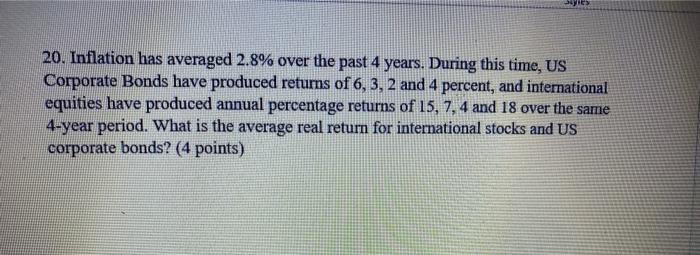

Question: please answer quickly for hw Jes 20. Inflation has averaged 2.8% over the past 4 years. During this time, US Corporate Bonds have produced returns

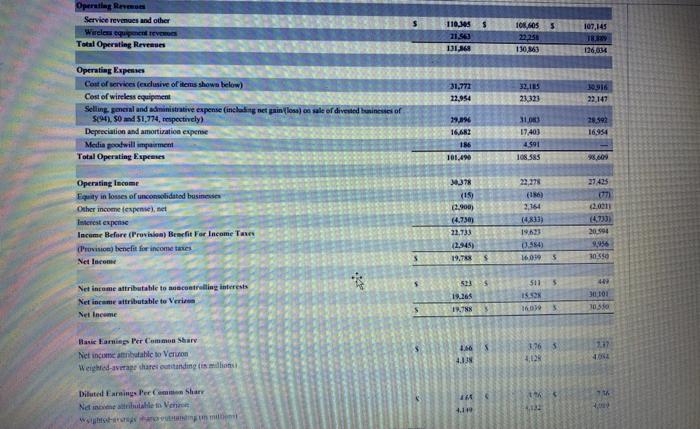

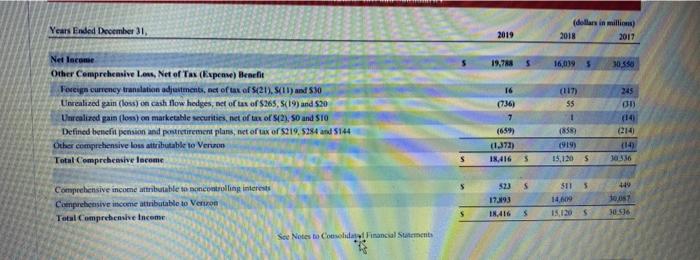

Jes 20. Inflation has averaged 2.8% over the past 4 years. During this time, US Corporate Bonds have produced returns of 6, 3, 2 and 4 percent, and international equities have produced annual percentage returns of 15, 7, 4 and 18 over the same 4-year period. What is the average real return for international stocks and US corporate bonds? (4 points) Operating R Service revenues and other Wireles que entre Total Operating Revenues 108 SOSS 110.95 $ 21.54 131 107,145 J. 126,034 110,33 31,772 22,954 32,105 23323 22,147 Operating Espesses Cont of services (exclusive of items shown below) Cost of wireless equiem Selling general and administrative expense (incang net painos) on sale of divested business of $94.50 51,774, respectively) Depreciation and amortization expense Media potwill impairment Total Operating Expenses 28.592 16,954 29.896 1642 186 101.490 31.03 17.403 4.591 108.585 27425 071 Operating Income Equity in losses of unconsolidated businesses Other income expensel.net Interest expense Income Before (Provision) Benefit For Income Tax (Provision) benefit for income taxes Net Income M78 19 0.900) (4.750) 22.733 (2.945) 19,78 22,278 (1) 2,164 (4.13 4 ( 1994 9,956 30.550 0.584) 16.01 5 5 5 Net income attributable to controlling interests Net income attributable to Veri Net Income 513 19.265 19. NN 511 153 1601 4 30.101 10 3 5 3.76 3 Basie Farnie Per Common Share Net income attributable to Verum Weighted aver varet ottanding is mi 1.66 4.13 217 4 IN Diluted Earnings Per Shar Nebula. Ver Wag mit 4.119 Years Ended December 31 2019 (dollar in millions) 2018 2017 19,73 5 16,0195 30.550 16 245 Net lacone Other Comprehensive Loss, Net of Tas (Expense) Benefit Foreign currency tranulation adjustment, net of tax of_21).SL) and 530 Unrealized gain (loss) on cash flow hedges, net of tax of $265. S(19) and 520 Uncalized gam (loss) on marketable securities, net of ux of 12), SO and STO Defined benefit pension and pentretirement plans, met of lux of 5219.5284 and 5144 Other comprehensive loss attributable to Veron Total Comprehensive Income (736) 7 (659 (1.373) 13.416 55 1 (8389 (919) 15,1205 0313 14 (214 (147 10.336 $ 5 5 523 S SIT 5 449 Comprehensive income attributable to socontrolling interest Comprehensive income attributable to Verron Total Comprehensive Income 17.93 18,416 14,609 15,120 10.087 30.56 $ 5 Soe Notes to Cose da mancial Suments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts