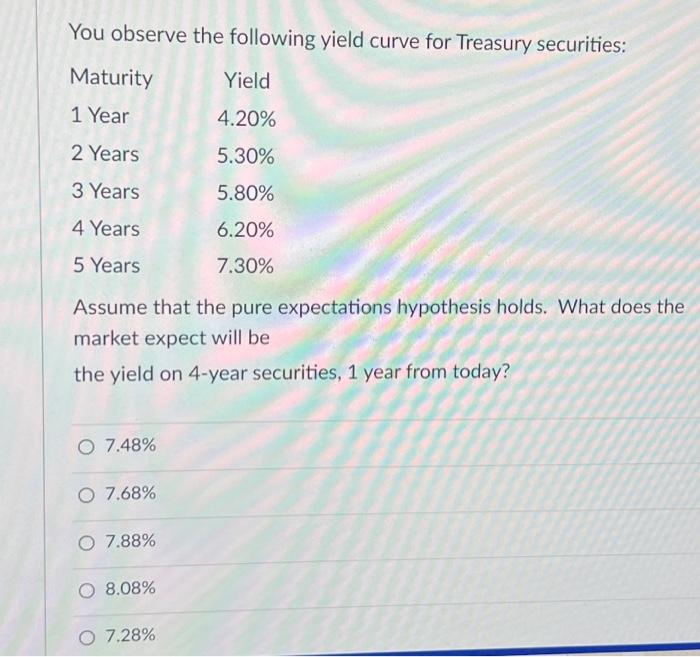

Question: Please Answer quickly for thumbs up 31 32 You observe the following yield curve for Treasury securities: Maturity Yield 1 Year 4.20% 2 Years 5.30%

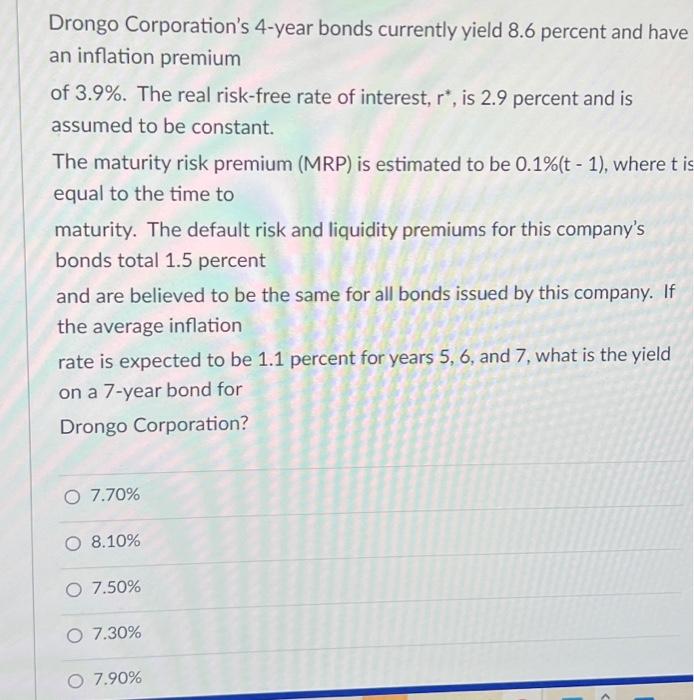

You observe the following yield curve for Treasury securities: Maturity Yield 1 Year 4.20% 2 Years 5.30% 3 Years 5.80% 4 Years 6.20% 5 Years 7.30% Assume that the pure expectations hypothesis holds. What does the market expect will be the yield on 4-year securities, 1 year from today? O 7.48% O 7.68% O 7.88% O 8.08% O 7.28% Drongo Corporation's 4-year bonds currently yield 8.6 percent and have an inflation premium of 3.9%. The real risk-free rate of interest, r*, is 2.9 percent and is assumed to be constant. The maturity risk premium (MRP) is estimated to be 0.1% (t-1), where t is equal to the time to maturity. The default risk and liquidity premiums for this company's bonds total 1.5 percent and are believed to be the same for all bonds issued by this company. If the average inflation rate is expected to be 1.1 percent for years 5, 6, and 7, what is the yield on a 7-year bond for Drongo Corporation? O 7.70% O 8.10% O 7.50% O 7.30% O 7.90%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts