Question: Please Answer quickly for thumbs up 9 10 You have the opportunity to buy a perpetuity that pays $21,262 annually. Your required rate of return

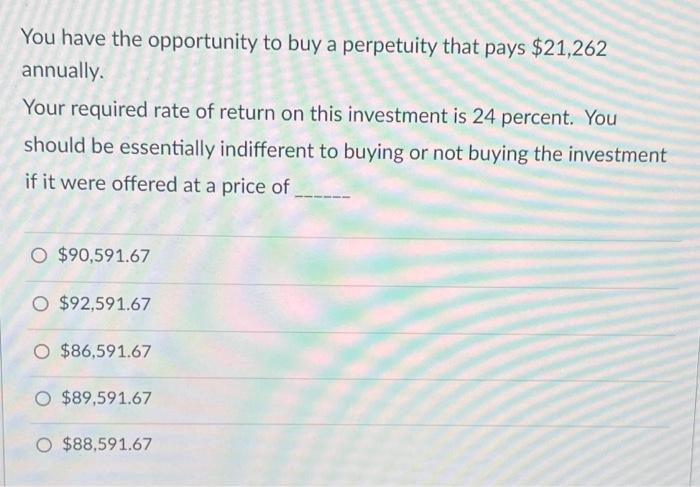

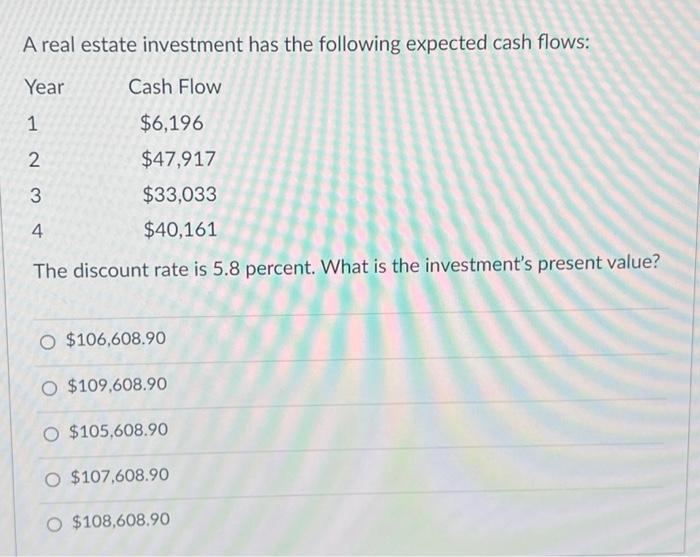

You have the opportunity to buy a perpetuity that pays $21,262 annually. Your required rate of return on this investment is 24 percent. You should be essentially indifferent to buying or not buying the investment if it were offered at a price of O $90,591.67 O $92,591.67 O $86,591.67 O $89,591.67 O $88,591.67 A real estate investment has the following expected cash flows: Year Cash Flow 1 $6,196 $47,917 $33,033 $40,161 The discount rate is 5.8 percent. What is the investment's present value? 23 4 O $106,608.90 O $109,608.90 O $105,608.90 O $107,608.90 O $108,608.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts