Question: Please answer quickly I will upvote :) The bank operates several decentralized branches which are either lending or deposit oriented. The lending oriented branches are

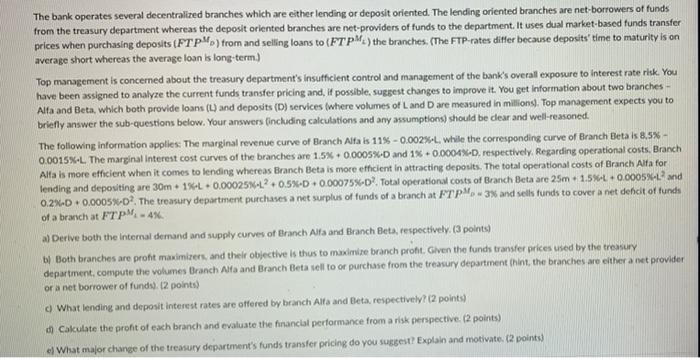

The bank operates several decentralized branches which are either lending or deposit oriented. The lending oriented branches are net borrowers of funds from the treasury department whereas the deposit oriented branches are not providers of funds to the department. It uses dual market-based funds transfer prices when purchasing deposits (FTP) from and selling loans to (FTPM) the branches. (The FTP-rates differ because deposits time to maturity is on average short whereas the average loan is long-term) Top management is concerned about the treasury department's insufficient control and management of the bank's overall exposure to interest rate risk. You have been assigned to analyze the current funds transfer pricing and, if possible, suggest changes to improve it. You get information about two branches - Alta and Beta, which both provide loans (L) and deposits (D) services (where volumes of Land D are measured in millions. Top management expects you to briefly answer the sub-questions below. Your answers including calculations and any assumptions) should be clear and well-reasoned. The following information applies: The marginal revenue curve of Branch Alta is 11% -0.002%-L while the corresponding curve of Branch Beta is 8,5%- 0,0015%-L. The marginal Interest cost curves of the branches are 1.5%+0.0005%D and 1% +0.0004%-D, respectively Regarding operational costs. Branch Alla is more efficient when it comes to lending whereas Branch Beta is more efficient in attracting deposits. The total operational costs of Branch Alta for lending and depositing are 30m. 1%-L+0.00025XL? 0.5%-D 0.00075%-D? Total operational costs of Branch Beta are 25m 1.5%+0.0005%-Land 0.2%-D 0.00054-09. The treasury department purchases a net surplus of funds of a branch at FTP-3% and sells funds to cover a net decit of lunch of a branch at FTPM - 4% a) Derive both the internal demand and supply curves of Branch Alfa and Branch Beta, respectively. (3 points) bl Both branches are profit maximizers, and their objective is thus to maximize branch pront. Given the funds transfer prices used by the treasury department, compute the volumes Branch Ato and Branch Beta sell to or purchase trom the treasury department (hint, the branches are either a net provider or a net borrower of funds). 2 points) What lending and deposit interest rates are offered by branch Alfa and Beta, respectively? (2 points) Cakulate the profit of each branch and evaluate the financial performance from a risk perspective. (2 points) el What major change of the treasury department's funds transfer pricing do you sugest? Explain and motivate. (2 points) The bank operates several decentralized branches which are either lending or deposit oriented. The lending oriented branches are net borrowers of funds from the treasury department whereas the deposit oriented branches are not providers of funds to the department. It uses dual market-based funds transfer prices when purchasing deposits (FTP) from and selling loans to (FTPM) the branches. (The FTP-rates differ because deposits time to maturity is on average short whereas the average loan is long-term) Top management is concerned about the treasury department's insufficient control and management of the bank's overall exposure to interest rate risk. You have been assigned to analyze the current funds transfer pricing and, if possible, suggest changes to improve it. You get information about two branches - Alta and Beta, which both provide loans (L) and deposits (D) services (where volumes of Land D are measured in millions. Top management expects you to briefly answer the sub-questions below. Your answers including calculations and any assumptions) should be clear and well-reasoned. The following information applies: The marginal revenue curve of Branch Alta is 11% -0.002%-L while the corresponding curve of Branch Beta is 8,5%- 0,0015%-L. The marginal Interest cost curves of the branches are 1.5%+0.0005%D and 1% +0.0004%-D, respectively Regarding operational costs. Branch Alla is more efficient when it comes to lending whereas Branch Beta is more efficient in attracting deposits. The total operational costs of Branch Alta for lending and depositing are 30m. 1%-L+0.00025XL? 0.5%-D 0.00075%-D? Total operational costs of Branch Beta are 25m 1.5%+0.0005%-Land 0.2%-D 0.00054-09. The treasury department purchases a net surplus of funds of a branch at FTP-3% and sells funds to cover a net decit of lunch of a branch at FTPM - 4% a) Derive both the internal demand and supply curves of Branch Alfa and Branch Beta, respectively. (3 points) bl Both branches are profit maximizers, and their objective is thus to maximize branch pront. Given the funds transfer prices used by the treasury department, compute the volumes Branch Ato and Branch Beta sell to or purchase trom the treasury department (hint, the branches are either a net provider or a net borrower of funds). 2 points) What lending and deposit interest rates are offered by branch Alfa and Beta, respectively? (2 points) Cakulate the profit of each branch and evaluate the financial performance from a risk perspective. (2 points) el What major change of the treasury department's funds transfer pricing do you sugest? Explain and motivate. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts