial model

As a financial analyst at JP Morgan Chase, you are applying a two step onomial model to vale a stock option. A stock price is currently $70. Over each of the next two three-month periods it is expected to go up by 6% or down by 5%. The risk free interest rate is 5% per annum with continuous compounding and. You want to find the answers to the following questions a) What is the value of a six-month European put option with a strice price of $71? b) the put option were American, would it ever be optima to exercise oorly at any of the nodes on the tree? Pioase choose al correct answers Piose colo that each incorrect antwor will reduce the score by 10% 1. The value of a six-month American put option is 53.0 D 2. The value of a six month European put option is $123 3. The value of a six-month European put option is 51.80 Da The value of a sac-month American put option is $1.00 Ds. The value of a six month European put option is $1.66 6. The value of a six-month American put option is $130 7. It's worthwhile to exercise this put option if it were American 8. The value of a six-month American put option a $2.04 9. It's not worthwhile to exercise this put option it were American

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts