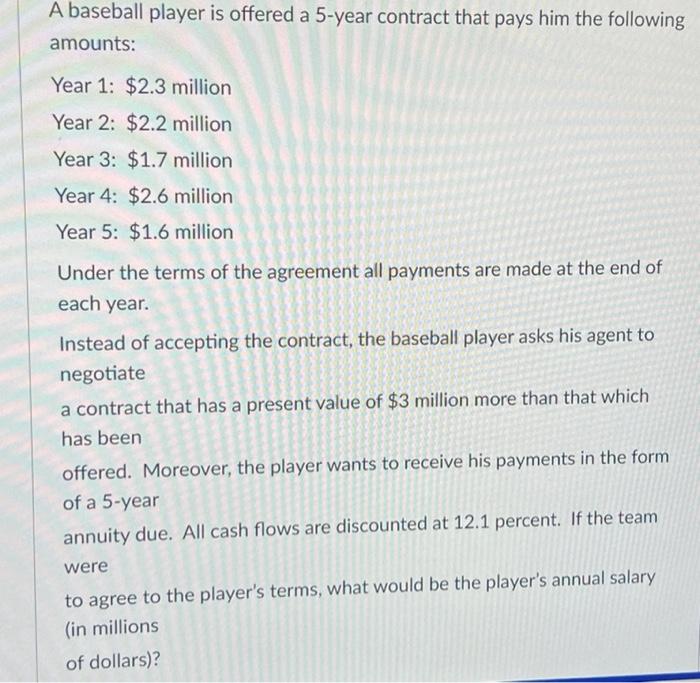

Question: Please Answer quickly for thumbs up 23 Question 23 Choices 24 A baseball player is offered a 5-year contract that pays him the following amounts:

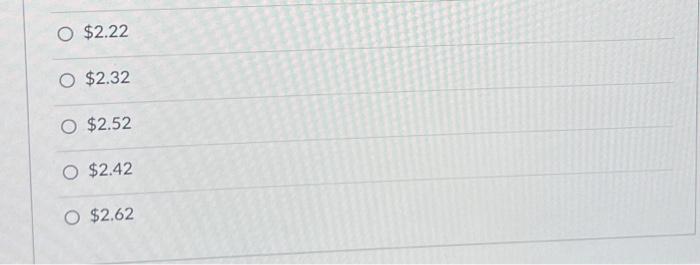

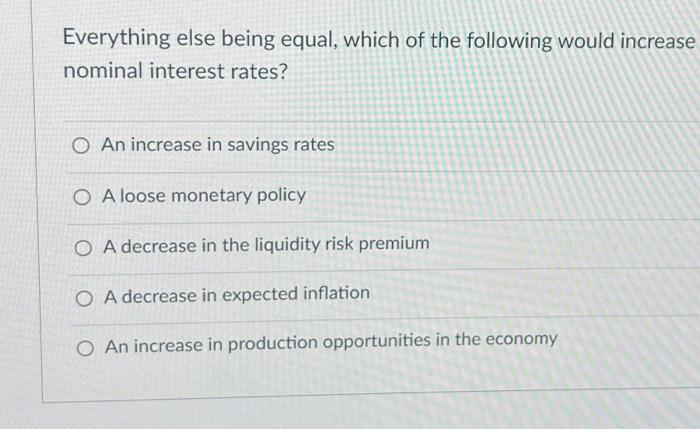

A baseball player is offered a 5-year contract that pays him the following amounts: Year 1: $2.3 million Year 2: $2.2 million Year 3: $1.7 million Year 4: $2.6 million Year 5: $1.6 million Under the terms of the agreement all payments are made at the end of each year. Instead of accepting the contract, the baseball player asks his agent to negotiate a contract that has a present value of $3 million more than that which has been offered. Moreover, the player wants to receive his payments in the form of a 5-year annuity due. All cash flows are discounted at 12.1 percent. If the team were to agree to the player's terms, what would be the player's annual salary (in millions of dollars)? O $2.22 O $2.32 O $2.52 O $2.42 O $2.62 Everything else being equal, which of the following would increase nominal interest rates? O An increase in savings rates O A loose monetary policy O A decrease in the liquidity risk premium O A decrease in expected inflation O An increase in production opportunities in the economy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts