Question: Please answer quickly for a like 12 13 You have just been offered a $1,000 par value bond for $1,308.88. The coupon rate is 12

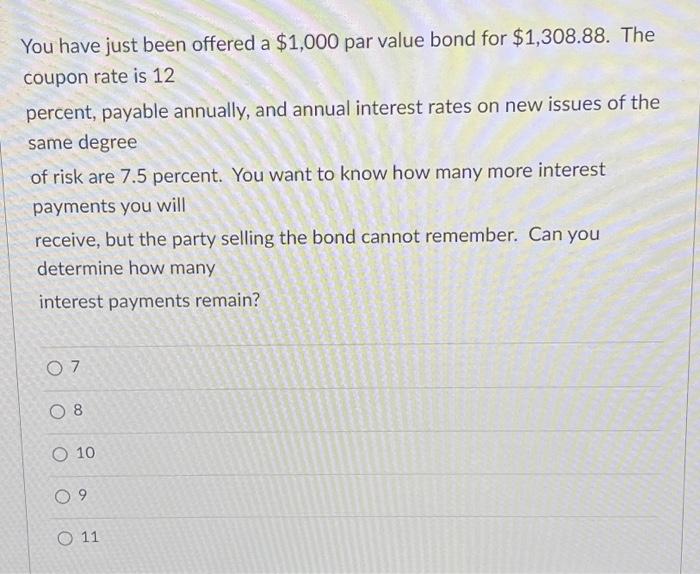

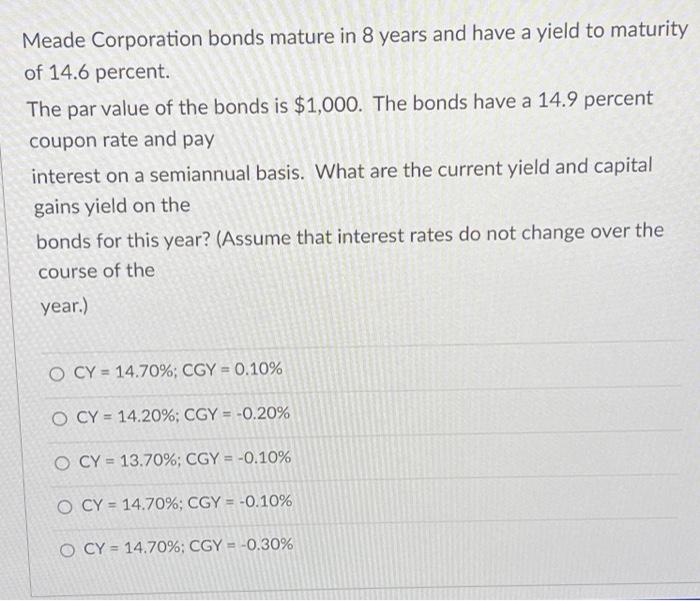

You have just been offered a $1,000 par value bond for $1,308.88. The coupon rate is 12 percent, payable annually, and annual interest rates on new issues of the same degree of risk are 7.5 percent. You want to know how many more interest payments you will receive, but the party selling the bond cannot remember. Can you determine how many interest payments remain? 7 8 10 9 11 Meade Corporation bonds mature in 8 years and have a yield to maturity of 14.6 percent. The par value of the bonds is $1,000. The bonds have a 14.9 percent coupon rate and pay interest on a semiannual basis. What are the current yield and capital gains yield on the bonds for this year? (Assume that interest rates do not change over the course of the year.) CY=14.70%;CGY=0.10% CY=14.20%;CGY=0.20% CY=13.70%;CGY=0.10% CY=14.70%;CGY=0.10% CY=14.70%;CGY=0.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts