Question: PLEASE ANSWER QUICKLY AND CORRECLY. Need it quickly. thank you. The adjusted trial balance for Crane Company is given below. CRANE COMPANY Trial Balance August

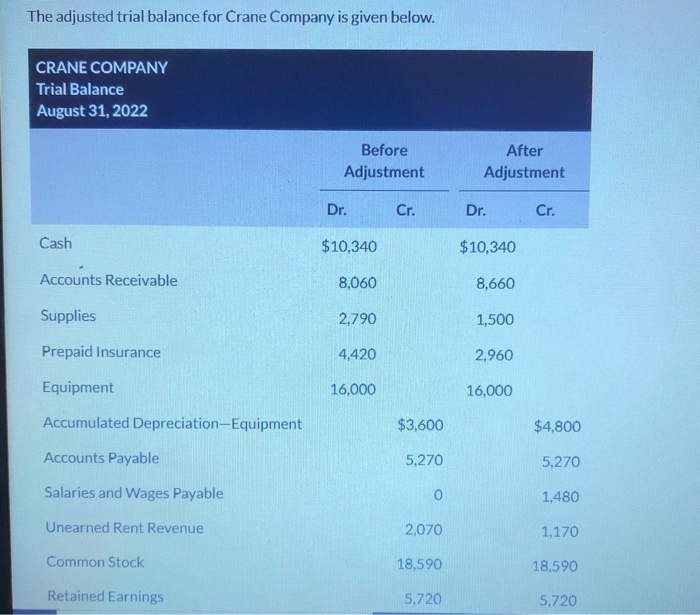

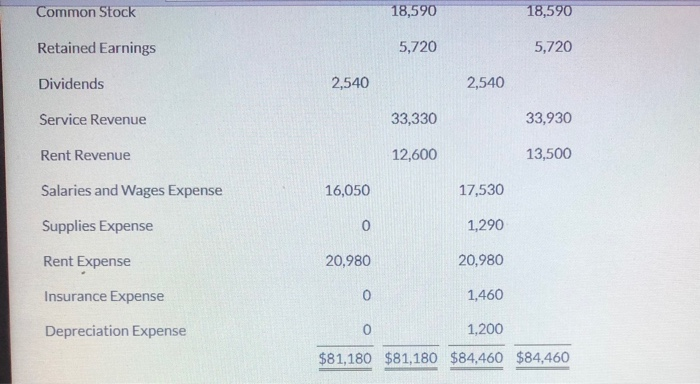

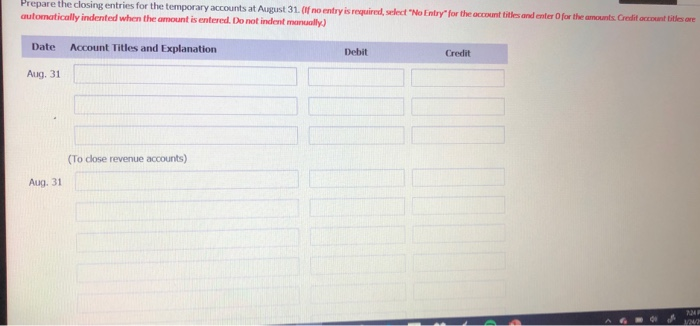

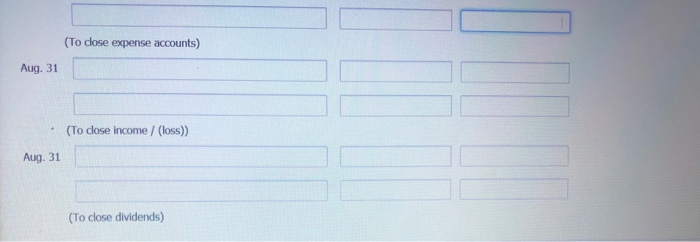

The adjusted trial balance for Crane Company is given below. CRANE COMPANY Trial Balance August 31, 2022 Before Adjustment After Adjustment Dr. Cr. Dr. Cr. Cash $10,340 $10,340 Accounts Receivable 8,060 8,660 Supplies 2,790 1,500 Prepaid Insurance 4,420 2,960 Equipment 16,000 16,000 Accumulated Depreciation-Equipment $3,600 $4,800 Accounts Payable 5,270 5,270 Salaries and Wages Payable 1,480 Unearned Rent Revenue 2,070 1,170 Common Stock 18,590 18,590 Retained Earnings 5.720 5.720 Common Stock 18,590 18,590 Retained Earnings 5,720 5,720 Dividends 2,540 2,540 Service Revenue 33,330 33,930 Rent Revenue 12,600 13,500 Salaries and Wages Expense 16,050 17,530 Supplies Expense 0 1,290 Rent Expense 20,980 20,980 Insurance Expense 1,460 Depreciation Expense 1,200 $81,180 $81,180 $84,460 $84,460 Prepare the closing entries for the temporary accounts at August 31. Of no entry is required automatically indented when the amount is entered. Do not indent manually lect"No Entry for the accounts and for the amounts are Date Account Titles and Explanation Debit Credit Aug. 31 (To dose revenue accounts) Aug. 31 (To close expense accounts) Aug. 31 . (To cose income / (loss)) Aug. 31 (To close dividends)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts