Question: Please answer quickly i rate good! 15) 16) Williamson Distributors separates its accounts recelvable Into three age groups for purposes of estimating the percentage of

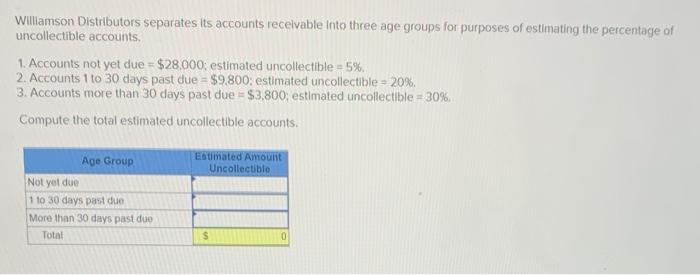

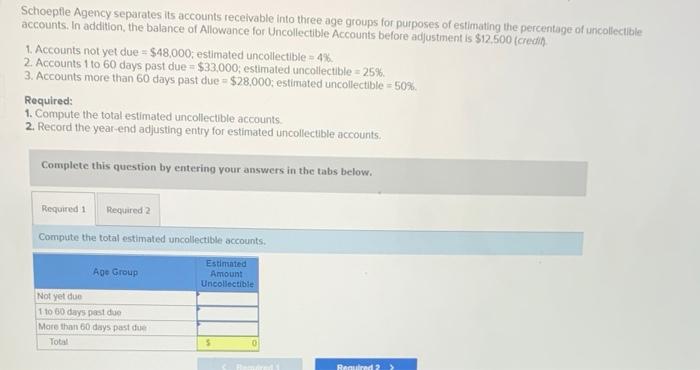

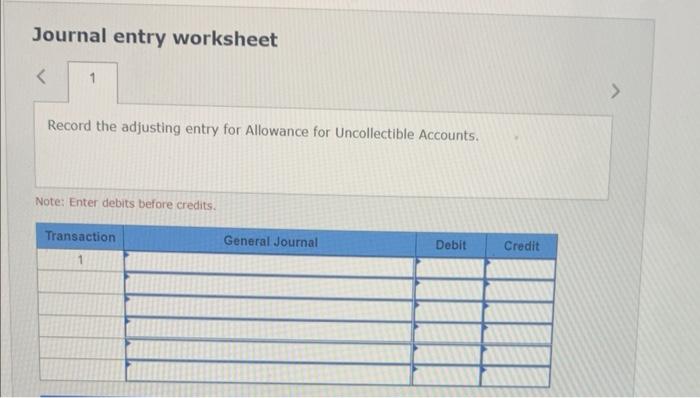

Williamson Distributors separates its accounts recelvable Into three age groups for purposes of estimating the percentage of uncollectible accounts. 1. Accounts not yet due =$28,000; estimated uncollectible =5%. 2. Accounts 1 to 30 days past due =$9.800; estimated uncollectible =20%. 3 . Accounts more than 30 days past due =$3.800; estimated uncollectible =30%; Compute the total estimated uncollectible accounts. Schoepfle Agency separates its accounts receivable into three age groups for purposes of estimating the percentage of uncollectible accounts. In addition, the balance of Allowance for Uncollectible Accounts before adjustment is $12.500 (credit). 1. Accounts not yet due =$48,000; estimated uncollectible =4% 2. Accounts 1 to 60 days past due =$33,000; estimated uncollectible =25%. 3. Accounts more than 60 days past due =$28,000; estimated uncollectible =50%. Required: 1. Compute the total estimated uncollectible accounts. 2. Record the year-end adjusting entry for estimated uncollectible accounts. Complete this question by entering your answers in the tabs below. Compute the total estimated uncollectible accounts: Journal entry worksheet Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts